Wind energy prices are coming down thanks to advancements in wind technology, says a team of researchers. New wind projects in the USA are quoting an average of approximately 2 cents per kilowatt-hour (kWh). Cost reductions and technology breakthroughs are driving down kWh prices.

Berkeley Lab Senior Scientist Ryan Wiser of the Electricity Markets & Policy Group said:

“Wind energy prices – particularly in the central United States, and supported by federal tax incentives – remain at all-time lows, with utilities and corporate buyers selecting wind as a low-cost option.”

Dr. Wiser and Mark Bolinger, both from the Lawrence Berkeley National Laboratory, authored the US Department of Energy’s ‘Wind Technologies Market Report.’

Wind energy – Report highlights

The following highlights come from the report:

Wind power capacity

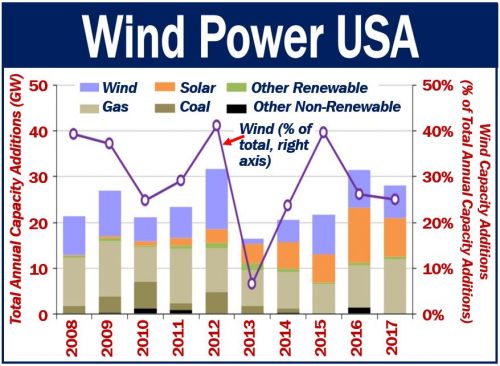

In 2017, wind power capacity continued to expand. Total additions to national wind power capacity equaled 7,017 MW in 2017. MW stands for megawatts. A total of $11 billion were invested in new plants.

Wind power represented one-quarter of all generation capacity additions in the US in 2017.

Wind energy represented 6.3% of America’s electric supply. In fourteen states, it represented over 10% of total electricity generation. In South Dakota, Oklahoma, and Kansas it represented more than 30%. It also represented over 30% in Iowa.

Larger turbines

New wind turbines contributed 2.32 MW to America’s average generating capacity. Power generation from wind energy increased by 8% in 2017, and by 224% since 1998/9.

Average rotor diameter was 113 meters in 2017. Rotor diameter increased by 4% in 2017 vs. 2016 and by 135% vs. 1998/9. The average hub height was 86 meters in 2017, which represented a 4% increase vs. 2016 and 54% since 1998/9.

Federal Aviation Administration permit applications suggest that even taller turbines are on their way.

Wind energy capacity has begun to increase dramatically due to greater rotor diameters.

The average capacity factor in 2017 among projects built from 2014 to the end of 2016 was 42%. This compared to 31.5% among projects built from 2004 to the end of 2011, and 23.5% among 1998-to-2001 projects.

Low wind turbine pricing – installed project costs

Installed project costs are declining partly due to low wind turbine pricing.

Wind turbine equipment prices have declined to $750-$950/kW. These declines are subsequently pushing down the costs of projects.

The average installed costs on wind projects were $1,610/kW in 2017, compared to $795/kW from the peak in 2009/10.

Low wind energy prices

Improvements in capacity factors plus lower installed project costs are helping make wind energy prices more competitive.

According to Berkeley Lab:

“After topping out at 7 cents per kWh in 2009, the average levelized long-term price from wind power sales agreements has dropped to around 2 cents per kWh – though this nationwide average is dominated by projects that hail from the lowest-priced region, in the central United States.”

“Recently signed wind energy contracts compare favorably to projections of the fuel costs of gas-fired generation. These low prices have spurred demand for wind energy from both traditional electric utilities and nonutility purchasers, such as corporations, universities, and municipalities.”

Diverse domestic supply chain for wind equipment

At the end of 2017, the wind sector had 105,500 full-time employees. For wind projects recently installed in the US, 90% of the content in nacelle assembly was made in America.

Seventy to 90% of the content of towers and 50% to 70% of blades and hubs were made in America. For most of the components internal to the turbine, on the other hand, the figure was much lower; less than twenty percent.

Some manufacturing plants have closed down over the past ten years. However, each of the three biggest turbine suppliers serving the US market has at least one domestic manufacturing facility in operation. The three largest turbine suppliers serving America’s market are Siemens Gamesa, General Electric Co., and Vestas.

According to Berkeley Lab:

“Berkeley Lab’s contributions to this report were funded by the U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy.”

Video – Wind Energy

Wind energy involves capturing the energy in moving air (wind) and converting it into electricity.