Winner-takes-all market – definition and meaning

A Winner-Takes-All Market is one where the top players capture a disproportionately large share of the rewards, while the rest of the performers are left with extremely little. In a winner-takes-all market, individuals are paid not according to their absolute performance, but rather according to their performance relative to their competitors.

A winner-takes-all market may refer to people, products, or services. In such markets, a product or service which is just 1% better than the competing ones may get more than a 90% share of all the revenues for that class of good or service.

Put simply, when the top supplier or performer earns disproportionately more than his, her or its competitors, it is a winner-takes-all market.

Winner-takes-all market – examples

Examples of winner-takes-all markets may be found in sports, pop music, entertainment, and movies. A top rock superstar earns significantly more than all the other rock musicians there are, even though his or her skill level is only slightly higher than the next highest earning rock musician.

-

Actors

The highest-paid Hollywood actor or actress earns considerably more than the second-highest, who earns significantly more than the third, etc. The ten highest-paid Hollywood stars earn hundreds of times more than rest of the actors and actresses across the world.

-

Soccer players

The highest paid soccer (British: football) players in Europe’s most successful clubs, such as Barcelona, Manchester United, Bayern Munich, Juventus, Paris Saint-Germain, and Chelsea earn infinitesimally more money than the players in the second, third, or fourth divisions in their country’s leagues.

-

World of finance

In the world of finance, bond sellers with a slight edge have colossal incomes, while their competitors – who don’t have that slight edge – do not earn ‘slightly’ less, they earn considerably less.

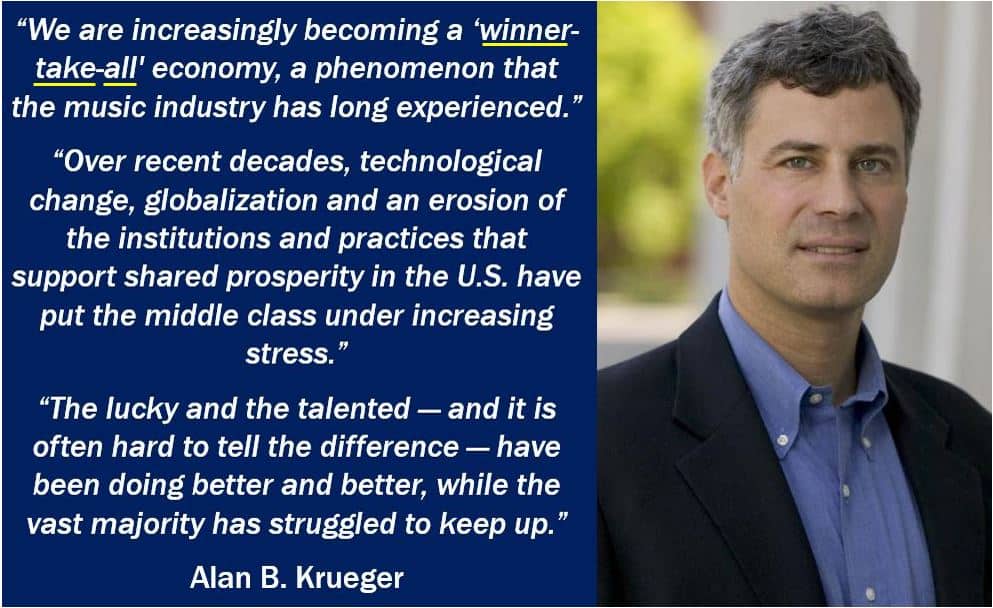

This disproportionate reward structure used to exist in very few sectors, but have been spreading to an ever-increasing number of occupations, including law, corporate management, and medicine.

As the world’s economy becomes more globalized, the winner-takes-all market is spreading. “Globalization has expanded the market for skills, increasing the opportunities for the rich to become even richer,” says The Economist’s glossary of terms.

Winner-takes-all tech market

In a Bloomberg article published in March, 2017 – ‘Tech Fuels the Winner-Take-All Economy‘ – Noah Smith writes that the Internet creates monopolies that suppress startups required for faster growth.

-

Decline in us startup numbers

Recent studies have been investigating the cause of declining dynamism among American businesses. The fall in the number of startups in the United States is a real concern, writes Smith, since new high-growth businesses are vital drivers of GDP (gross domestic product) growth.

In a study published in August 2016 – ‘Nowcasting And Placecasting Entrepreneurial Quality And Performance’ – Jorge Guzman and Scott Stern, from MIT (Massachusetts Institute of Technology), argue that new companies are finding it hard to scale up.

Guzman and Stern used historical data to identify businesses that show promising future growth. They found that more companies today – with the same characteristics as past companies that thrived – are not succeeding.

-

US market changing

Their study suggests that the whole US business environment is becoming a winner-takes-all market.

The changing nature of technology may have transformed the competition structure in the American economy, which today encourages more monopolies, Smith believes.

Smith wrote:

“The changing nature of technology may have altered the structure of competition in the U.S. economy, encouraging more monopolies. Venture capitalists have been noticing the troubling rise of winner-take- all situations in the startup world.”

Winner-takes-all market – Internet

Today’s growth industries are more likely to exist in a winner-takes-all market because of the Internet, argues Smith. Companies such as Snapchat and Facebook have very strong network effects. When their user numbers grow, even more people want to join.

Having three or more Facebooks out there makes no sense. “Strong network effects create natural monopolies — industries where competition tends to vanish on its own,” Smith writes.

It is not possible to successfully break up tech monopolies today. In the past, we could break up utilities companies and other monopolies when they became too powerful.

If Facebook split itself into two social networks, people would gradually leave one and move to the other. Subsequently, the monopoly would soon return.

The Internet, because of its very nature, breeds natural monopolies that stifle startups. This does not bode well for the US economy.

New ambitious companies that would have succeeded in the past will now fail. According to Guzman and Stern, this has been happening in the United States since the turn of the century.

This market dynamic often results in significant barriers to entry, making it difficult for new contenders to challenge established leaders. “Barriers to entry” are hurdles or obstacles that new businesses or newcomers face when trying to break into a market.

A less dynamic and less efficient economy

Regarding America’s winner-takes-all market of today, Smith writes:

“The result won’t just be a less dynamic economy, it will also be a less efficient one, as monopolies jack up prices above their efficient levels.”

“Natural monopoly is an economic threat that the U.S. simply hasn’t had to cope with very much in the past, and policy makers don’t have good countermeasures available.”

A 2014 report by Oxfam informed that the 85 richest people globally had as much wealth as nearly half the world’s population. Oxfam Executive Director, Winnie Byanyima, said:

“Without a concerted effort to tackle inequality, the cascade of privilege and of disadvantage will continue down the generations. We will soon live in a world where equality of opportunity is just a dream. In too many countries economic growth already amounts to little more than a winner-takes-all windfall for the richest.”

Video – What is a Winner-Takes-All Market?

This educational video, from our sister channel on YouTube – Marketing Business Network, explains what a ‘Winner-Takes-All Market’ is using simple and easy-to-understand language and examples.