Expressing serious concern about job losses in the United States, US lawmakers question Pfizer regarding its AstraZeneca bid.

The governors of Delaware and Maryland have told Pfizer’s CEO in writing that they are extremely concerned about the potential deal and the subsequent job losses in their state.

On both sides of the Atlantic politicians are voicing their concerns about job losses and the decline in scientific research that might follow a Pfizer AstraZeneca acquisition or merger. Pfizer has a history of acquiring drugmakers and then significantly reducing their research and development (R&D) activities.

Pfizer lacks new products

In fact, one of the reasons Pfizer is so desperately interested in AstraZeneca, apart from the tax benefits, is its lack of new medications. Pfizer is facing a series of patent expiries and very few new products to replace them, while AstraZeneca has a bagful of promising goodies.

Analysts say Pfizer is currently a victim of its own strategy. If you buy businesses and treat them and your own like a cash cow, you may accumulate lots of money, but your long-term future is in jeopardy, especially in such an R&D-dependent business as the pharmaceutical industry. Like in the game of Monopoly, he/she who does not invest in hotels soon faces serious problems.

Pfizer’s profits were 15% down in Q1 2014, a sign that the world’s largest drugmaker is probably already in trouble.

Pfizer following “tax inversion” path

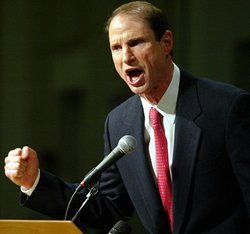

Senators Carl Milton Levin (D-MI) and Ronald Lee “Ron” Wyden (D-OR) are seeking to plug a tax loophole to prevent companies like Pfizer from moving their headquarters into countries with lower corporate tax.

In the United States corporate tax, at 35%, is among the highest in the developed world, compared to just 21% in the UK (which is considering lowering it to 20%). Many find it ironic that the US, historically known as the flagship of capitalism, is today seen as a high-taxed nation weighed down by cumbersome bureaucracy.

Moving head offices to another country for tax reasons is a strategy known as “tax inversion”. If Pfizer acquires AstraZeneca, its headquarters could legally move to London, even though its senior management would continue in the United States.

Regarding the strategy of tax inversion, Senator Carl Levin said:

“I’ve long been concerned about inversions – companies moving offshore on paper, for tax purposes, while the management and operations remain in the United States. It’s become increasingly clear that a loophole in our tax laws allowing these inversions threatens to devastate federal tax receipts. We have to close that loophole.”

“I am talking to my colleagues about legislation to close the loophole, which I intend to introduce soon. Companies that exploit this loophole benefit from the protections and services the federal government provides, including patent protection, research and development tax credits, national security and more; they shouldn’t be allowed to shift their tax burden onto others.”

More than fifty US companies have bought foreign companies and moved their headquarters abroad over the last 30 years, with more than 20 of them doing so during the past 24 months. Economists have been saying for years that the US corporate tax system keeps money abroad.

American government and taxpayer losing out

These companies, while not breaking American laws, along with their shareholders may gain a temporary win, but their employees, the US government and the American taxpayer lose out. The US government loses billions of dollars in tax revenues, increasing the burden on individual and corporate taxpayers. The US also finds it harder to compete on a global stage, jobs are either lost or new ones not created, talent is wasted, as is investment.

In the Wall Street Journal Senator Ron Wyden wrote:

“The U.S. is stuck with a 35% corporate tax rate—one of the highest in the world—and a painfully complicated and outdated tax code. Few companies pay the full 35%, but some come close and others pay next to nothing. Effective tax rates vary wildly by industry; the entire system flunks the fairness test.”

Current US law stipulates that a US company reincorporating abroad must ensure that at least 20% of its stock is owned by its new, foreign partner. Senator Wyden says that as chairman of the Senate Finance Committee, he is committed to raising that minimum to at least 50% for all inversions taking place as from May 8th, 2014.

Wyden added “I don’t approach retroactivity in legislation lightly, but corporations must understand that they won’t profit from abandoning the U.S.”

US lawmakers question Pfizer regarding job losses

Governor of Maryland, Martin Joseph O’Malley, and Governor of Delaware, Jack A. Markell, have expressed serious concern about the job losses that may follow a Pfizer AstraZeneca deal. AstraZeneca employes about 2,600 workers in Delaware and 3,100 in Maryland.

They are concerned about the assurances Pfizer has given to UK Prime Minister David Cameron that there will be no AztraZeneca job losses or shutting down of R&D in England. “Why haven’t similar assurances been given in the United States?” they ask.

Pfizer’s history of closing research laboratories

In a joint statement, the two governors wrote:

“We are concerned, because despite our requests, we have received no corresponding assurances about retaining jobs and R&D in our states. Our concern is exacerbated by Pfizer’s history of closing US research facilities, including sites in Michigan and Illinois, after closing on previous corporate transactions.”

“It is also concerning that Pfizer is seeking to complete an acquisition involving jobs supporting thousands of families in our states in order to achieve tax advantages.”

The Governors quote Pfizer’s Chief Financial Officer who said regarding the reason for the proposed takeover “that would still allow me to access the offshore funds and do it in a tax-efficient way.” They add that relocating Pfizer’s corporate and tax residence outside of the US is not only detrimental to America, but potentially comes at a direct cost to the governors’ states and their constituents.