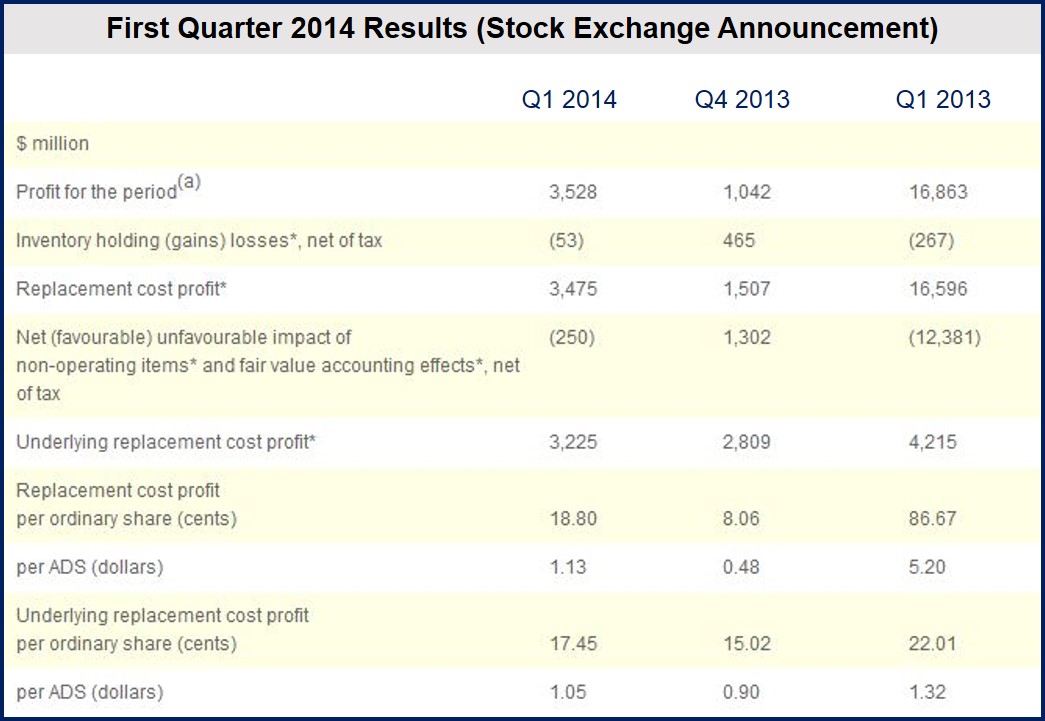

BP Q1 2014 profits fell 23% to $3.22 billion, compared to $2.8 billion in Q4 2013 and $4.2 billion in Q1 2013. The company reported operating cash flow in Q1 2014 of $8.2 billion. Figures were better than analysts had forecast.

BP said its Q1 2014 dividend, which will be paid in June, will be 9.75 cents per ordinary share, 8.3% higher than in Q1 2013.

Bob Dudley, BP Group’s CEO, said:

“This is a very solid start to 2014. Operating cash flow was strong in the first quarter, we have seen further exploration success and upstream project start-ups, and the upgraded Whiting refinery is ramping up steadily. We remain confident of delivering our 10-point plan targets that we set in 2011 for delivery in 2014.”

BP PLC, with headquarters in London, employs about 87,500 people around the world.

BP near share buyback conclusion

BP is close to completing its current $8 billion share buyback program, with $7.6 billion spent rebuying shares for cancellation.

Divestment totaling more than $3 billion have been agreed by the company, including the agreement last week to sell several assets in Alaska, “towards its expectation of agreeing $10 billion in additional divestments by the end of 2015. BP expects to use the post-tax proceeds from these divestments primarily for distributions to shareholders, biased towards share buybacks.”

Mr. Dudley said:

“We expect material growth in operating cash flow, coupled with disciplined investment, to deliver sustainable growth in free cash flow.”

“This will support increasing distributions to our shareholders. As well as progressive growth in the dividend per share, we expect to use surplus cash to support further distributions through share buy-backs or other mechanisms.”

(Source: BP)

BP’s Upstream segment

BP’s Upstream segment registered $4.4 billion underlying pre-tax replacement cost profit for Q1 2014, compared to $3.8 billion in Q4 2013 and $5.7 billion in Q1 2013. Compared to Q1 2013, the result was affected by the impact of sell-offs and higher non-cash costs.

Following the company’s decision to create a separate business around its US lower 48 onshore oil and gas activities, BP has opted not to proceed with the Utica shale development plans. The Upstream result includes a write-off linked to the Utica acreage.

Production down on previous quarter

Total oil and gas production for Q1 2014, including the Russian Federation, was 3.13 million barrels of oil equivalent per day (boe/d). One million boe/d of Rosneft’s oil and gas production in Q1 2014 was BP’s share.

Underlying production, excluding Russia, was slightly less than in Q1 2013, as higher output from new projects in the Gulf of Mexico, Angola, and the North Sea was offset by turnaround activity in Angola and less production in other parts of the world.

Excluding Russia, reported production was 8.5% less, reflecting both the January expiry of the onshore concession in Abu Dhabi and the impact of asset selling.

Production, excluding Russia, is forecast to be lower in the next quarter as a result of planned seasonal turnaround activity.

BP added that legal and compensation costs related to the 2010 Gulf of Mexico oil spill had not increased in Q1 2014, remaining at $42.7 billion.

BP says it will not cut its ties with Rosneft, despite Igor Sechin, the company’s CEO being the target of another round of American sanctions. BP is one of Rosneft’s largest shareholders.

A BP spokesman said:

“We are committed to our investment in Rosneft, and we intend to remain a successful, long-term investor in Russia.”

The spokesman added, however, that BP is studying the US sanctions announcement “in order to understand what exactly it might mean for BP.”

In March BP got the green light to compete against other oil companies for contracts in the Gulf of Mexico.