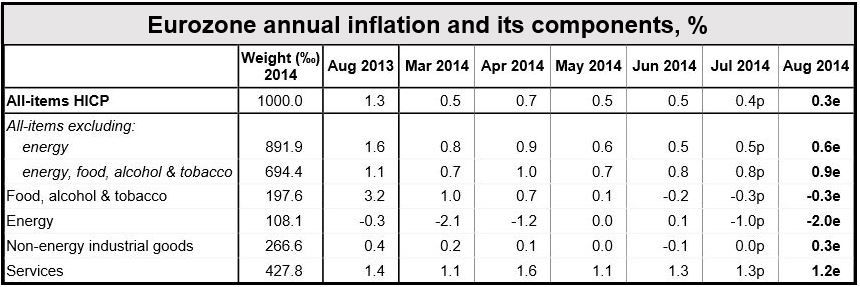

August Eurozone inflation sank to a five-year low of 0.3%, according to Eurostat, fueling concerns that the currency bloc is slipping into a spiral of deflation and economic stagnation, much like Japan did for two decades. In the previous month the inflation rate had fallen to 0.4% from 0.5% in June.

The inflation decline was driven by energy and food, alcohol & tobacco prices, which fell by -2% and -0.3% respectively.

Economists and lawmakers in Europe fear that the region’s ultra-low inflation and high unemployment rates will eventually drag it back to recession.

In the second quarter Eurozone GDP flatlined.

What will the European Central Bank do?

The ECB (European Central Bank), which meets next Thursday, will be under even greater pressure now to do something to boost the economy.

Most economists are betting the central bank will not implement anything yet, but may do so in the months to come by injecting money into the system. It will likely eventually initiate large-scale purchases of public and private debt (quantitative easing).

Although the ECB had said it may consider quantitative easing as an option, it resisted because it was sure inflation would rise. In Germany, for historical reasons, people are suspicious of quantitative easing – they fear it may eventually trigger runaway inflation.

(Data source: Eurostat)

Earlier this month, ECB chief Mario Drahi said “Over the month of August financial markets have indicated that inflation expectations exhibited significant declines at all horizons,” which does not sound like somebody expecting prices to recover.

On Friday, Credit Suisse wrote in a note to clients “We now expect the E.C.B. to launch a broad-based asset purchase program – QE – by the end of the year. Importantly, we think this could be clearly telegraphed to markets as soon as next week’s governing council meeting.”

(Data Source: Eurostat. e = estimate p = provisional)

Why is deflation undesirable?

When consumers know that prices are unlikely to go up, or may even fall (deflation), they tend to reduce their spending. If you expect prices to fall, you wait before buying things knowing there may be better deals later on.

If everybody starts delaying their purchases businesses sell less and the economy slows down.

In order to boost falling demand businesses reduce their prices. However, lower prices discourage people from buying now because they expect better deals later on … and the cycle of lower prices and dwindling demand continues on its downward spiral.

Businesses behave much in the same way as private consumers do. If they know prices will be lower later, they wait. Spending all over the economy goes down.

Eventually companies either reduce their workers’ wages or start firing them because they are selling less. This pushes demand even further down.

Debt burden increases: if wages slide the debt burden rises. Somebody on a salary of $2,500 per month who pays $500 towards his/her mortgage has a debt burden of 20%. If the salary is cut to $2,000 but the mortgage payments remain the same, the debt burden rises to 25%.

July Eurozone unemployment still high

Eurostat has also published jobless figures for July, which shows that unemployment is still hovering close to record levels.

July unemployment remained the same at 11.5% in the Eurozone and 10.2% in the wider European Union (EU), too high to remove concerns about ultra-low inflation.

There were 18.4 million jobless people in the Eurozone and 25 million in the wider EU in July.