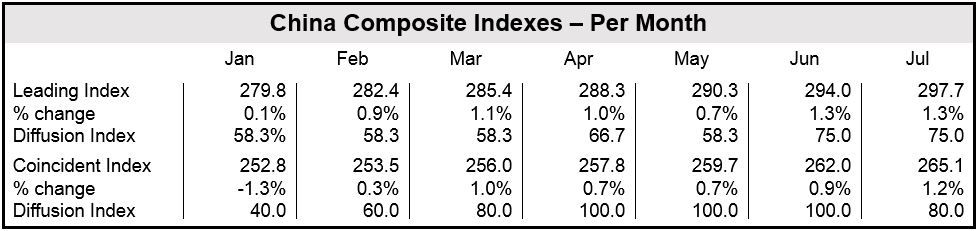

Chinese economic outlook improved significantly in July, says The Conference Board, as the country’s Leading Economic Index and Coincident Economic Index increased by 1.3% and 1.2% respectively.

The Leading Economic Index (LEI) points to what is going to happen in a country’s economy. If the figure rises it suggests that economic activity will improve.

The Coincident Economic Index (CEI) tells you how the economy is at the moment. Economists generally check the CEI to determine how far up or down the economic cycle a country is.

Resident economist at The Conference Board China Center in Beijing, Andrew Polk, said:

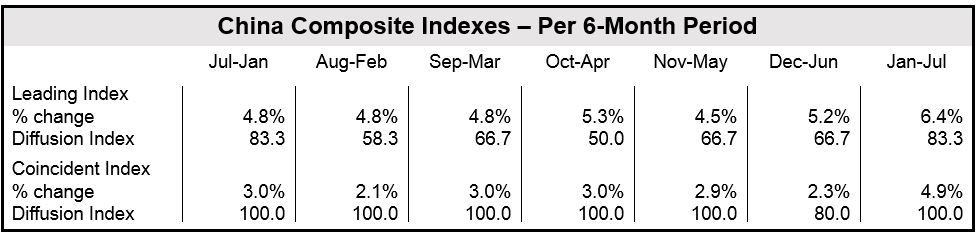

“The six-month growth rate of the China LEI increased considerably in July. However, the improvement was driven primarily by an increase in new floor space starts, which is unsustainable in the longer-term. Bank loans, meanwhile, offered their weakest contribution to the LEI since January 2012.”

“Given tight financing conditions and a still-fragile real estate market, there is some doubt as to whether recently improved LEI growth will translate into an acceleration of economic growth in the second half of 2014.”

China’s Leading Economic Index (LEI)

Of the six components that make up China’s LEI, five contributed positively to July’s figure.

Below is a list of the six LEI components and how they contributed (in order), with the strongest positive one first:

- total floor space started (positive),

- total loans issued by financial institutions (positive),

- the (inverted) PMI supplier delivery index (positive),

- the PMI new export orders index (positive),

- the 5000 industry enterprises diffusion index: raw material supply index, (positive),

- consumer expectations index (negative).

After July’s 1.3% increase, China’s LEI currently stands at 297.7 (2004 = 100), following May and June increases of 0.7% and 1.3% respectively.

(Data source: The Conference Board)

China’s Coincident Economic Index (CEI)

Of the five components that make up China’s CEI, four contributed positively to July’s figure.

Below is a list of how the five CEI components contributed to China’s July results (in order):

- the volume of passenger traffic (positive),

- value-added industrial production (positive),

- retail sales of consumer goods (positive),

- manufacturing employment (positive),

- electricity (negative).

After increasing by 1.2% in July, China’s CEI currently stands at 265.1 (2004 = 100), after rising in May and June by 0.7% and 0.9% respectively.

(Data source: The Conference Board)

Record trade surplus in July

In July, China recorded a 14.5% increase year-on-year in exports to $212.9 billion and a 1.6% decline in imports to $165.6 billion, leaving a record surplus of $47.3 billion, 6.9% higher than in July 2013.

The Chinese government has a GDP growth target of 7.5% for 2014. Most analysts believe the country’s growth will be export-led, principally due to demand from the advance economies.

Chinese exports in July 2014 compared to the same month last year increased by 17% to Europe, 12.3% to the US, and 11.9% to ASEAN.