BG Group’s incoming CEO Helge Lund is to get a £25 million pay deal if the proposal goes through, which the Institute of Directors (IoD) describes as “excessive, inflammatory and contrary to the principles of good corporate governance.”

The IoD rarely comments on directors’ pay, making its latest remark stand out.

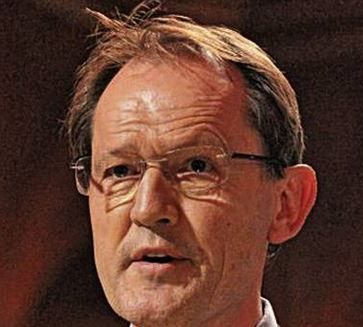

Director General of the IoD, Simon Walker, said:

“The Institute of Directors is always reluctant to criticize an individual company. However we do have a responsibility to criticize an action that brings the whole of British business into disrepute and threatens already fragile attitudes to corporate Britain.”

“For that reason we state explicitly our strong opposition to BG Group’s recommended £25 million pay deal for its incoming chief executive, Helge Lund. It is excessive, inflammatory and contrary to the principles of good corporate governance.”

Mr. Lund will join the British multinational oil and gas company next year and has been awarded a £12 million “golden hello” in stocks, plus the opportunity to earn an additional £14 annually if certain performance targets are met.

Mr. Lund has served as Chief Executive of the Norwegian oil & gas company Statoil since 2004.

This generous deal follows a 3-year ‘binding’ pay policy which BG shareholders had approved only six months ago.

Mr. Walker added:

“There is no doubt that Mr Lund is a talented Chief Executive, but the pay package and the decision making process behind this is wrong. It will damage the legitimacy and integrity of corporate Britain as a whole by seeking to unpick binding votes cast by the owners of the company.”

“Calling an extraordinary general meeting in order to slip through a pay deal that drives a coach and horses through those arrangements is unacceptable. It cannot be right to put fund managers in a position where, unless they approve excessive pay way beyond agreed policy, their shares will fall in value. We urge shareholders – including investment institutions – to put their credibility and that of the business community first.”

Mr. Walker says such pay deals damage the reputation of UK plc.

Given BG’s size and sector, the pay proposal is just too high, the IoD emphasized, adding that it relies on vague performance conditions. It also smashes to pieces the pay policy shareholders had recently agreed to.

The peal deal would seriously undermine the credibility of British business just six months before a general election, and at a time when the reputation of several UK corporations are still suffering, Mr. Walker argued. “It is a red rag to the enemies of the free market. We urge shareholders to call BG’s bluff,” he said.