Allergan sues Valeant, Mr. Ackman and his hedge fund firm Pershing Square, accusing them of insider trading as well as other fraudulent practices. The Botox maker also alleges they did not disclose legally required data during the lead up to the hostile takeover bid for Allergan.

Illegal insider trading refers to using material non-public information (confidential information) for personal gain. It is also unlawful to pass on that confidential information to others.

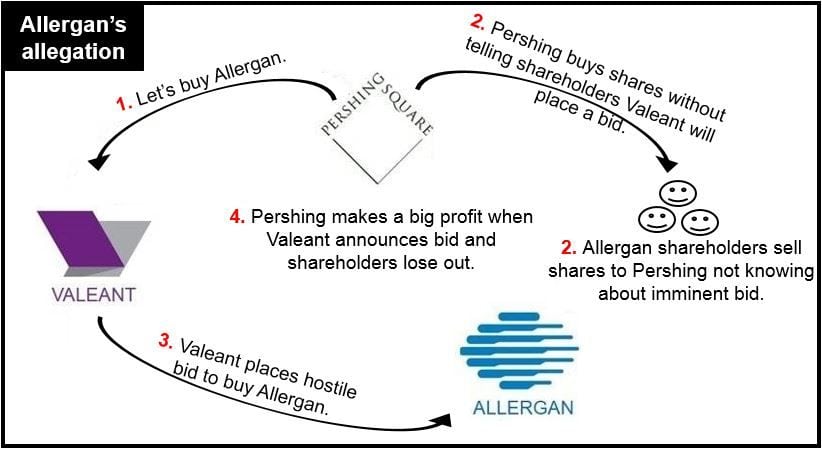

Allergan’s complaint, filed in the United States District Court for the Central District of California, says Pershing Square knew very well that Valeant was secretly planning to bid for Allergan when it purchased Allergan stocks.

Allergan said:

“The Allergan Board of Directors is strongly committed to protecting the stockholder franchise and believes it is important that the rights of the Company’s stockholders not be infringed by the actions of one hedge fund that significantly profited (to the detriment of other stockholders and the market) by trading in Allergan securities while in possession of material non-public information regarding Allergan.”

So far, Allergan’s Board have unanimously rejected Valeant’s acquisition offers.

Pershing allegedly made $1.2 billion profit illegally

Specifically, the complaint accuses Pershing Square of buying Allergan stock and securities valued (at the time) at more than $3.2 billion from unknowing company shareholders “while fully aware of Valeant’s non-public takeover intentions.”

By doing this, Allergan says Pershing secured for itself and deprived the selling shareholder of value appreciation worth about $1.2 billion when Valeant announced its first hostile bid on April 22, 2014.

In other words, the Allergan shareholders who sold their shares to Pershing knew nothing about Valeant’s interest and might not have sold them had they known the value of the stocks were about to rise sharply following a bid from Valeant. Pershing allegedly knew a takeover bid was coming but kept quiet about it.

Cancel Pershing’s share purchases, Allergan demands

Among several remedies sought in the complaint, Allergan says it wants a declaration from the court that the two companies – Pershing and Valeant – broke insider trading and disclosure laws. It is also seeking an order annulling Pershing’s purchase of the Allergan shares “it acquired illegally.”

The Irvine-based Botox maker added that it reserves the right to seek further remedies against Valeant, Pershing and/or Mr. Ackman.

Pershing eventually acquired approximately 9.7% of Allergan. It has been trying to call a special meeting of the Botox maker’s stockholders, where it would fire six of Allergan’s nine directors and pave the way for the $53 billion cash-and-stock hostile bid to proceed.

‘Debt-laden Valeant needed help, Allergan alleges

According to Allergan, Valeant, which it describes as “debt laden”, did not have the resources to place a bid without help. It “therefore sought third-party financing assistance from Mr. Ackman and his hedge fund, Pershing Square, which are wholly separate persons from Valeant.”

Allergan says that since 2008, Valeant has built up debts totaling $17.3 billion to fund its acquisitions. It survives on a business model that “depends constantly on making new and larger acquisitions,” it added.

The Botox maker has $1.5 billion in cash on its balance sheets and low debt, making it an ideal target for Valeant, which could use Allergan’s assets to service its mounting debt, Allergan wrote.

In the complaint, Allergan wrote:

“Allergan fully supports the rights of its stockholders to call a special meeting in accordance with the Company’s charter and bylaws, and therefore will seek expedition of the federal court’s decision so that the Company can quickly resolve this matter and continue focusing on delivering enhanced value to all of its stockholders.”

Valeant’s share price falls

Valeant’s bid to buy Allergan is losing value rapidly. It has sharply reduced its 2014 guidance for its revenue and earnings per share. It now expects 2014 cash earnings of $7.90 to $8.10 per share on revenue of $8 billion to $8.7 billion, compared to April’s guidance of $8.55 to $8.80 and $8.3 billion to $8.7-billion respectively. The company’s outlook for 2015 has also been revised downward.

Investors took a dim view of Valeant’s new outlook. Shares took a 10% nosedive yesterday after the new guidance was published.

Half of Valeant’s cash-and-share offer to buy Allergan is in the form of stock, which means the value of the bid is rapidly sliding.

Valeant’s total revenue increased to $2.04 billion in the second quarter, compared to $1.09 billion last year.