Despite leading indicators showing that the US economy continues moving into positive territory and the Dow Jones Industrial Index is at record levels, why are Americans still worried? According to The Harris Poll, US citizens are still concerned about several aspects of the overall economic picture, and more importantly, how it affects their savings accounts and wallets.

The Harris Poll surveyed 2,306 American adults online between July 16th and 21st.

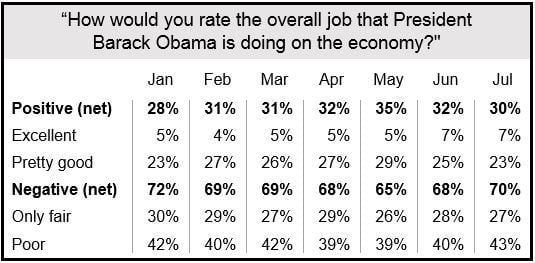

Barack Obama rating

Historically, when things are going well the President is praised, and then blamed when the economy takes a downturn.

Despite the current economic recovery, only 30% of Americans give President Obama a positive rating for how the economy is being handled, while 70% give him a negative rating. During the previous month the figures were 32% and 68% respectively.

(Data source: The Harris Poll)

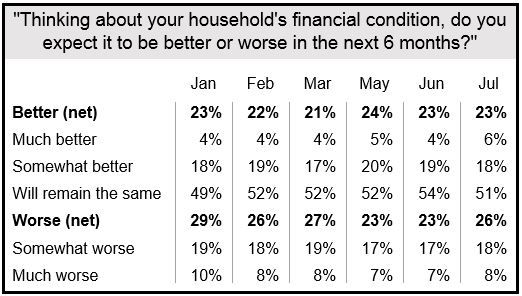

Just over half of all Americans (51%) expect their household’s financial conditions to remain the same during the next six months, while just 23% believe things will improve, and 26% say their situations will worsen, compared to last month’s 23%, 54% and 23% respectively.

(Data Source: Harris Poll)

What are Americans worried about?

Retirement and Healthcare

Sixty-eight percent of Americans who are self-employed or have a spouse who is self-employed say they are concerned that they will not have enough put aside for retirement. Sixty-three percent in the same group worry that they will not be able to afford their healthcare costs.

Even though sixty percent of Americans say they are not worried that they (or their spouse) might have to take a second job to get by, 40% are worried.

Fifty-five percent of US citizens are concerned that they will have to work during their old age because they won’t have enough money to retire. The Harris Poll adds “However, this includes people who may have their eyes already on retirement.” Sixty-four percent of Millennials and 74% of Gen Xers are worried about this. (Millennials are people born in the 1980s or 1990s, while Gen Xers are those born from the early 1960s to early 1980s).

Parents

Sixty-three percent of parents whose children are under 18 worry that they will not be able to afford their kids’ college fees.

Thirty-six percent of parents with children of all ages worry that their kids will not be able to afford housing and might have to move back and live with them.

Housing

Twenty-three percent of respondents worry that they might not be able to afford their mortgage payments and could subsequently lose their homes. Thirty-two percent of Millennials who own a home and have a mortgage have this concern.

Among people who do not yet own a home, 61% are worried they will not be able to afford to buy one. Sixty-eight percent of Gen Xers and 66% of Millennials have the same concern.

More than half of all respondents (51%) said they are worried that all they will only have enough money for basic necessities, while 41% express concern about not being able to afford food, clothes, housing and transport.