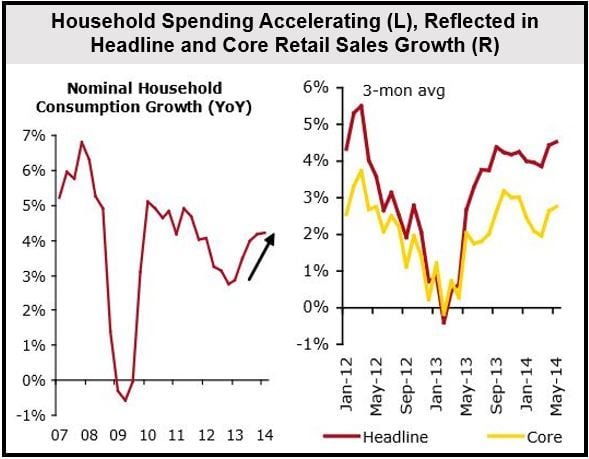

Canadian consumers have been driving GDP growth by dipping into their savings rather than borrowing, says a new report from CIBC World Markets. First quarter economic growth was driven by a 4.2% year-on-year increase in nominal household spending (nominal means inflation and some other variables have not been factored in).

Savings refers to the money that people put aside for emergencies, expected future expenses (such as college fees for their children), etc.

Avery Shenfeld, Chief Economist at CIBC, said that consumer spending’s contribution to the Canadian economy continues to remain in line with its long-term average. In fact its impact may be even greater in the second quarter.

Mr. Shenfeld said:

“It wasn’t borrowing, but until recently, elevated confidence and its impact on savings, that provided the fuel.”

The report – “How Long Can Consumers Hold the Fort?” (PDF: page 6) – was written by Benjamin Tal, Nick Exarhos and Avery Shenfeld.

The authors explain that poor disposable income gains have been offset by sharp increases in net worth driven by rising home prices and healthy equity markets. Consequently, Canadians stabilized their saving at approximately 5% in Q1 2014, a decline from levels recorded in early 2013.

Interest payment vs. disposable income ratio fell

Mr. Shenfeld said:

“With the asset side of consumer balance sheets allowing Canadians to reduce how much they squirrel away, more money has been temporarily available for spending. Falling rates on pre-existing debt – which lowered both the incentive to save and debt-servicing costs – provided consumers with additional sources of relief.”

“In fact, interest payments as a share of disposable income fell over the past year by a full percentage point to a record low of 7.1 per cent in the first quarter. Had payments and the savings rate stayed constant since Q1 2013, household consumption would have been around a percentage-point lower.”

Near-record low household credit growth

Today in Canada, household credit is increasing by just over 4% year-over-year – the slowest rate of growth since 1995, and the most sluggish pace for credit growth in any non-recessionary period during the last four decades.

- Non-mortgage loans that generally finance ongoing consumption are currently increasing by just 2% annually. Over the last 24 months they have been declining relative to income.

- Over the past 12 months, credit card balances outstanding and lines of credit have not increased at all.

- Direct loans have risen by 7.5% compared to the same time last year – mostly driven by a sharp increase in car loans (18%). Car loans, which represent a minor proportion of consumer credit, are typically offered at artificially reduced rates, in some way representing a subsidy on the part of dealers and manufacturers.

(Source: CIBC)

(Source: CIBC)

A March US interest rate hike?

With the US economy expanding by 4% in the second quarter and strong job growth, Mr. Shenfeld believes the US Federal Reserve will raise interest rates in March next year. He is calling for the Fed to increase the rate from its near-zero to 1.25% over the subsequent four quarters.

Mr. Shenfeld believes the interest rate increases will be moderate because US GDP growth rates have been erratic (Q1 posted a contraction).

The gap between US job gains and GDP growth over the last few quarters also has implications for the Bank of Canada.

Mr. Shenfeld said:

“An earlier than expected hike by the U.S. would allow the Bank to raise Canadian short rates here without fear of excessive Canadian dollar strength. But Bank of Canada Governor Stephen Poloz has been clear that he won’t see the economy on a sustainable expansion path, justifying monetary tightening, until real exports and related capital spending supplant households as a growth driver.”

“It’s U.S. growth, not employment, that drives Canadian export activity. Softer U.S. trend GDP gains lean against a quick acceleration in Canadian export volumes, which might need some juice from a still-weaker loonie.”

“As a result, we see no reason to move up the timing of the first Bank of Canada rate hike, which could be a half year later than the Fed. Patient Poloz will outlast Gentle Janet in the contest to see who blinks first.”

Interest rate hike effect on consumer spending

While interest-rate hikes will have some effect on home prices, the authors believe the impact on household spending will be much greater.

Canada’s home ownership rate currently stands at nearly 70%, while housing-related spending makes up almost 30% of the consumption basket. Although household debt (including mortgages) has been growing at a slower pace recently, it is at over 1.5 times disposable income.

Mr. Shenfeld said:

“Applying our forecasts for Canadian rates to the historical relationship they have held with interest costs suggests that Canadians will soon be faced with paying 100 basis-points more in interest on existing debt by the first quarter of 2016. Those higher rates would mean close to $18 billion dollars more in interests costs at today’s debt levels – over 1.5 per cent of current household consumption.”

Consequently, the authors believe that Canadian consumers will not be able to carry on driving the economy for long. “U.S. GDP growth and the Canadian corporate sector will need to take the reins,” they say.