For the first seventy-five years of the 20th century, the Republic of Ireland’s (Ireland’s) economy was much weaker than Northern Ireland’s. Agriculture represented an important part of the national economy. Much of the agriculture at the time consisted of uneconomically small farms. Seán Francis Lemass (1899-1971), Minister for Industry and Commerce, introduced protectionism in 1932, which subsequently isolated the country’s economy.

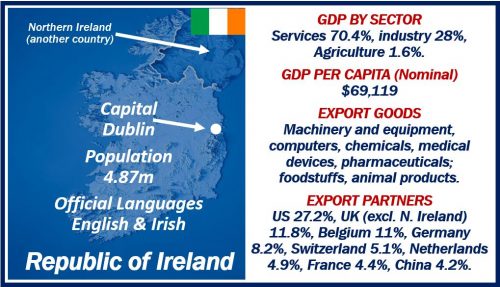

We can also refer to the country using its Irish Gaelic name Éire. In this article, you will see both words – ‘Ireland’ and ‘Éire.’

Many countries in Europe experienced an economic boom after the end of World War II; from 1945 to the 1960s. Ireland, however, did not. During that period, half a million people emigrated.

Ireland joins the European Union

In 1973, Éire became a member of the EEC. EEC stands for the European Economic Community, which today is the European Union (EU).

It was undoubtedly the most significant step the country took to transform its economy. Since joining the EU, Ireland changed from an antiquated, agriculture-dependent economy into a prosperous, modern one. Today, the economy is largely driven by global exports and high-tech industry. It is also a very popular place for businesses from all over the world to register their companies.

Foreign direct investment

According to a team of experts in company formation matters in Ireland, Ireland is a popular destination for foreign investors. Especially those who want to enter the eurozone and wider EU market. Its low corporate tax rates and pro-business environment attract investors from all over the world.

Irish Tax and Customs says that Ireland has signed comprehensive Double Taxation Agreements with 74 nations, of which 73 are in effect.

Éire today is the European hub of more than 1,000 leading multinational companies, says an Irish law office specialized in setting up companies. Multinationals that require a skilled and educated workforce choose to locate in the Celtic tiger. The term ‘Celtic Tiger’ refers to the thriving economy of Ireland, which grew dramatically from the mid-1990s to the late 2000s.

Foreign direct investment or FDI is today a key plank upon which the country’s economy is built. Economists estimate that twenty percent of private-sector employment is attributable directly and indirectly to FDI. FDI also contributes considerable taxation revenue for the government.

The economy of Ireland today

The economy of Éire today is a knowledge economy. In other words, it is the use of knowledge that generates intangible and tangible values. It focuses on services into life sciences, high-tech, and financial services industries. Currently, there are various Irish people thriving in different sectors globally and spreading the word about the things Ireland can offer. Such is the case of the top 10 Irish Americans who have impacted the world.

The country is sixth in the Index of Economic Freedom, which means that it has a very open economy. It currently ranks fifth globally for high-value FDI flows.

Of the 187 countries in the IMF table, Éire’s GDP per capita ranks 5th. According to the World Bank ranking, the country is in sixth place, regarding GDP per capita, out of 175 countries.

Of Ireland’s top 20 firms by turnover, 14 are American multinationals. “There are no non-US/non-UK foreign firms in Ireland’s top 50 firms by turnover,” says Wikipedia.

Major sectors of the economy

Below is some information about the main sectors of the economy of Ireland:

Alcoholic drinks industry

This sector employs about 92,000 workers and contributes approximately €2bn ($2.27bn, £1.78bn) annually to the national economy. It supports jobs in brewing, distilling, and agriculture.

Pharmaceutical industry

The pharmaceutical industry employs about 50,000 workers. Pharmaceutical exports are worth approximately €55bn ($62.45bn, £4.885bn) annually.

Aircraft leasing

Irish lessors manage over €100bn ($113bn, £89bn) in assets. The sector employs approximately 1,200 workers directly. Eire manages almost twenty-two percent of the global fleet of aircraft. The country has fourteen of the top fifteen lessors by fleet size.

ICT

ICT stands for information and communications technology. This sector employs more than 37,000 workers. It generates approximately €35bn ($40bn, £31bn) annually. There are more than 200 ICT companies nationwide. Many ICT multinationals have their EU headquarters in Ireland. Apple Inc., for example, has its European headquarters in Cork.

Software

Approximately 24,000 employees work in the software sector. It contributes about €16bn ($18bn, £14bn) to the national economy. Eire is the world’s number one exporter of software. It is home to more than 900 software companies.

MedTech

MedTech stands for medical technology. This sector employs almost 25,000 workers. It generates approximately €9.4bn ($10.7bn, £8.4bn).

Setting up a company in Ireland

In 2014, the Irish Companies Act underwent significant changes. As a result of the changes, it became possible to set up several new types of limited liability companies. The aim was to provide more flexibility to investors from abroad who wanted to open a company.

2011 – 2018 Company Formation Ireland has a list of the main types of Irish limited liability companies that exist today.

Subsidiary or branch office

If you are a foreign investor and are considering expanding your business in Ireland, you have two options:

- Open a subsidiary.

- Open a branch office.