CEOs say the US economy will be underperforming during the next six months, according to the 3rd quarter 2014 CEO Economic Outlook Index published by the Business Roundtable.

The Survey, which included 135 CEOs (Chief Executive Officers), was conducted from August 11th to 29th. The participating CEOs collectively post $7.4 trillion in annual sales and employ more than 16 million workers. Their six-month plans have a major impact on the country’s economy.

The Index provides a picture of the future direction of the American economy based on CEOs’ plans for hiring, capital spending and sales.

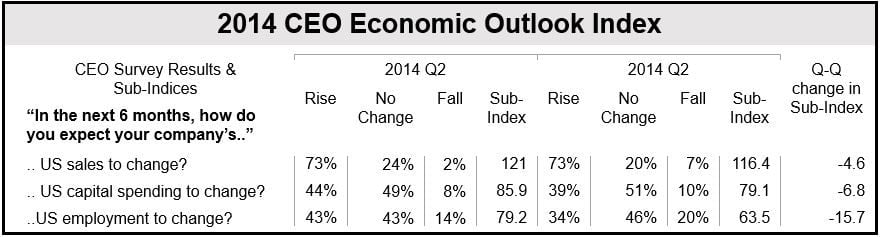

The Index fell marginally in the latest quarter of 2014, with plans for hiring, sales and capital spending all declining compared to the previous quarter. Hiring plans posted the sharpest fall.

According to the survey, just 34% of all the CEOs interviewed expect to hire more people during the next six months, compared to 43% in the previous quarter. Twenty percent plan to reduce their workforce, from 14% in the last quarter.

The percentage planning higher capital expenditure also declined, to 39% from 44%.

US economy underperforming

Randall Stephenson, chairman of Business Roundtable, and also CEO at AT&T, said:

“While some U.S. economic indicators are improving moderately, the results from our survey of CEOs seem to reflect an underperforming U.S. economy held back by policy uncertainty and growing conflicts around the world.”

CEOs’ forecast for 2014 GDP growth is now 2.4%, compared to 2.3% in the last quarter.

Mr. Stephenson said the US economy is still performing below its potential. While the country faces a number of economic problems, growth remains the key priority.

“We believe Congress and the Administration must focus on policies that drive economic growth, including tax reform, immigration reform, trade expansion and long-term fiscal stability,” he said.

(Data Source: 2014 CEO Economic Outlook Index)

The Survey found that the vast majority of CEOs (almost 90%) believe that tax reform – including having a corporate tax rate of 25% and a competitive territorial tax system – would boost investment and encourage companies to expand their operations in the United States.

The US has the highest corporate tax rate in the world.

The CEO Economic Outlook Index – a composite of how CEOs predict the next six months regarding employment, capital spending and sales – fell in Q3 2014 to 86.4, compared to 95.4 in Q2. The Index’ long-term average is 80.2.