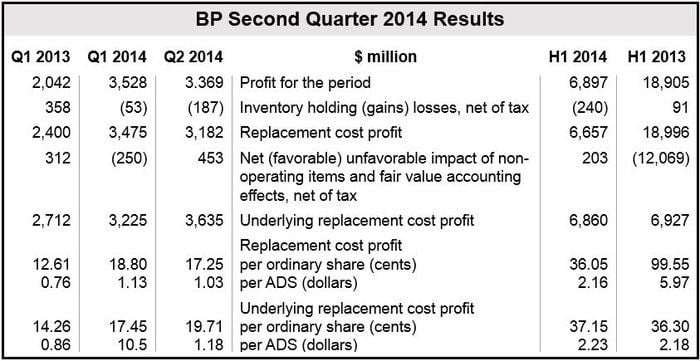

A BP Q2 profit rise was boosted by its investment in Rosneft, the Russian energy group. *Replacement Cost Profits increased to $3.2 billion, 34% and 13% percent higher than the $2.4 billion and $3.2 billion posted in Q2 2013 and Q1 2014 respectively.

Revenue in the quarter stood at $95.83, versus $95.7 billion in the same quarter last year.

*Replacement Cost Profit, also known as Current Cost of Supplies (CCS), strips out volatility in oil prices, it allows oil businesses to base their cost of goods sold on the current oil price, rather than when they were acquired, i.e. the profit is based on how much it would cost BP to replace the reserves it sells.

The company, which reviews the level of dividend with Q1 and Q3 results each year, announced a Q2 quarterly dividend of 9.75 cents per ordinary share, the same as in Q1 but 8.3% higher than in Q2 2013.

Despite higher profit, production fell 6% in the second quarter to 2.11 million barrels per day. The third quarter may post even lower production, the company warned. The company said the drop in production reflected seasonal maintenance in the Gulf of Mexico and Alaska.

US output was 28% higher than in the same quarter last year.

BP set to meet 2014 targets

Bob Dudley, BP CEO, described Q2 as another successful quarter which delivered both robust cash flow and operational progress. He said the company continues to ramp up its major new projects that push up cash flow. “This operational momentum keeps us well on track to meet our 2014 targets and underpins our longer-term commitment to grow distributions to our shareholders,” Mr. Dudley added.

Second quarter operating cash flow of $7.9 billion ($16.1 billion in H1) was driven by new and recently-started higher-margin upstream projects and greater processing of heavy crude oil at the company’s newly-modernized Whiting refinery in Indiana.

BP divestment program on track

BP, which has a divestment target of $10 billion by the end of next year, announced divestment agreements with a cumulative value of $3.4 billion so far.

Most of the divestment proceeds will go towards shareholder distributions, the company said, “with a bias to share buybacks.” In the middle of this month, it completed the $8 billion share buyback program that was launched after the sale of its stake in TNK-BP.

(Data source: BP plc)

Sanctions and Russian operations

BP has a 20% shareholding in Russian energy giant Rosneft. It says that the sanctions imposed so far associated with the Ukraine crisis have not affected business, but warned that if they are expanded they might.

BP, which is by far the largest foreign investor in Russia, said regarding its relationship with Rosneft:

“Any future erosion of our relationship with Rosneft, or the impact of further economic sanctions, could adversely impact our business and strategic objectives in Russia, the level of our income, production and reserves, our investment in Rosneft and our reputation.”

Net income from Rosnet in Q2 was $1 billion. The UK oil company received a c. $700 million dividend payment earlier in July.

The United States has already added Igor Sechin, Rosneft’s boss, to its sanctions list, i.e. Americans are not allowed to do business with him.

Seeking overcompensation return ‘with interest’

In June, BP said it was seeking overcompensation returns from a “vast number” of companies that exaggerated their losses from the Gulf of Mexico spill disaster.

The company told a US court that Patrick Juneau, the administrator assigned to process damages claims, had approved too many inflated applications. A US court in 2013 had accepted that the claims process was not fair.

The company’s attorneys say they want those overpayments back ‘with interest’.

BP, based in London, England, is one of the six “supermajor” oil companies. It employs more than 85,000 workers worldwide.