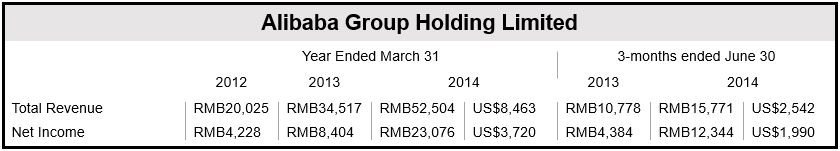

Alibaba sales increased significantly, driven by dramatically higher sales through mobile devices, the company reported in its latest quarterly results, probably the last before it launches its IPO in the New York Stock Exchange in less than one month’s time.

Revenue increased by 46% to Rmb15.771 billion ($2.542 billion) compared to the same quarter in 2013.

Net income nearly tripled to Rmb12.344 billion ($1.9 billion), according to a filing amendment.

Mobile business shoots up

The world’s largest e-commerce company generated approximately $395 million in mobile revenue, about ten times more than in the same quarter last year.

Monthly active mobile device users jumped to 188 million in the quarter ending on June 30, twenty-five million more than in the previous quarter.

Merchandise sales from mobile devices now represent almost one 32.8% of all goods volume sold on the website, up from 27.4% in the previous quarter and 12% in the same quarter last year.

Investors encouraged

These latest performance figures are likely to significantly encourage investor interest ahead of Alibaba’s market debut. The IPO is forecast to be one of the largest ever, possibly raising more than $20 billion, signaling a new era in the Chinese Internet industry.

Alibaba, which is a blend of Amazon, eBay and PayPal, derives its power and remarkable profits margins from its two giant e-commerce markets – Tmall and Taobao – and a number of other services, including online payments.

The company, launched by former English teacher Jack Ma in 1999, has been so successful that its own internal valuations of its shares have rocketed during the last three years.

(Data source: Alibaba filing)

Dominates Chinese market

Today, about 80% of all online retail sales in China are done by Alibaba. In the 12-month period ending on June 30, gross merchandise volume reached $269 billion.

It gives itself a value of about $140 billion today, from $133 billion in July and $119 billion in June.

Most analysts value the company at somewhere between $130 billion and $150 billion.

Reuters quoted James Cordwell, an analyst at Atlantic Equities, who said:

“The main positive I take away is that (it) seems the mobile monetization is on a very strong upwards trajectory. The results are very positive overall for the forthcoming IPO and I think you can see valuations to head north of $200 billion as we go through the IPO process.”

Jack Ma, China’s richest person

Alibaba founder Jack Ma currently has a net worth of $21.8 billion, according to Bloomberg. He owns 7.3% of Alibaba.

Ma also has a 48.5% stake in Zhejiang Ant Small & Micro Financial, which operates the Alipay online-payment service. The company is estimated to have a value of about $25 billion.

Ma’s net worth is $5.5 billion greater than Tencent’s founder Ma Huateng. Tencent is China’s biggest Internet firm by market value.

The third richest person in China is Baidu founder Robin Li.

Video – E-Commerce

Alibaba is an e-commerce company.