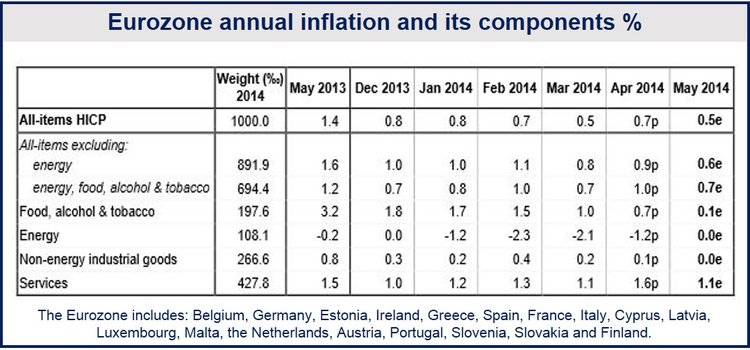

As Eurozone May inflation declines to 0.5% (annualized) from 0.7% in April, moving further below the European Central Bank’s (ECB’s) target of 2%, economists expect the ECB’s Governing Council to take measures to boost prices and prevent deflation when it meets on Thursday.

According to Eurostat’s flash estimate, prices increased at the following rates in May:

- Services: 1.1% (April 1.6%),

- Food, alcohol & tobacco: 0.1% (April 0.7%),

- Non-energy industrialized goods: 0.0% (April 0.1%),

- Energy:0.0% (Apriil -1.2%).

Eurostat also reported today that unemployment in the Eurozone in April fell slightly to 11.7% compared to 11.8% in March and 12% in April last year.

The Eurozone’s persistently high unemployment rate has been accompanied by poor economic growth – GDP (gross domestic product) expanded by just 0.2% in the first quarter of this year.

With inflation declining over the last twelve months, there is growing concern that the currency bloc could slide into a deflationary spiral, a situation that undermined Japan’s economy for over two decades. Even northern European countries, such as Sweden are reporting lower prices, as well as non-EU Switzerland.

Why is deflation undesirable

When prices are increasing businesses and consumers make their purchases as soon as possible, because they know there is a better chance of a good deal now. When prices don’t rise, or even start falling (deflation) they postpone their purchases because they know they can get better deals if they wait.

If shoppers and businesses postpone their purchases business’ sales drop and the economy’s growth rate slows down. As the economy slows down and prices fall further, purchases continue to be postponed and a deflationary spiral ensues.

People’s and business’ debts eventually make up a higher proportion of income. If your salary falls from, say from $3,000 to $2,500 per month and your monthly mortgage installments cost $500 per month, your mortgage payments will increase from one-sixth of your monthly income to one-fifth.

European Central bank expected to take action

The majority of analysts expect the ECB to seriously consider taking measures to boost growth and spending when its Governing Council meets this Thursday.

Late in May, Mario Draghi, the President of the ECB, warned that the expectation of falling prices could encourage businesses and consumers to postpone purchases. He added that the central bank was carefully monitoring data and was seriously considering a range of measures, including:

- reducing interest rates (possibly to below zero),

- new bank loans, and

- a Fed-like asset buying program.

Mr. Draghi said “What we need to be particularly watchful for at the moment is the potential for a negative spiral to take hold between low inflation, falling inflation expectations and credit, in particular in stressed countries.”

(Source: Eurostat)