Commodity market – definition and meaning

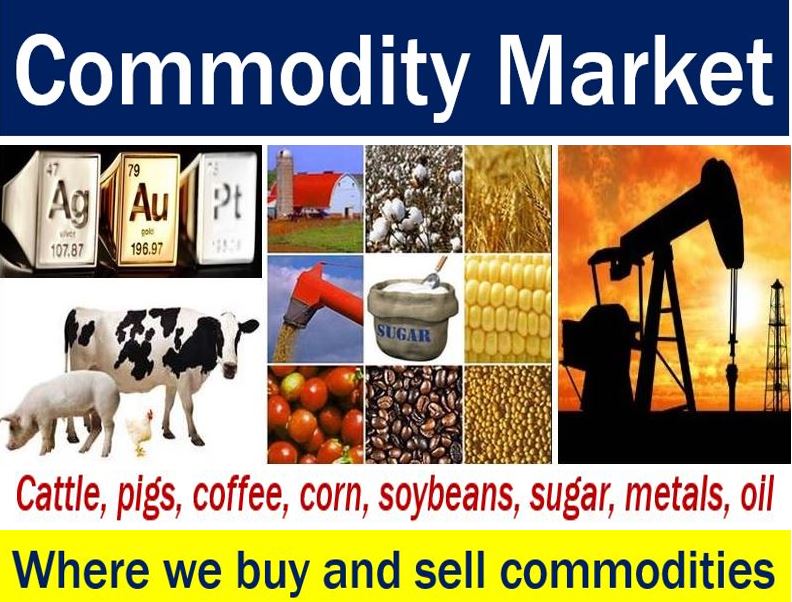

The commodity market is a market where traders buy and sell commodities. Commodities are raw materials or primary agricultural products. In other words, things that farmers, mining companies, and oil and gas companies produce or extract.

The commodity market is similar to the equity market. However, in the equity market, people buy and sell shares.

Goldrate.com has the following definition of commodity market:

“A market where oil, agricultural products, and oil, i.e., commodities, are bought and sold.”

There are two broad types of commodities:

1. Agricultural goods, such as sugar, cocoa, and wheat. In other words, soft commodities.

2. Raw materials, such as gold, silver, and oil. We call these hard commodities.

There are four narrow categories for trading commodities. They include:

- Energy: such as natural gas, gasoline (UK: petrol), heating oil, and crude oil.

- Metals: including silver, gold, platinum, nickel, zinc, and copper.

- Livestock and Meat: examples include feeder cattle, live cattle, poultry, eggs, pork bellies, and lean hogs.

- Agricultural Foodstuffs: including sugar, cotton, coffee, cocoa, rice, wheat, corn, and soybeans.

We see commodities all around us. The commodity market influences the price of a gallon of gas and the cost of a cup of coffee bought from Starbucks. In fact, it affects the price of most of the food we consume at home.

Additionally, the commodity market determines the cost of electricity. It matters to all of us. Put simply; it has a major bearing on our day-to-day lives.

There are about fifty major commodity markets globally. These markets facilitate investment trade in almost 100 primary commodities.

According to ft.com/lexicon, the commodity market is:

“A market where commodities (oil, metals, farm products, etc.) are bought and sold.”

Investing in the commodity market

The oldest way of investing in commodities is with futures contracts. We secure futures contracts with physical assets.

Investors can also buy shares in companies whose businesses rely on commodities prices.

Additionally, we can buy index funds, mutual funds, or ETFs that focus on commodity companies. ETFs stands for exchange-traded funds.

Commodity market – different segments

The commodity market exists in two main forms:

1. The OTC Market. OTC stands for over the counter.

2. The Exchange Based Market. As with trading in stocks, there is also the spot and derivatives segments.

The spot markets are essentially OTC markets. Farmers, processors, and wholesalers work in this market. In other words, people who produce and deliver commodities.

Most of the derivative trading occurs through exchange-based markets with contracts, settlements, etc.

Commodity markets – history

Commodity markets date back to Sumer between 4500 BC and 4000 BC. Sumer was where modern day southern Iraq is.

Sumerians used clay tokens to represent quantities of livestock. They specified details of time and date of delivery. In fact, their clay tokens resembled today’s futures contracts.

Commodity markets, as we know them today, have their roots in the trading of agricultural products in Europe.

People in Europe and America have traded cattle, pigs, corn, and wheat extensively using standard instruments since the 1800s.

However, trading in other basic foodstuffs, such as soybeans and coffee, is a relatively recent activity.

For a commodity market to establish itself, people need to agree on what types of products there are. They must also agree on acceptable standards of quality.

Video – what are commodities?

In this MoneyWeek video, Tim Bennet tells us what commodity markets are. He also explains how investors can trade in them.