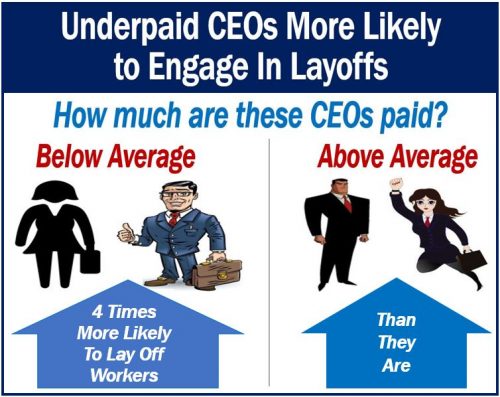

CEOs are more likely to engage in layoffs if they earn less than their peers, a new study reports. In fact, CEOs who earn less are four times more likely to lay off workers, say researchers at Binghamton University, the State University of New York, and Rutgers University, the State University of New Jersey.

Scott Bentley and colleagues wrote an article about their study and findings. Personnel Psychology has accepted the article, which is available online (citation below).

Bentley is Assistant Professor of Strategy at Binghamton University’s School of Management. When he was a Ph.D. student at Rutgers University, he worked on the research.

Prof. Bentley, Ingrid Fulmer, and Rebecca Kehoe sought to find out whether there was a correlation between CEO pay and layoff announcements. Fulmer and Kehoe are both associate professors at Rutgers School of Management and Labor Relations.

Prof. Bentley said:

“In terms of strategic decisions that a CEO can make that could lead to higher pay, layoffs are one of the easiest to do.”

“Relative to other decisions such as mergers or acquisitions, layoffs typically don’t need the approval of shareholders, the board or regulators, and they don’t take years to do. Layoffs can be determined overnight.”

S&P 500 – layoffs and CEO pay

The researchers gathered and analyzed data on S&P 500 companies. They focused on CEO pay and layoff announcements.

S&P 500 stands for Standard & Poor’s 500. It is a stock market index that includes the 500 biggest companies listed on NASDAQ and NYSE.

First, the researchers adjusted the analysis for several different factors that may influence a layoff. Company size and performance, for example, are factors that may influence layoff decisions. Industry conditions are also potential factors.

Underpaid CEOs

After adjusting for those factors, they identified a relationship between CEO pay and layoffs. Specifically, they found that ‘underpaid’ CEOs were four times more likely to announce layoffs.

Regarding the similarities between CEOs and other people in the workplace, Prof. Bentley said:

“In a way, CEOs are just like any other type of employee. They are going to compare their pay to those around them.”

“The difference is that the average employee can’t make strategic decisions for the company that influences their own pay. Executives can.”

CEOs who earn the same or more than peers

The researchers were surprised with what happened when CEOs were paid the same as or more than their peers. There was a steep decline in the likelihood of layoffs once their pay was the same as other CEOs.

Prof. Bentley explained:

“Right around the point where CEOs are paid equal to their peers, the effect kind of goes away.”

“We found that there’s this huge dropoff in the likelihood of announcing layoffs once your pay is relatively the same as, or more than, your peers.”

Did CEOs benefit?

So, for the CEO, did these actions actually pay off? The authors said that it depends.

In the year after layoffs, if performance also improved, on average CEO pay generally rose.

Regarding shareholders and CEO compensation, Prof. Bentley said:

“While there are some instances where pay increased when performance decreased, we found that if the company and the shareholders don’t benefit from the layoffs, neither does the CEO in most cases.”

Regarding the findings of this study, Prof. Kehoe said:

“This research raises difficult questions for boards and shareholders. On one hand, we’ve seen a push to rein in excessive CEO compensation packages by giving investors a ‘say on pay.'”

“On the other hand, underpaying CEOs could lead to layoffs, which have lasting negative effects on the terminated employees and may harm the firm’s reputation.”

Citation

“Payoffs for layoffs? An examination of CEO relative pay and firm performance surrounding layoff announcements,” F. Scott Bentley, Ingrid S. Fulmer, and Rebecca R. Kehoe. Personnel Psychology. First published: 11 July 2018. https://doi.org/10.1111/peps.12293.