The Nobel Prize for Economics is an award for outstanding contributions to the field of economics. Economists across the world say it is most prestigious award anybody can receive in their field. People also call it the Nobel Memorial Prize in Economic Sciences. Some people also refer to it as the Swedish National Bank’s Prize in Economic Sciences in Memory of Alfred Nobel. The Swedish National Bank (Sveriges Riksbank or simply Riksbanken) puts up the $1 million annual prize money.

The Nobel Prize for Economics, strictly speaking, is not a fully-fledged Nobel Prize. Alfred Nobel mentioned five prizes in his will – for physics, chemistry, medicine, literature, and peace – but not for economics. The sixth annual prize was established by the Swedish National Bank – Sweden’s central bank – in 1968, on its 300th anniversary, with a donation.

The Swedish National Bank is the world’s oldest central bank, and the third oldest bank that is still in operating.

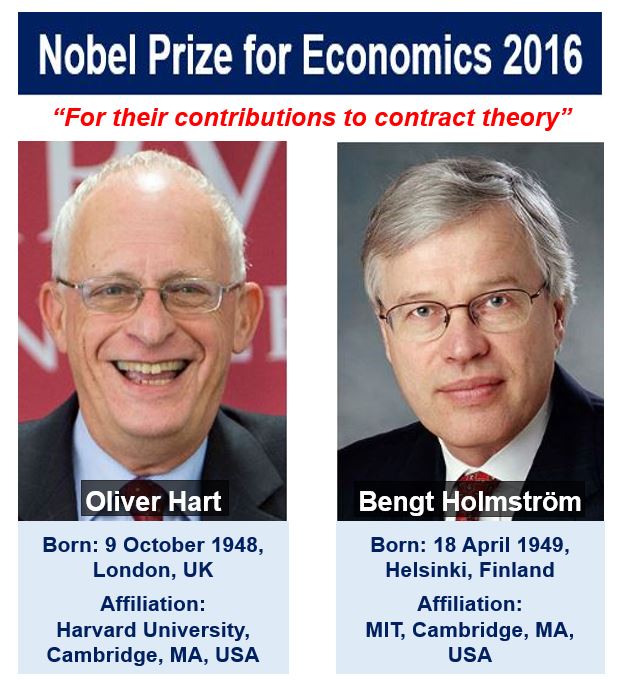

According to WhatIs.TechTarget.com: “Contract theory is the study of how people and organizations develop legal agreements in situations with uncertain conditions, unknown factors and information asymmetry. Contract theory applies to both multi-party negotiations between a principal and one or more agents and contracts created by a single individual or organization to specify details of multi-party agreements, such as employee contracts.” Images: Oliver Hart – nobelprize.org. Bengt Holmström – nobelprize.org)

According to WhatIs.TechTarget.com: “Contract theory is the study of how people and organizations develop legal agreements in situations with uncertain conditions, unknown factors and information asymmetry. Contract theory applies to both multi-party negotiations between a principal and one or more agents and contracts created by a single individual or organization to specify details of multi-party agreements, such as employee contracts.” Images: Oliver Hart – nobelprize.org. Bengt Holmström – nobelprize.org)

NobelPrize.org makes the following comment regarding the Nobel Prize for Economics:

“The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel has been awarded 48 times to 78 Laureates between 1969 and 2016.”

Nobel Prize for Economics awarded annually

Even though the Nobel Prize for Economics was not one of the original prizes created by Alfred Nobel’s will, the selection criteria, nomination process, and awards presentation are performed in the same manner as that of the other five annual Nobel Prizes.

Economics laureates are announced with other Nobel Prize laureates, and are given the award in the same ceremony each year.

The Nobel Prize for Economics winners each year are selected by the Royal Swedish Academy of Sciences (Kungliga Vetenskapsakademien).

In 1969, Norwegian economists Ragnar Frisch (1895-1973) and Jan Tinbergen (1903-1994) were the first economics laureates – according to the Royal Swedish Academy of Sciences: “For having developed and applied dynamic models for the analysis of economic processes.”

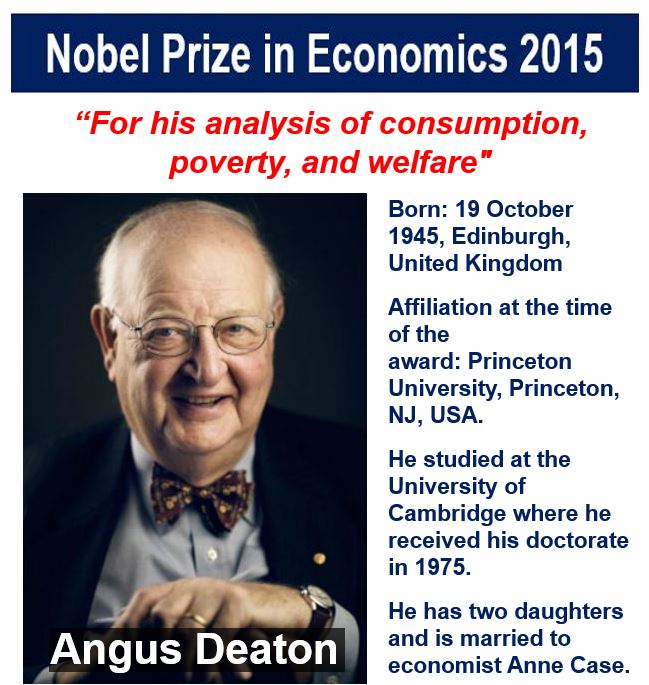

Angus Deaton examined people’s consumption and how this related to the economic development of society in general. His research dealt with how consumption relies on prices. It studied the relationship between consumption, savings and incomes, and showed how consumption data could be used to analyze economic development, poverty and welfare. (Image: nobelprize.org)

Angus Deaton examined people’s consumption and how this related to the economic development of society in general. His research dealt with how consumption relies on prices. It studied the relationship between consumption, savings and incomes, and showed how consumption data could be used to analyze economic development, poverty and welfare. (Image: nobelprize.org)

Nobel Prize for Economics – criticisms

Peter Nobel, great-grandson of Ludvig Nobel – elder brother of Nobel Prize founder Alfred Nobel – criticized the awarding institutions ‘misuse’ of his family’s name.

According to Ludvig Nobel, no member of his family ever had the intention of establishing an economics prize.

Kjell-Olof Feldt and Gunnar Myrdal (1898-1987), both former Swedish Ministers of Finance, wanted to abolish the prize.

In a 2003 article in the Financial Times, Samuel Brittan wrote:

“Myrdal rather less graciously wanted the prize abolished because it had been given to such reactionaries as Hayek (and afterwards Milton Friedman).”

When American economist Milton Friedman (1912-2006) was awarded the Nobel Prize for Economics in 1976 for his work on monetarism, there were protests across the world. He was accused of supporting Chile’s military dictator General Augusto Pinochet (1915-2006), because Pinochet’s economists were supporters of the Chicago School (University of Chicago) of economics.

Milton claimed he had never been an adviser to the Chilean dictatorship, and only gave a few lectures and seminars on inflation when he met General Pinochet and other officials in Chile.

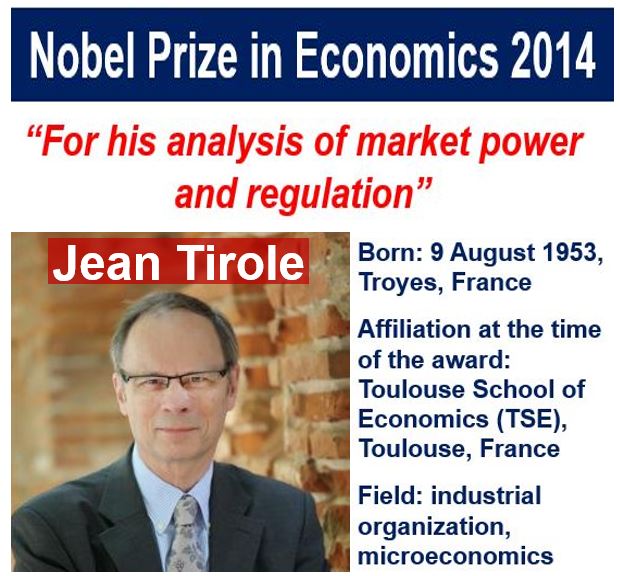

If the marketplace that is dominated by a small number of firms is left unregulated, society tends to suffer negative consequences. Prices can be abnormally high and new competitors may be prevented from entering the market. Jean Tirole had been working to develop a coherent theory, for example, showing that regulations need to be adapted to suit specific conditions in each industry. He put forward a framework for designing regulations and applied it to several industries. (Image: twitter.com/jeantirole)

If the marketplace that is dominated by a small number of firms is left unregulated, society tends to suffer negative consequences. Prices can be abnormally high and new competitors may be prevented from entering the market. Jean Tirole had been working to develop a coherent theory, for example, showing that regulations need to be adapted to suit specific conditions in each industry. He put forward a framework for designing regulations and applied it to several industries. (Image: twitter.com/jeantirole)

When John Forbes Nash (1928-2015) received the prize, there had been controversy within the Selection Committee because of Nash’s anti-Semitism and history of mental illness. The controversy led to a change in the rules governing the committee. Since 1994, Prize Committee members have not been allowed to serve for more than three years.

Winners of the Nobel Prize for Economics

2016: Oliver Hart and Bengt Holmström “For their contributions to contract theory.”

2015: Angus Deaton “For his analysis of consumption, poverty, and welfare.”

2014: Jean Tirole “For his analysis of market power and regulation.”

2013: Eugene F. Fama, Lars Peter Hansen and Robert J. Shiller “For their empirical analysis of asset prices.”

2012: Alvin E. Roth and Lloyd S. Shapley “For the theory of stable allocations and the practice of market design.”

2011: Thomas J. Sargent and Christopher A. Sims “For their empirical research on cause and effect in the macroeconomy.”

2010: Peter A. Diamond, Dale T. Mortensen and Christopher A. Pissarides “For their analysis of markets with search frictions.”

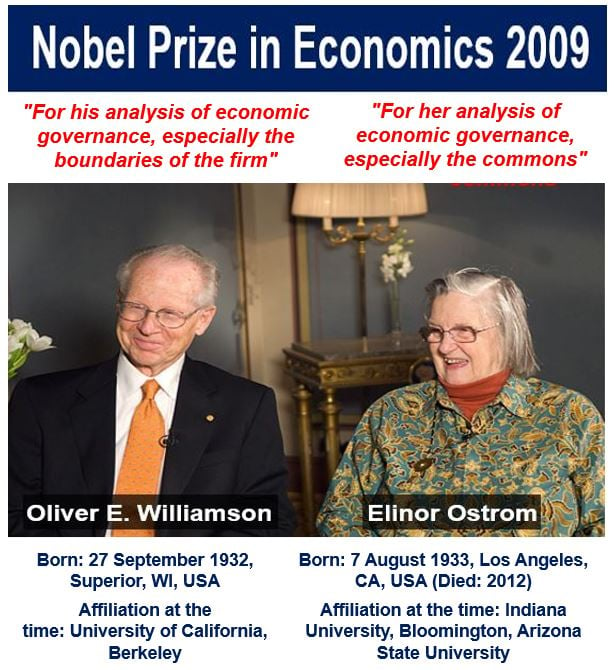

Elinor Ostrom disproved the long-held belief among economists that natural resources which were collectively used by their users would be over-exploited and eventually destroyed. In the early 1970s, Oliver Williamson proposed the theory that organizations may sometimes be more efficient than markets because their conflicts are simpler and much cheaper to solve. (Image: nobelprize.org)

Elinor Ostrom disproved the long-held belief among economists that natural resources which were collectively used by their users would be over-exploited and eventually destroyed. In the early 1970s, Oliver Williamson proposed the theory that organizations may sometimes be more efficient than markets because their conflicts are simpler and much cheaper to solve. (Image: nobelprize.org)

2009: Elinor Ostrom “For her analysis of economic governance, especially the commons,” and Oliver E. Williamson “For his analysis of economic governance, especially the boundaries of the firm.”

2008: Paul Krugman “For his analysis of trade patterns and location of economic activity.”

2007: Leonid Hurwicz, Eric S. Maskin and Roger B. Myerson “For having laid the foundations of mechanism design theory.”

2006: Edmund S. Phelps “For his analysis of intertemporal tradeoffs in macroeconomic policy.”

2005: Robert J. Aumann and Thomas C. Schelling “For having enhanced our understanding of conflict and cooperation through game-theory analysis”

2004: Finn E. Kydland and Edward C. Prescott “For their contributions to dynamic macroeconomics: the time consistency of economic policy and the driving forces behind business cycles.”

2003: Robert F. Engle III “For methods of analyzing economic time series with time-varying volatility (ARCH),” and Clive W.J. Granger “For methods of analyzing economic time series with common trends (cointegration).”

2002: Daniel Kahneman “For having integrated insights from psychological research into economic science, especially concerning human judgment and decision-making under uncertainty,” and Vernon L. Smith

“For having established laboratory experiments as a tool in empirical economic analysis, especially in the study of alternative market mechanisms.”

Milton Friedman (1912-2006) was an American economist who was among the intellectual leaders of the 2nd generation of Chicago Price Theory, a methodological movement at the Chicago School (University of Chicago’s Department of Economics). Friedman strongly opposed Keynesian government policies. In the 1980s, he was adviser to both US President Ronald Reagan and British Prime Minister Margaret Thatcher. He believed in the free market system with minimal government intervention. (Image: The Libertarian Republic)

Milton Friedman (1912-2006) was an American economist who was among the intellectual leaders of the 2nd generation of Chicago Price Theory, a methodological movement at the Chicago School (University of Chicago’s Department of Economics). Friedman strongly opposed Keynesian government policies. In the 1980s, he was adviser to both US President Ronald Reagan and British Prime Minister Margaret Thatcher. He believed in the free market system with minimal government intervention. (Image: The Libertarian Republic)

2001: George A. Akerlof, A. Michael Spence and Joseph E. Stiglitz “For their analyses of markets with asymmetric information.”

2000: James J. Heckman “For his development of theory and methods for analyzing selective samples,” and Daniel L. McFadden “For his development of theory and methods for analyzing discrete choice.”

1999: Robert A. Mundell “For his analysis of monetary and fiscal policy under different exchange rate regimes and his analysis of optimum currency areas.”

1998: Amartya Sen “For his contributions to welfare economics.”

1997: Robert C. Merton and Myron S. Scholes

“for a new method to determine the value of derivatives”

1996: James A. Mirrlees and William Vickrey “For their fundamental contributions to the economic theory of incentives under asymmetric information.”

1995: Robert E. Lucas Jr. “For having developed and applied the hypothesis of rational expectations, and thereby having transformed macroeconomic analysis and deepened our understanding of economic policy.”

1994: John C. Harsanyi, John F. Nash Jr. and Reinhard Selten “For their pioneering analysis of equilibria in the theory of non-cooperative games.”

1993: Robert W. Fogel and Douglass C. North “For having renewed research in economic history by applying economic theory and quantitative methods in order to explain economic and institutional change.”

1992: Gary S. Becker “For having extended the domain of microeconomic analysis to a wide range of human behaviour and interaction, including non-market behavior.”

1991: Ronald H. Coase “For his discovery and clarification of the significance of transaction costs and property rights for the institutional structure and functioning of the economy.”

1990: Harry M. Markowitz, Merton H. Miller and William F. Sharpe “For their pioneering work in the theory of financial economics.”

1989: Trygve Haavelmo “For his clarification of the probability theory foundations of econometrics and his analyses of simultaneous economic structures.”

1988: Maurice Allais “For his pioneering contributions to the theory of markets and efficient utilization of resources.”

1987: Robert M. Solow “For his contributions to the theory of economic growth.”

1986: James M. Buchanan Jr. “For his development of the contractual and constitutional bases for the theory of economic and political decision-making.”

1985: Franco Modigliani “For his pioneering analyses of saving and of financial markets.”

1984: Richard Stone “For having made fundamental contributions to the development of systems of national accounts and hence greatly improved the basis for empirical economic analysis.”

1983: Gerard Debreu “For having incorporated new analytical methods into economic theory and for his rigorous reformulation of the theory of general equilibrium.”

1982: George J. Stigler “For his seminal studies of industrial structures, functioning of markets and causes and effects of public regulation.”

1981: James Tobin “For his analysis of financial markets and their relations to expenditure decisions, employment, production and prices.”

1980: Lawrence R. Klein “For the creation of econometric models and the application to the analysis of economic fluctuations and economic policies.”

1979: Theodore W. Schultz and Sir Arthur Lewis “For their pioneering research into economic development research with particular consideration of the problems of developing countries.”

1978: Herbert A. Simon “For his pioneering research into the decision-making process within economic organizations.”

1977: Bertil Ohlin and James E. Meade “For their pathbreaking contribution to the theory of international trade and international capital movements.”

1976: Milton Friedman “For his achievements in the fields of consumption analysis, monetary history and theory and for his demonstration of the complexity of stabilization policy.”

1975: Leonid Vitaliyevich Kantorovich and Tjalling C. Koopmans “For their contributions to the theory of optimum allocation of resources.”

1974: Gunnar Myrdal and Friedrich August von Hayek “For their pioneering work in the theory of money and economic fluctuations and for their penetrating analysis of the interdependence of economic, social and institutional phenomena.”

1973: Wassily Leontief “For the development of the input-output method and for its application to important economic problems.”

1972: John R. Hicks and Kenneth J. Arrow “For their pioneering contributions to general economic equilibrium theory and welfare theory.” Economic equilibrium exists when demand and supply are the same.

1971: Simon Kuznets “For his empirically founded interpretation of economic growth which has led to new and deepened insight into the economic and social structure and process of development.”

1970: Paul A. Samuelson “For the scientific work through which he has developed static and dynamic economic theory and actively contributed to raising the level of analysis in economic science.”

1969: Ragnar Frisch and Jan Tinbergen “For having developed and applied dynamic models for the analysis of economic processes.”

Video – Nobel Prize for Economics 2016

This Wall Street Journal video shows the announcement of the winners of the 2016 Nobel Prize for Economics – US based Oliver Hart and Bengt Holmström, for their contributions to the understanding of contract design.