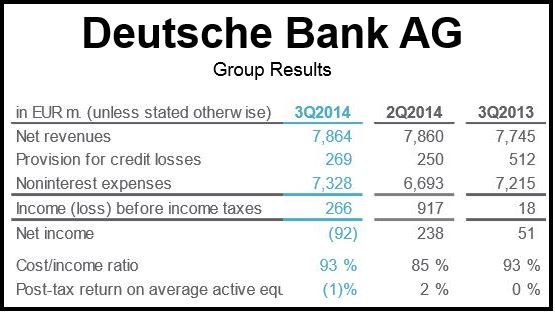

Frankfurt-based Deutsche Bank AG posted a €94 million loss for the third quarter compared to a €41 million profit in Q3 2013, after setting aside €894 million to cover settlement costs.

On Wednesday, Germany’s largest lender said revenue from trading fixed income and currencies was higher-than-expected.

Deutsche Bank has been accused of trying to manipulate currency markets. It says it is talking to authorities as it tries to reach an agreed settlement regarding its role in rigging benchmark interest rates.

In the United States, the German bank is also being investigated for allegedly doing business with Iran and possibly some others countries that are subject to American sanctions.

The mounting costs of resolving accusations of past illegal activities have undermined the company’s ability to build up capital, something it has to do to comply to looming regulatory requirements. Earlier this year, co-CEOs Jürgen Fitschen and Anshu Jain had to sell €8.5 million in shares.

(Source: Deutsche Bank AG)

Mr. Fitschen and Mr. Jain, said, regarding the third quarter figures:

“Net income in this quarter was materially impacted by provisions as we continued to work toward resolution of litigation matters related to legacy issues. We also incurred costs of adapting to new regulation, elevating our systems and control frameworks to best in class, and investing in growth in our core businesses. These costs were partly offset by further savings in our Operational Excellence (OpEx) program which has already reached its original year end 2014 target.”

The co-CEOs said that near-term headwinds still persist, with the Eurozone’s weakening economic outlook and geopolitical risks fueling uncertainties.

The co-CEOs added:

“In the coming quarters, we will continue to work systematically through our strategic agenda: resolving outstanding litigation matters, completing the task of adapting our platform to new regulation, finalising our investments in OpEx, and reaping the benefits of investments in core business growth. We remain resolutely focused on executing this agenda. Robust underlying performance in our core businesses indicates the progress we are making on that journey.”

CFO replaced

Deutsche Bank announced on Tuesday that its Chief Financial Officer (CFO), Stefan Krause, will be redeployed as Head of Strategy and Organizational Development as from November 1.

Dr. Marcus Schenk, a Goldman Sachs partner, will join the German bank as General Manager and Deputy CFO. On May 21, 2015, he will succeed Mr. Krause as CFO.

Mr. Krause will continue as CFO until May 21, 2015.

Chairman of the Supervisory Board, Dr. Paul Achleitner, said:

“In Marcus Schenck we have found a future CFO who combines the experience of a DAX CFO with an impressive international banking background. His personality and expertise make him a welcome addition to the management team.”