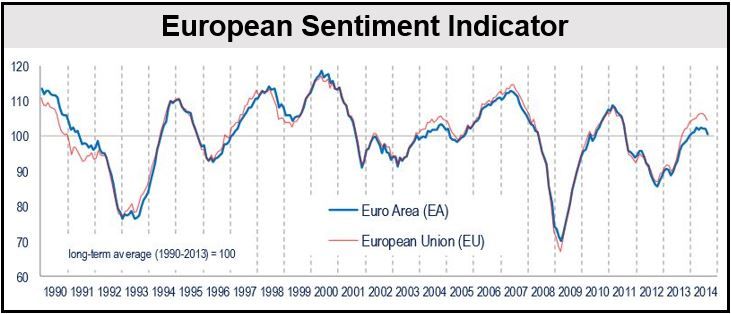

In August, European economic sentiment fell in both the whole of the EU and the Eurozone, the European Commission reported today, which says that after a “flat” five month period, business confidence has slipped back to last year’s level.

The Eurozone’s Economic Sentiment Indicator (ESI) declined by -1.5 points to 100.6, while in the wider European Union (EU) it slid by -1.2 points to 104.6.

The Eurozone’s economic recovery stalled in the second quarter. Add to this the crisis in Ukraine and economic sanctions against Russia, and the prospects of a rebound for the block of 18 nations is becoming bleak.

Pressure is growing on the ECB (European Central Bank) to pursue more aggressive policies to help pull the Eurozone out of a looming deflationary recession.

Declining economic sentiment was the result of a worsening of confidence in industry, consumer perception, the retail trade, and also to a certain extent in the services sector. Confidence in construction fell marginally.

Among the Eurozone members, sentiment fell by:

- Italy: -4.1,

- Germany: -1.9,

- France: -0.6,

- the Netherlands: -0.8.

In Spain, sentiment remained unchanged.

(Source: European Commission)

Industry confidence

Industry confidence declined by -1.5, driven mainly by managers’ more cautious views regarding production.

Managers’ assessment of current and overall stocks of finished products and order books remained the same.

However, their assessment of past production levels, and to a lesser extent export order books, improved (export order books were not included in the current Economic Sentiment Indicator calculation).

Services confidence

Services confidence declined by -0.5, driven by managers’ assessment of past demand and the past business situation. Demand expectations, however, remained the same.

Consumer confidence

Consumer confidence fell by -1.6, driven by people’s pessimism regarding future job prospects and the general economic situation, and to a lesser extent future households’ financial situations and savings.

Retail trade confidence

Managers’ negative assessments of both the present and near-future business situation, together with a negative assessment of the adequacy of stock volumes, pushed the retail trade confidence down -2.3.

Construction confidence

Downward revisions of the level of order books, which were partially offset by better job expectations, pushed confidence down slightly (-0.2).

Financial services confidence

Financial services confidence increased by +0.4. There was a more positive assessment of past demand and the past business situation. However, expectations for demand were down. Financial services confidence is not included in the Economic Sentiment Indicator.