Approximately 5.84 million British workers are paid less than the Living Wage, says a new study published by KPMG, a professional services company. Twenty-three percent of all employees currently earn less than the Living Wage, compared to 22% in 2014 and 21% in 2013.

Although the figures may not appear statistically significant, they equate to an increase of 497,000 people. During the same period, there were 435,000 more people in work – a total of 25 million.

The percentage of British workers earning less than the Living Wage has increased for three consecutive years. The figures also belie a worrying trend that sees part-time, female and young employees as the most likely to earn a wage that does not cover a basic but decent standard of living.

Most of the world’s advanced economies have a Living Wage movement.

Most of the world’s advanced economies have a Living Wage movement.

Low pay common in part-time jobs

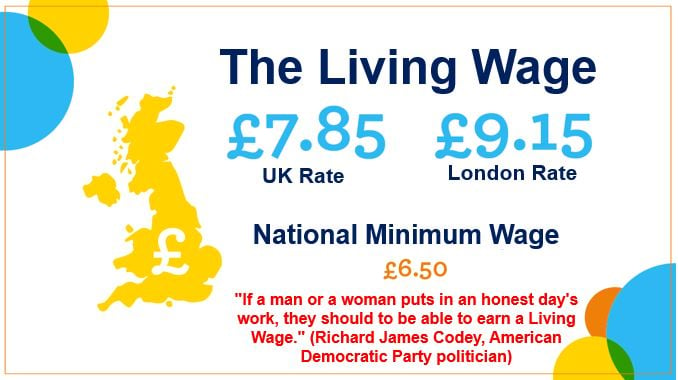

The study, carried out by Markit for KPMG, shows that part-time positions are three times as likely to pay less than £7.85 per hour (£9.15 in London) as full-time jobs.

There are 3.205 million part-time jobs paying below the Living Wage, compared to 2.623 full-time positions, even though part-time positions account for less than one-third of all British jobs.

For the third year running, the study found that women are significantly more likely to be paid less than the Living Wage than men. With almost 280,000 more female workers in 2015 than 2014, this year’s data shows that an estimated 29% of women earn less than the Living Wage, compared to 18% of men.

With more young adults in jobs than last year, the study shows that younger employees remain the most likely group to be stuck in the ‘working poverty trap’.

Seventy-two percent of 18 to 21 year-old workers today earn less than the Living Wage, compared to 17% of 30 to 39 year-olds. This means, in real terms, that 880,000 employees of traditional university age do not earn enough to support the purchase of basic necessities.

More FTSE 100 firms paying the Living Wage

Head of Living Wage at KPMG, Mike Kelly, said:

“The past year has seen some notable achievements, with 2000 employers, including more than a quarter of the FTSE 100 now accredited by the Living Wage Foundation. Awareness of the issue has also increased, with more than 3 out of 4 of the general public in the know about what the Living Wage is.”

“With the cost of living still high the squeeze on household finances remains acute, meaning that the reality for many is that they are forced to live hand to mouth. The figures released today show that there is still more to be done if we are to eradicate in work poverty.”

The study also found that in October 2015, four times as many workers earning less than the Living Wage were pessimistic about their household finances than were positive, compared to the figures in October last year.

The most common worries were pessimism regarding job security and the rise in debt levels. Contrastingly, about 30% of those earning more than the Living Wage expect their household finances to improve during the next 12 months.

What is the Living Wage?

Employers volunteer to pay the Living Wage, it is not compulsory. It is a rate of pay (per hour) set independently and updated each year.

It is calculated according to the cost of living in Britain. The calculation takes into account healthy food, accommodation, travel, and some little extras.

The Living Wage is supported by all major political parties. In the UK, it began in 2001 and is led by the Living Wage Foundation and Citizens UK. The current UK Living Wage outside London is £7.85 per hour, and £9.15 per hour in London.

The Living Wage is not the same as the Minimum Wage, which is compulsory. The minimum wage is £6.70 per hour and £3.30 per hour for an apprentice.

According to the UK Government’s website:

“It doesn’t matter how small an employer is, they still have to pay the minimum wage.”

The Mayor of London, Boris Johnson, announced on November 2nd that the London Living wage increased from £9.15 to £9.40 per hour.

Video – Working three jobs to get by

In this Living Wage Foundation video, Nana-Ben explains why he has to work three jobs to make ends meet. He is campaigning for all Whitehal departments to pay the Living Wage.