What is Venture Capital? Definition and Meaning

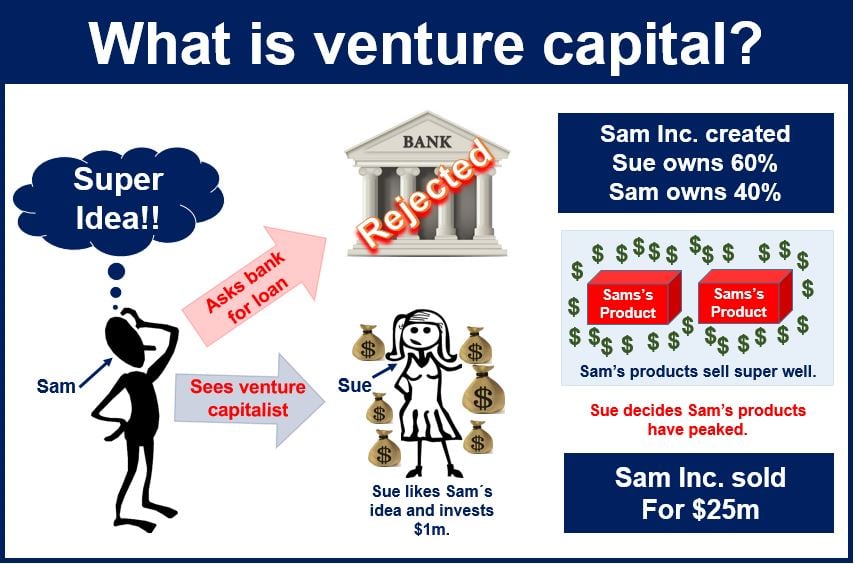

Venture Capital or VC is financial capital provided by investors to small businesses that have high long-term potential. It is a type of private equity.

Private equity refers to the stocks (shares) and debts of private companies, i.e. firms not listed on a stock exchange.

It is a primary source of funding for startups that do not have access to capital markets or are not able to secure a bank loan or complete a debt offering. They need capital for growth, new products or to enter new markets.

Most venture capital comes from a group of wealthy investors, investment banks, or other financial institutions.

It does not solely focus on financial funding, but may also help provide managerial and technical expertise.

A small part of private equity world

Venture capital makes up a very small part of the private equity world. About $25 billion annually goes into venture funds, which is a drop in the ocean compared to private equity funds which go into buyouts, recapitalizations, rollups, etc.

Venture capitalists provide funding in the interest of generating a return through an an IPO or trade sale of the company.

It is different from raising debt or a loan from a lender as lenders have a legal right to repayment of the capital (regardless of how well the business performs). Venture capitalists don’t have a legal right to any repayment as they are essentially purchasing an equity stake in the business and their return depends on how profitable the business becomes.

There are six main stages of venture funding:

- Seed funding: financing needed to prove a new idea. This occurs at the very early stage of a business, the idea or conceptual stage.

- Start-up: capital for costs associated with marketing and product development.

- Growth (Series A round): funds for sales and manufacturing.

- Second-Round: capital for companies that are selling product without turning a profit.

- Expansion: expansion money for a relatively new company that has become profitable.

- Exit of venture capitalist: finance provided to help the company go public.

Difference between an angel investor and venture capitalist: venture capital is money invested by firms – they often use other people’s money. An angel investor is an individual, not a company, who uses his or her own money to invest in startups.

Scientists and people with good ideas prefer the venture capital route instead of being employed by a large company. If their idea takes off, they make much more money when a large company comes in and places a bid to take over their business.

Internet giants have become venture capitalists

Google Inc., for example, has a large venture capital division called GV (formerly Google Ventures).

In July 2014, a Google Ventures European fund was launched with an initial investment of $100 million. According to Google, Europe is teeming with good ideas and it wants to get in there to back interesting startups.

Companies that Google has acquired over the last several years were startups it funded. Examples include Nest Labs (bought for $3.2 billion) and Dropcam (which Nest Labs later acquired for $555 million).

It now, as of 2023, boasts $8 billion in assets under management and has 400 active portfolio companies in North America and Europe. It has significant investments in companies like Uber, Nest, Slack, GitLab, Duo Security, Flatiron Health, Verve Therapeutics, and One Medical.

What do venture capitalists look out for?

Venture capitalist companies typically see thousands of plans each year and only choose to back one or two dozen.

What they look out for is great people, expertise, ventures that are bringing an ‘unfair advantage’ that are likely to outperform because they have unique insights or market penetration, or perhaps unique defensible technology.

The venture capitalists wrap that all up and marry it with an enormous market opportunity that can create outsize returns for investors – and that’s a venture capital deal.

California – the world’s Mecca of venture capitalists

According to dealsroom.net, 8 out of ten of the top venture capitalists of 2023 are located in California:

1. Sequoia Capital – Menlo Park, California

2. Andreessen Horowitz – Menlo Park, California

3. Kleiner Perkins – Menlo Park, California

4. Khosla Ventures – Menlo Park, California

5. Battery Ventures – Boston, Massachusetts

6. New Enterprise Associates (NEA) – Chevy Chase, Maryland

7. Founders Fund – San Francisco, California.

8. First Round Capital, San Francisco, California.

9. Accel – Palo Alto, California.

10. Greylock Partners – Menlo Park, California.

Capital – Venture – Definitions

The word ‘capital’, when used on its own, refers to money used to start up a business or expand one, plus vehicles, buildings, machinery and equipment, etc.

The word ‘venture,’ on its own, means a new activity, in most cases in business, that involves uncertainty or risk.

If the business is a partnership, venture capitalists often become limited partners, i.e. their liability is limited to the money invested in the business.

Venture capital and the environment

In recent years, there’s been a growing trend among venture capital firms to invest in socially responsible or ‘impact’ businesses, which align financial returns with positive social or environmental impact.

Additionally, venture capital firms are increasingly utilizing advanced data analytics and artificial intelligence to identify promising startups and optimize their investment strategies.

Compound phrases with ‘venture capital’

With the term ‘venture capital,’ we can create many compound phrases. Here are some of the most common ones used in the world of business and investing:

- Venture Capital Fund: A pooled investment vehicle for funding startups.

- Venture Capital Firm: A company specializing in startup investments.

- Venture Capital Trust: A UK-based public fund for venture capital.

- Venture Capital Network: An interconnected system of investors and startups.

Video – What is Venture Capital?

This video presentation, from our YouTube partner channel – Marketing Business Network, explains what ‘Venture Capital’ is using simple and easy-to-understand language and examples.