The performance of European venture capital funds has been impressive, achieving net returns of at least 20% per year over a 10-year horizon. They are beating many global benchmarks.

In an article published by EURACTIV, Brian Maguire, from the journal’s Advocacy Lab, wrote that investing early is key.

Europe’s Future

For Europe to remain competitive tomorrow, innovation is crucial. In an increasingly unstable world, the European Union (EU) needs to create new, improved ways of delivering existing products and services and finding profitable solutions to worldwide problems.

Emerging technologies are expected to improve our quality of life, provide good quality jobs, and boost economic growth.

Examples of such technologies include the power of supercomputing, state-of-the-art materials that protect our environment, advancements in renewable energy systems, breakthroughs in biotech and healthcare innovations, the development of autonomous transportation solutions, and *generative AI (artificial intelligence).

* Generative AI is a type of artificial intelligence that creates new content, such as text, images, or music, by learning patterns from data, unlike general AI, which focuses on decision-making and automation.

However, to harness the potential of those emerging technologies, thousands of companies must invest or expand their operations. Venture capital can help make this happen.

European Venture Capital

European venture capital provides essential funding and support to medium-sized enterprises (SMEs) and startups that have the potential for rapid growth.

What is a Startup? In one of our previous articles, we wrote:

“A Startup is a new company. Its founder recently set it up and it is now doing business. We tend to use the term for companies that investors, especially venture capitalists, will become interested in. If I opened a corner grocery store, I would not describe it as a startup.”

Over the past ten years, more than 26,100 European startups have attracted approximately €143 billion ($149 billion). European venture capital is becoming a major driver of economic growth and new jobs.

Companies backed by European venture capital today employ over 1 million workers in the EU. In 2022, they achieved a job-creation rate of 18%, which was nine times greater than the EU’s overall rate of 2%.

Fueling growth with capital and expertise

Venture capital goes beyond providing financial support; it injects energy, creativity, innovation, and expertise, fostering an environment where transformative technologies and solutions addressing challenges like climate change and digital transformation can flourish.

Startups backed by VC benefit from the experience of seasoned mentors, entrepreneurs, and investors who have achieved prior success.

Additionally, VC drives employment growth more effectively than any other private equity sector.

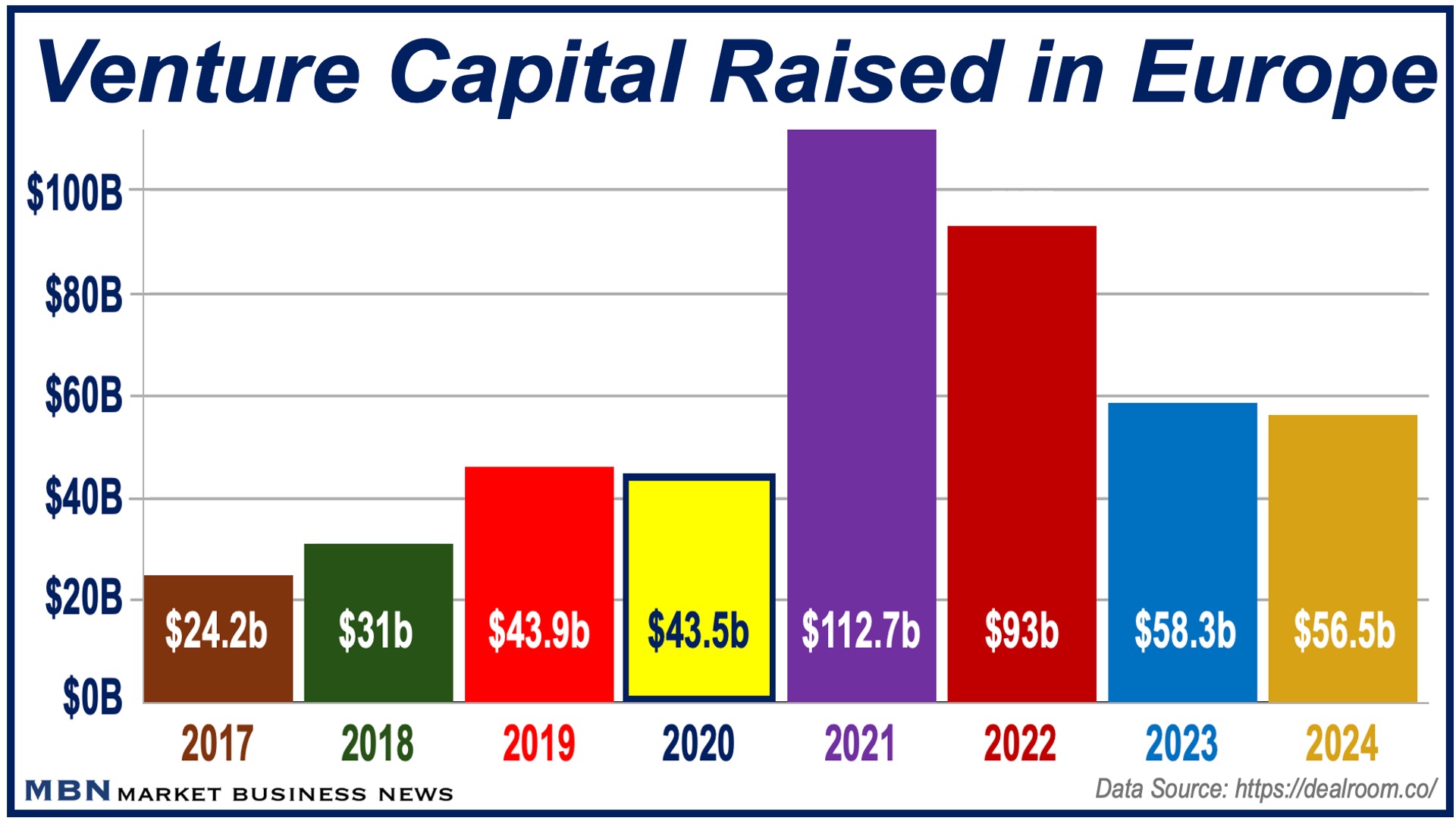

Despite the region’s current and recent economic issues and downturns, the European venture landscape has grown solidly and steadily.

Tech Scene in Europe

Since the turn of the century, the tech scene in Europe has evolved dramatically. Twenty years ago, Europe was an outsider; today it is a global challenger.

“Venture capital investment in European startups reached $63 billion in 2023 invested across over 10K funding rounds, above pre-pandemic levels though down against the highs seen in 2021 and 2022.”

“Europe’s share of global venture capital increased from ~5% seen two decades ago to 20% in 2023. At the early-stage level, Europe now raises a third of global seed funding.”

Stages of Venture Capital

In the world of venture capital, there are three stages:

-

Early Stage

In this phase, the startup focuses on product development, market validation, and securing initial funding.

-

Breakout Stage

This is a growth phase where the startup gains significant traction, expands its customer base, and secures larger funding rounds to scale (expand) operations.

-

Scaleup or Scaleup Stage

An advanced stage where the business focuses on rapid expansion, profitability, and solidifying its position in the market.

European Venture Capital for AI Startups

Venture capital funding in Europe for AI startups is thriving. Twenty-five percent of the region’s venture capital in 2024 was directed at AI enterprises, compared to 15% in 2020.

According to Digital Watch, which is supported by the Swiss Confederation and the Republic and Canton of Geneva:

“The collective value of European AI companies has doubled in four years, reaching $508 billion, now making up nearly 15% of the region’s entire tech sector. While much of the funding still comes from outside Europe, especially the US, the local AI ecosystem is flourishing with a growing talent pool.”

“In 2024, 349,000 people were employed by AI companies in Europe, a 168% increase since 2020, indicating a buoyant and increasingly productive sector.”