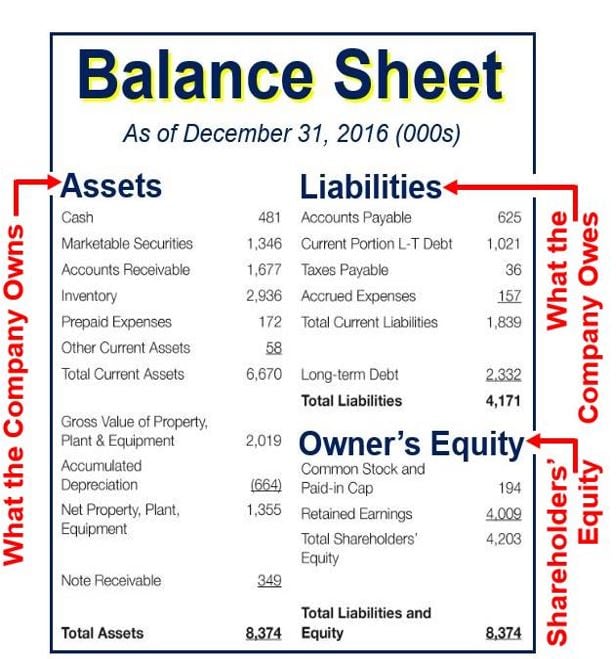

A Balance Sheet is a financial report that summarizes a company’s assets and liabilities plus owner’s equity. The balance sheet refers to a given time. This given time is usually the end of a quarter, half-year, or year. People, companies, charities, and many other entities use balance sheets.

Assets are everything the company owns, while all it owes are its liabilities. The owner’s equity refers to the shareholders’ investment minus company withdrawals plus the net income since the company started.

The term ‘statement of financial position’ means the same as ‘balance sheet.’ We also use the terms ‘stockholder equity’ or ‘shareholder equity’ with the same meaning as ‘owner’s equity.’ In both cases, we can write either stockholder, shareholder, stockholders‘ or shareholders’.

The balance sheet is one of the major financial statements that accountants use. The others are the income statement, the statement of stockholders’ equity, and the statement of cash flows.

The balance sheet tells us what a company’s financial position is on a given date. In fact, many call it a ‘snapshot’ of the firm’s financial position at a point in time.

For example, September 31, 2016, on a balance sheet reflects that moment; everything the company recorded up to that date.

We divide a balance sheet into two main sections:

- One that records assets

- One that records liabilities and stockholder equity (owner’s equity).

Balance sheet of interest to many people

Interested parties such as creditors can see what a business owns and owes on a specific date. In other words, they know what the firm’s financial position is at a given time.

A bank uses the information in a balance sheet to determine whether to lend a loan applicant money. The bank might also use it to decide whether to lend a borrower more money.

Additionally, a company’s management, investors, competitors, and suppliers all seek to examine a firm’s balance sheet. For example, before considering whether to offer credit terms, a supplier needs to know how the buyer stands financially.

Entrepreneurs scrutinize the balance sheet to identify opportunities for improving cash flow, highlighting potential areas for cost reduction or asset optimization.

Some customers, labor unions, and government agencies may also want to look at a company’s balance sheet.

The balance sheet serves as a critical tool for financial analysts who assess the leverage, profitability, and operational efficiency of a company by closely examining the relationship between debt and equity.

Everything balances out

The monetary total of everything on the left of a balance sheet must equal the total on the right. They have to ‘balance.’

A business entity must pay for all its assets either by borrowing money or issuing owner’s/shareholders’ equity. In other words, it must either increase its liabilities or get money from investors.

Imagine that John Doe LLC takes out a 4-year $5,000 loan from the bank. Its assets will rise by $5,000, while its liabilities will increase by the same amount. In other words, it will have $5,000 more cash, and what it owes will also rise by $5,000. John Doe thus balances the two sides of the sheet.

If John Doe got the $5,000 from investors, what would happen? Its assets would subsequently increase by $5,000, as would its owner’s equity.

All generated revenues more than total liabilities will go into the owner’s equity account. The owner’s equity account represents the net assets held by the shareholders. These revenues will appear as inventory, cash, investments, or some other asset. The accountant, therefore, balances them on the assets side.

Assets, liabilities, and owner’s equity are each made up of many smaller accounts. They break down the components of a business’ finances.

However, these accounts vary significantly from industry to industry. In fact, the same terms may have different implications depending on what type of business it is.

Video explanation

This educational video we created explains what a “Balance Sheet” is using easy-to-understand vocabulary and examples.