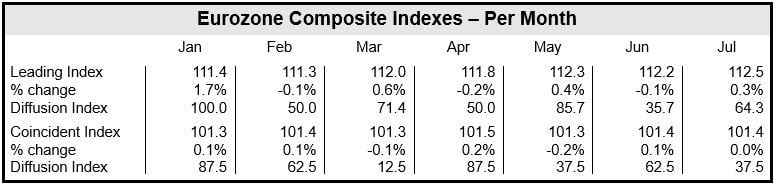

The Conference Board reported a slight improvement in Eurozone economic outlook. Its July Leading Economic Index rose by 0.3% while its Coincident Economic Index remained the same.

The Leading Economic Index (LEI) points to whether economic activity in the near-term future will increase or decline. A rising figure suggests activity will improve.

The Coincident Economic Index (CEI) shows the country’s current economic situation. It gives economists and analysts an idea of how the economy is doing at the moment, or where it is in the economic cycle.

After GDP flatlined in the second quarter and July inflation fell to 0.4% (annualized), anything positive coming out of the Eurozone is welcome.

Bert Colijn, Senior Economist at The Conference Board, said:

“The sharp slowdown in the six-month growth rate of the Leading Economic Index for the Euro Area points to more sluggish economic performance for the remainder of this year. Although the majority of the leading indicators have improved slightly over the last six months, weakness in economic sentiment and business expectations persists amid the uncertainty surrounding the crisis in the Ukraine.”

Eurozone’s Leading Economic Index (LEI)

Of the seven components that make up the Eurozone’s LEI, three contributed positively and two negatively.

Below is a list of the seven components and how they contributed (in order), with the strongest positive one first.

- interest rate spread (positive),

- real money supply, (positive),

- EURO STOXX Index (negative),

- Markit business expectations index (services) (negative),

- Markit Purchasing Managers’ Index (manufacturing) (unchanged),

- residential building permits (unchanged).

After increasing by 0.3% in July, the Eurozone’s LEI currently stands at 112.5 (2005 = 100), following a 0.4% increase in May and a 0.1% increase in June.

During the first six months of 2014, the LEI rose by 1%, with five of the seven components contributing positively.

(Data source: The Conference Board)

Eurozone’s Coincident Economic Index (CEI)

Only one of the four components that make up the Eurozone’s CEI contributed positively to July’s figure.

Below is a list of the four components and how they contributed:

- employment (positive),

- retail trade (negative),

- industrial production (unchanged),

- manufacturing turnover (unchanged).

After remaining unchanged in July, the Eurozone’s CEI currently stands at 101.4 (2004 = 100). In May it had fallen by 0.2% and increased by 0.1% in June.

During the first half of 2014, the CEI rose by 0.1%, with two of the four components contributing positively.

(Data source: The Conference Board)