The Eurozone Leading Economic Index (LEI) increased by 0.4% in May, following a 0.2% fall in April, says The Conference Board. Eurozone economic activity will probably grow very slowly during the next few months.

The Conference Board LEI for the Eurozone registered positive contributions from stock prices, real money supply and yield spread, which more than offset the negative or unchanged contributions.

During the first six months of 2014, the LEI rose by 2.5% (c. 5% annual rate), compared to 3.9% during the last six months of 2013.

In recent months, strengths among the leading indicators have become more widespread than the weaknesses.

Below is a list of positive/negative contributors to the LEI in June (in order of the largest positive to the largest negative):

- Interest rate spread (positive).

- Real money supply (positive).

- EURO STOXX Index (positive).

- Markit business expectations index (services) (unchanged).

- Residential building permits (negative).

- Markit Purchasing Managers’ Index (manufacturing) (negative), see the bottom of this page for Markit’s July PMI, which did well.

- Economic Sentiment Index (negative).

Bert Colijn, Senior Economist at The Conference Board, said the moderate May LEI increase points to a subdued recovery for the Eurozone for the months ahead. He added that the upward trend in the LEI has moderated significantly, while the recent falls in economic sentiment, the Markit PMI for manufacturing, and building permits suggest growth will be slow.

Mr. Colijn added “Meanwhile, the Coincident Economic Index is virtually flat, indicating little to no improvement in economic activity. Escalated tensions in Ukraine are adding more uncertainty to the Euro Area economy, further threatening the prospect of a rebound in employment, production, sales, and income.”

Eurozone CEI

The Coincident Economic Index (CEI) for the Eurozone, a measure of the currency bloc’s economic activity, remained unchanged in June. Including June’s unchanged CEI, the figure stands at 101.4.

During the first six months of this year, the CEI has risen by 0.2% (c. 0.4% annually), the same rate as during the second half of 2013. The strengths among the coincident indicators have also become more widespread than the weaknesses.

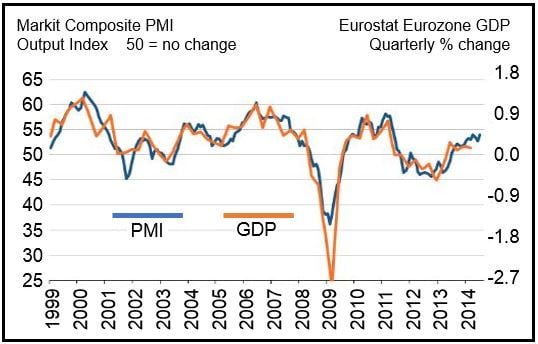

Eurozone real GDP grew by 0.8% (annual rate) in Q1 2014, following a 1.2% annual rate increase in Q4 2013.

Below are the four components that make up the CEI, and their positive/negative/unchanged contributions in June:

- Employment (positive).

- Industrial production (positive).

- Retail trade (unchanged).

- Manufacturing turnover (unchanged).

Markit Flash Eurozone PMI

The Markit Flash Eurozone Purchasing Managers’ Index (PMI) reached 54.0 in July, compared to a six-month low of 52.8 in June. Anything over 50 indicates economic growth. July’s figure matched April’s 3-year high.

Several Eurozone companies reported a pickup in business, after an unusually high number of holidays and a knock-on effect of mild winter weather had subdued activity in the previous months.

However, new-orders growth slowed down slightly in July amid signs that growth, especially in manufacturing, is being undermined by geopolitical concerns, in particular the volatile situation in Ukraine.

(Data source: Markit Economics)

In a report, Markit Economics wrote:

“While growth of service sector business activity accelerated to the fastest for just over 3 years, growth of output and new export orders in the manufacturing sector picked up only marginally, remaining well below the rates seen earlier in the year.”

The Eurozone’s unclear economic outlook plus ongoing pressure to reduce costs and improve competitiveness meant employment increased only slightly in both sectors in July. “While weak though, the continuous trend to moderate job creation seen over the past four months represents an improvement from the significant pace of job losses being recorded this time last year,” Markit wrote.

Since 2013, economists have been talking about a European jobless growth, a situation that is likely to remain unchanged in 2014.