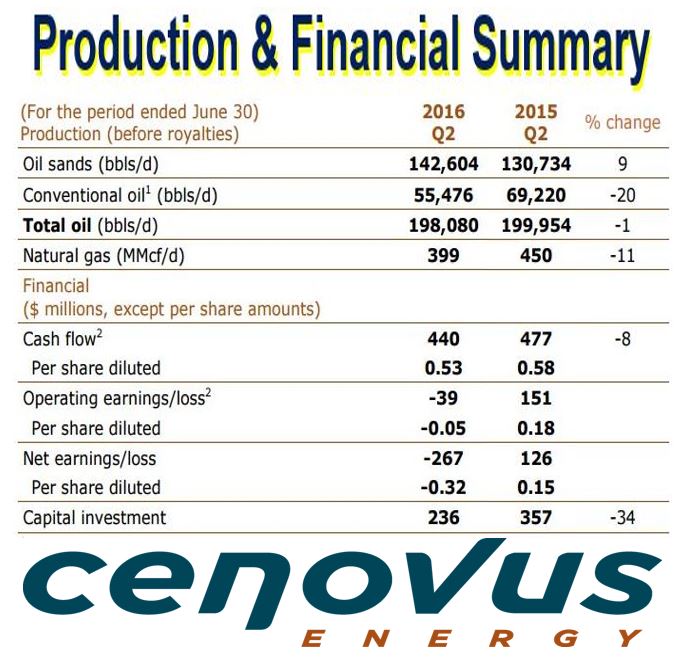

Canadian integrated oil company Cenovus Energy Inc. reported a $267 million loss for Q2, but says it is cutting costs big time and expects them to be reduced by approximately half-a-billion dollars this year, compared to its initial 2016 budget.

The Calgary-based company, which was formed in 2009 when Encana Corporation split into two distinct business entities, informed that its per-barrel operating costs are now 24% and 9% lower at its oil sand and conventional crude operations respectively.

Cenovus’ second-quarter net loss equaled 32 cents per share. It made a $126 million profit (15 cents per share) in the same quarter last year.

Regarding the company’s costs, Mr. Ferguson said: “I want to acknowledge the hard work of everyone at Cenovus in finding ways to reduce costs over the last year and a half,” said Ferguson. “This has made us stronger and more financially resilient, and we’ll continue to look for further efficiencies in the months ahead.” (Source: cenovus.com/news)

Regarding the company’s costs, Mr. Ferguson said: “I want to acknowledge the hard work of everyone at Cenovus in finding ways to reduce costs over the last year and a half,” said Ferguson. “This has made us stronger and more financially resilient, and we’ll continue to look for further efficiencies in the months ahead.” (Source: cenovus.com/news)

The bulk of this quarter’s loss was related to the company’s risk-management strategies, currency fluctuation and an operating loss of $39 million (5 cents per share), versus $151 million (18 cents per share) operating earnings the previous year.

Cenovus Energy becoming more streamlined

Cenovus, which currently employs about 3,500 workers, completed a workforce reduction program in Q2. Severance costs for the quarter totaled $19 million. The company has reduced its workforce by 31% since oil prices started to decline at the end of 2014.

Brian Ferguson, Cenovus President & Chief Executive Officer, said:

“We’ve achieved significant sustainable improvements in our cost structure over the last year and a half, and we’ll remain vigilant on costs to maximize our competitive position in this challenging and volatile commodity price environment.”

“Our reduced cost base and strong operational performance, coupled with an improvement in benchmark oil and natural gas prices from the lows reached earlier this year, contributed to a solid second quarter.”

Brian Ferguson, President and CEO of Cenovus Energy Inc., joined a predecessor company in 1984 and became a member of the Management Team in 1994. (Image: cenovus.com/about/leadership-team)

Brian Ferguson, President and CEO of Cenovus Energy Inc., joined a predecessor company in 1984 and became a member of the Management Team in 1994. (Image: cenovus.com/about/leadership-team)

Barrels per day production increasing

Production at Foster Creek reached nearly 69,000 barrels per day (bbls/d) net in June. During the second quarter, production was almost 65,000 bbls/d net, eleven percent higher than in the same quarter last year.

The company says it is on track to end the year with volumes greater than 70,000 bbls/d net.

Production at Christina Lake exceeded 78,000 bbls/d, which was eight percent more than in Q2 2015.

The Christina Lake phase F and Foster Creek phase G expansion projects are both on track to add to production totals in the third quarter.

Cenovus ended the second quarter with almost $8 billion in liquidity, consisting of $4 billion in unused credit facilities and $3.8 billion in cash.

Oil price plunge hurt financial performance

The company says its year-over-year financial performance was negatively affected by a dramatic fall in crude oil and natural gas prices compared to the second quarter last year.

Cenovus wrote in a press release:

“However, an increase in crude oil and natural gas prices from the multi-year lows reached in the first three months of 2016 contributed to improved cash flow compared with the first quarter of this year.”

Mr. Ferguson said:

“Given the strength of our balance sheet and financial position as well as our high level of confidence that the cost reductions we’ve achieved will be largely sustainable, I’m optimistic about the potential to resume construction on some of our deferred projects.”

“However, we still need additional clarity on federal fiscal and regulatory policies that could impact our operating environment.”

Video – Cenovus planting trees to support caribou

This Cenovus Energy video explains how the company is helping restore caribou habitat at its northeastern Alberta operations.