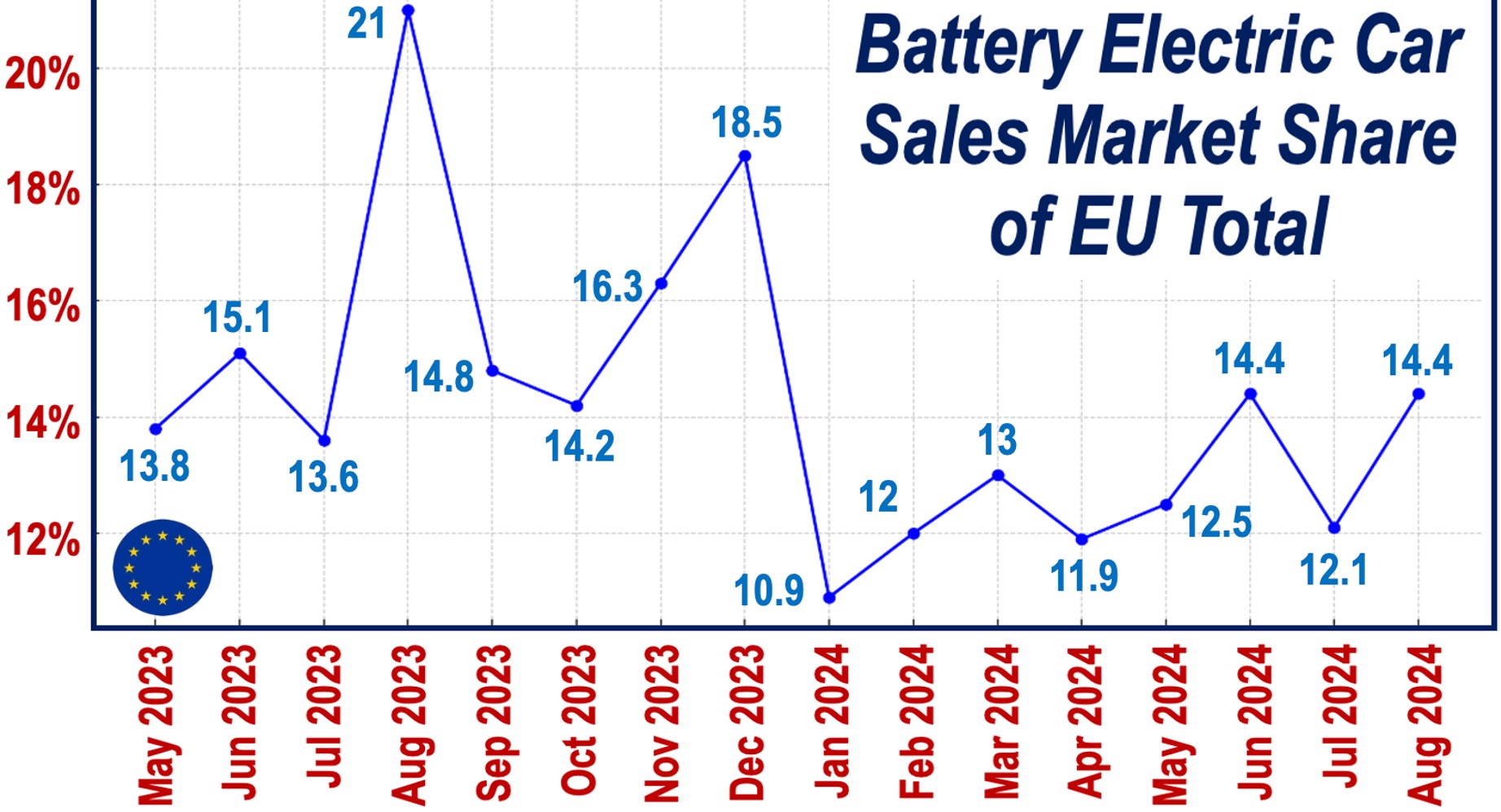

Electric vehicle (EV) sales in the European Union saw a sharp decline in August 2024, raising concerns among automakers and policymakers. EV sales plummeted by nearly 44%, with countries like Germany, France, and Italy recording significant drops in new car registrations.

This downturn comes at a crucial moment, as the EU’s 2025 deadline for CO2 emissions reduction looms, putting additional pressure on carmakers to meet stringent environmental targets.

The Numbers Behind the Decline

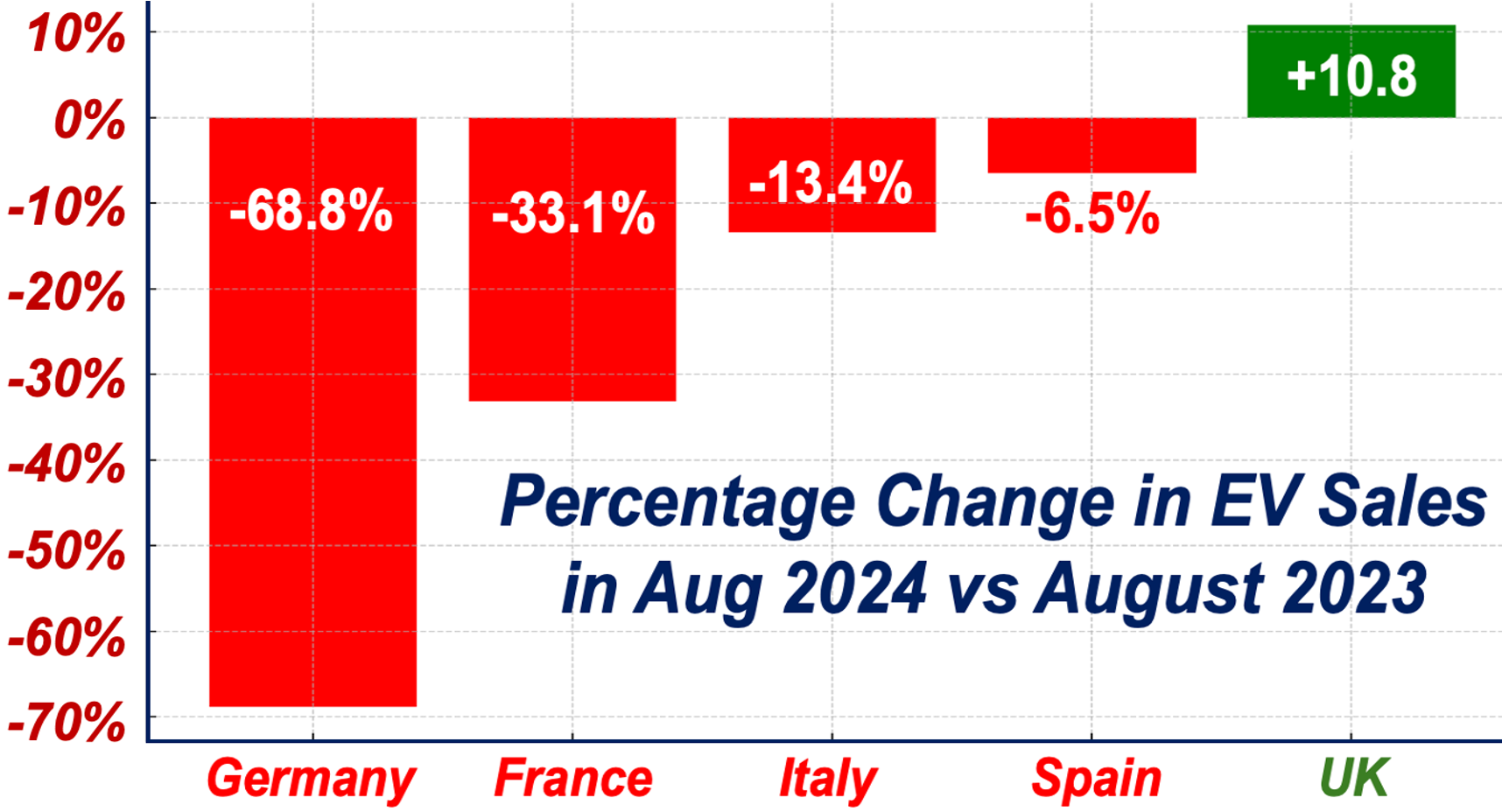

According to the European Automobile Manufacturers’ Association (ACEA), new car registrations across the EU fell by 18.3% in August. The largest markets—Germany, France, Italy, and Spain—all saw double-digit losses, with Germany’s EV market hit the hardest, reporting a staggering 68.8% drop. France also experienced a significant decline, with EV sales falling by 33.1%.

For the broader market, hybrid electric vehicles fared better, showing a 6.6% growth, making up 31.3% of new car registrations in the EU. Hybrids are seen as a compromise between traditional internal combustion engine (ICE) vehicles and full EVs, offering cleaner emissions at a lower cost.

However, despite the growth in hybrid sales, the drop in EV sales is alarming for automakers. “We are missing crucial conditions to boost zero-emission vehicle adoption,” stated a representative from the ACEA. “This includes charging infrastructure, affordable green energy, and a reliable supply of batteries and hydrogen.” The lack of progress in these areas is causing serious concern as the 2025 emissions target approaches.

Impact on Carmakers and the Economy

The decline in EV sales is not just a setback for automakers—it could have broader economic consequences. If current trends continue, the EU’s push toward zero-emission vehicles could stall, threatening its green transition goals. This would not only affect carmakers but could also lead to job losses in the automotive industry.

German automakers, in particular, are feeling the heat. Volkswagen, Europe’s largest car manufacturer, is considering closing domestic factories due to declining demand, while BMW has revised its earnings forecast for the year. “Germany’s economy isn’t gaining momentum, and consumers as well as investors are holding back,” noted Constantin Gall, EY’s mobility lead for Western Europe .

Moreover, the decline in EV sales has left automakers like Volkswagen and Renault at risk of hefty fines if they fail to meet the EU’s fleet-emissions standards. These fines could amount to billions of euros, potentially crippling the industry.

Calls for Action

In response to the crisis, the ACEA is urging the European Commission to implement immediate relief measures. One of the key issues highlighted by automakers is the reduction in government incentives, which had previously made EVs more affordable for consumers. With financial support dwindling, consumers are now turning away from these higher-priced vehicles.

“We stand ready to discuss a package of short-term relief for the 2025 CO2 targets,” the ACEA said in a statement. The organization emphasized the need for stronger government support to help carmakers transition to greener technologies while ensuring that consumers have access to affordable EV options .

The UK: A Bright Spot in the Market

While most of Europe experienced a decline in EV sales, the UK stood out with a 10% growth in new electric car registrations in August. This increase pushed the market share of battery electric vehicles (BEVs) to 23.2% of all new car sales in the UK. Analysts attribute this growth to strong consumer interest and supportive government policies.

Current-news.co.uk quoted James Court, chief executive of the Electric Vehicle Association (EVA) England, who said, “A 10% growth in EVs over just one month is a resounding vote of confidence from drivers that EVs are now very much part of the mainstream mix and rival petrol and diesel as a more cost-effective and enjoyable option” .

Conclusion

The decline in EV sales across Europe has raised alarms among carmakers and policymakers alike.

As the EU approaches its 2025 CO2 emissions targets, urgent action is needed to revitalize the market and ensure a smooth transition to zero-emission vehicles.

With automakers facing potential fines and production halts, the future of the European automotive industry—and the broader green transition—hangs in the balance.