The critical minerals required to make the magnets in wind turbines and the battery in your electric vehicle are controlled by China.

This dominance gives the country significant influence over the green economy transition. It also creates challenges for businesses and governments of other countries.

Critical Minerals – China’s Role

China has been a world leader in producing rare earth elements for a long time. Rare earth metals are a group of 17 elements, including lanthanides, scandium, and yttrium, essential for technologies like batteries, electric vehicle motors, wind turbines, and smartphones due to their unique magnetic, catalytic, and optical properties.

Gørild Heggelund, a research professor at the Fridtjof Nansen Institute, Oslo, Norway, said:

“China’s dominance gives it a strategic advantage but also exposes vulnerabilities for other nations.”

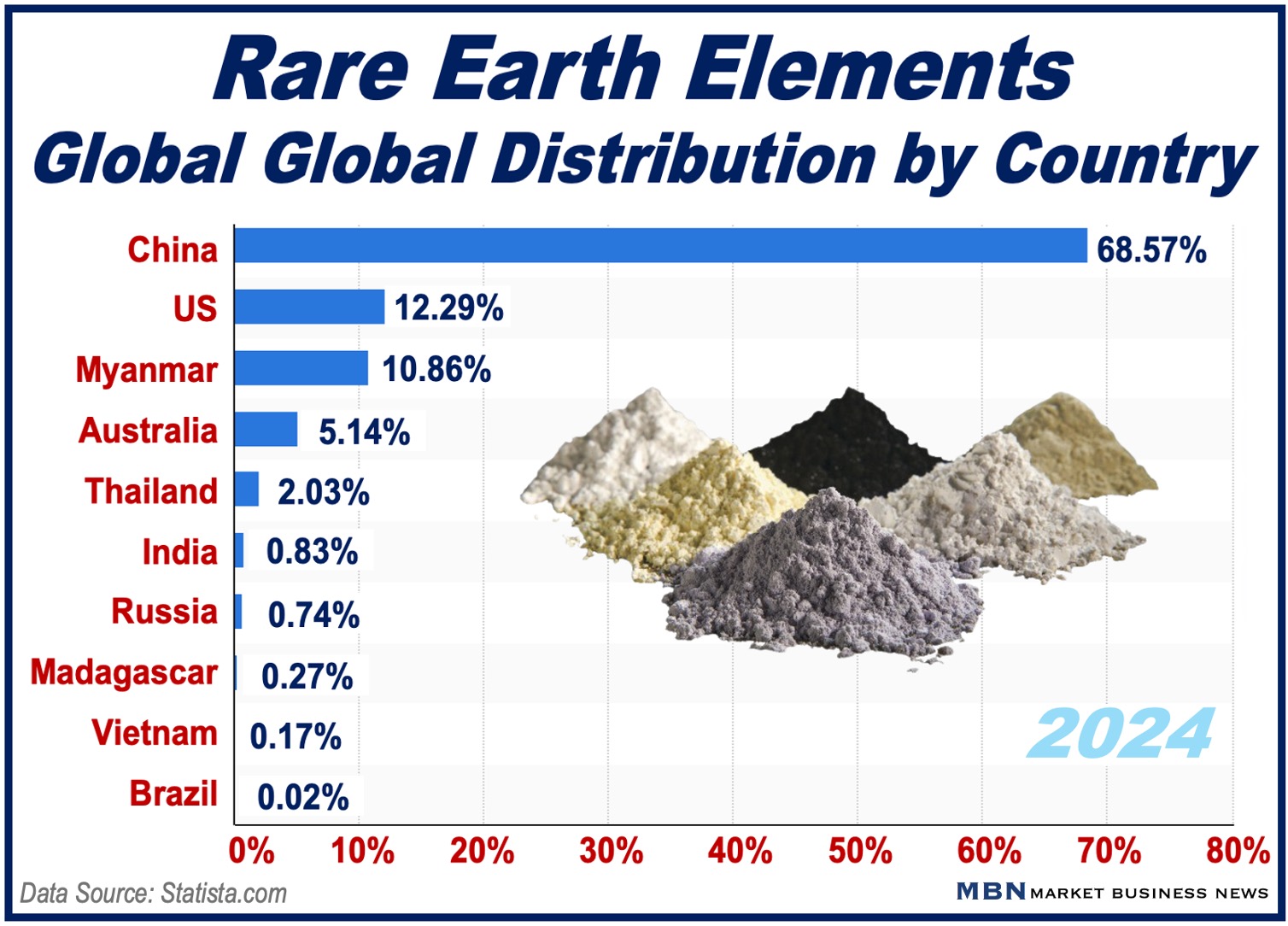

China controls more than sixty percent of rare earth production worldwide. However, it is very dependent on cobalt and lithium imports for batteries.

Heggelund explained:

“Almost all the cobalt used in China comes from the Democratic Republic of Congo. This makes their supply chains vulnerable.”

However, China has maintained its dominance by focusing on the processing stage, where raw materials are transformed into products that we can use.

Heggelund added:

“China’s focus on processing has allowed it to maintain control without owning all the mines. But it has become reliant on imports for parts of its supply as domestic policies aim at restricting mining and processing to conserve resources and reduce environmental pollution.”

Rare Earth Elements

The 17 rare earth elements (REEs) are:

- Lanthanum (La) – hybrid vehicle batteries, camera lenses, and catalysts for refining petroleum.

- Cerium (Ce) – catalytic converters, glass polishing, and as an alloy in steel manufacturing.

- Praseodymium (Pr) – high-strength magnets, aircraft engines, and coloring glass and ceramics.

- Neodymium (Nd) – permanent magnets for wind turbines, electric vehicles, headphones, and hard drives.

- Promethium (Pm) – luminous paint, atomic batteries, and scientific instruments (radioactive).

- Samarium (Sm) – magnets (samarium-cobalt), nuclear reactors, and optical lasers.

- Europium (Eu) – LED and fluorescent lighting, and color displays for TVs and computer screens.

- Gadolinium (Gd) – MRI contrast agents, nuclear reactors, and jet engine alloys.

- Terbium (Tb) – green phosphors for screens, solid-state devices, and energy-efficient lighting.

- Dysprosium (Dy) – high-temperature magnets for EVs, wind turbines, and aerospace components.

- Holmium (Ho) – nuclear control rods, magnets, and lasers for medical/scientific use.

- Erbium (Er) – fiber optics, laser surgery, and pink colorant for glass and ceramics.

- Thulium (Tm) – portable X-ray devices and specialized lasers.

- Ytterbium (Yb) – stainless steel production, earthquake monitoring devices, and lasers.

- Lutetium (Lu) – PET scan detectors, petroleum refining catalysts, and medical imaging.

- Scandium (Sc) – aerospace components, sports equipment (e.g., bicycle frames), and high-intensity lamps.

- Yttrium (Y) – phosphors for LED lighting, superconductors, and aerospace aluminum alloys. ‘Phosphors’ are materials that emit light when they absorb energy.

(Numbers 1 to 15 are lanthanides. Scandium and Yttrium (16 & 17) are rare earth elements but not lanthanides.)

US-China Rivalry

The rivalry between the U.S. and China has expanded to critical minerals. They are both vying for the top spot in green technology.

Iselin Stensdal, a researcher on China at the Fridtjof Nansen Institute, said:

“China’s strategy of building entire value chains in renewable energy is not new—it started in the 1990s.”

Dominating the extraction of raw materials has been a cornerstone in China’s leadership in many ‘green’ products, such as electric vehicles, lithium batteries, wind turbines, energy-efficient lighting, and solar panels.

Although the U.S. is making progress, China still leads in many important technologies.

Recent tensions have intensified. In response to US efforts to restrict its access to advanced technology on “national security” grounds, China recently prohibited the export of gallium, germanium, and antimony, which are three critical minerals, to the US.

According to Mining.com:

“Gallium and germanium are essential for semiconductors, with germanium also critical for infrared technology, fiber optic cables, and solar cells.”

“Antimony is widely used in bullets and other weaponry, while graphite constitutes the largest component by volume in electric vehicle batteries.”

Stensdal explained:

“The rivalry between the U.S. and China is marked by a retaliatory approach, with both nations responding to each other’s actions through countermeasures.”

What Does this Mean for the World?

China’s dominant position presents countries globally with a dilemma. While they depend on China for critical rare earth elements, this reliance exposes them to potential risks.

Heggelund heads a project that aims to help countries like Norway reduce their reliance on China while creating sustainable and competitive supply chains.

Heggelund concludes:

“We cannot completely decouple from China, but we can diversify our sources and learn from their strategies.”