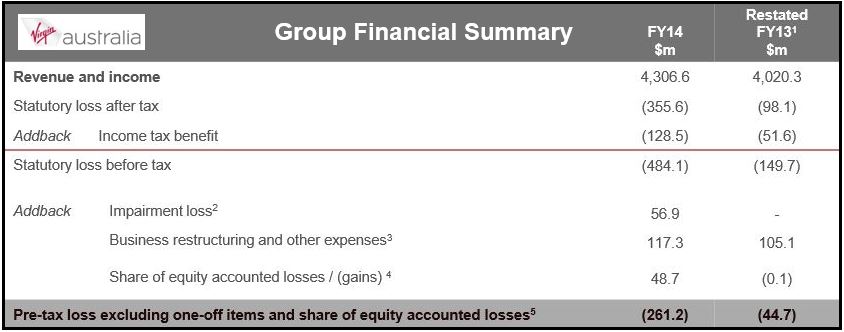

Virgin Australia posted a A$355.6 million ($332.6 million) after-tax loss for the full year, more than three times last year’s A$98.1 million loss. The airline said the increased loss was the result of one-off charges, the carbon tax (now defunct) cost, market overcapacity, economic uncertainty, and weak consumer sentiment.

Virgin Australia announced it would sell 35% of its frequent flyer program to private equity company Affinity Equity Partners in a deal that values it at A$960 million.

The airline will retain control of the program in the frequent flyer deal, with 65% of the voting rights, but it will operate under a separate board.

The sale of its Velocity frequent flyer program will be used to help reduce the company’s debt, if the Australian foreign investment review approves the move.

According to Sankar Narayan, Virgin Australia’s Chief Financial Officer, the airline was under no pressure to boost its balance sheet. He said it decided to sell the stake so that it could expand the business rapidly. “We want to turbocharge the growth profile,” he said.

The company says it will cut costs by more than A$1 billion during the next three years.

(Data source: Virgin Australia)

No fiscal 2015 guidance

Australia’s second-largest carrier after Qantas says it will not provide a guidance for the 2015 financial year, given the uncertainty in the economy. All it said was that the airline is well placed to capitalize on market recovery.

Chief Executive Officer John Borghetti said:

“The 2014 Financial Year has seen one of the most difficult operating environments in the history of Australian aviation.”

“While the Virgin Australia Group performed well in attracting high yielding passengers and containing cost growth over the full year, underlying revenue performance was impacted by the challenging operating conditions.”

Virgin’s competitor, Qantas, reported its largest ever net loss for the financial year – A$2.8 billion.

Tigerair loss

Virgin posted a loss of A$46 million from its 60% stake in Tigerair Australia, a budget carrier. It does not expect there will be any profits from the low-cost airline until the 2017 financial year.

Virgin’s capacity, excluding Tigerair, increased by only 0.1% during the 2014 financial year.

The company said it ended the 2014 financial year with an unrestricted cash balance of A$541 million, A$203 million more than in 2013. It also raised A$350 million from shareholders, including Singapore Airlines, Air New Zealand and Etihad Airways. The CEO’s of all three airlines became Virgin Australia board members in July.

The Brisbane-based carrier said it has also decided to set up a new air-freight business.

Boeing 737 MAX 8 deliveries

As part of its efforts to improve aircraft fleet efficiency, Virgin Australia announced it is bringing forward the first deliveries of the twenty-three Boeing 737 Max 8s from 2019 to 2018.

The aircraft were originally ordered in July 2012. Mr. Borghetti did not specify exactly when the first airplane would arrive. “I can give you a month range, but I won’t. But how did we do this? I’ve got the best negotiator, and his fleet team, in the business. It’s thanks to their good work,” he said at a press conference on Friday.