Asset allocation is the practice of balancing risk versus reward. Asset allocation is an investment strategy to spread one’s portfolio across a wide range of different asset classes. Investors also spread their investments over several geographical regions. The aim is to minimize the risk of all the investments falling simultaneously. A portfolio, in this context, means a range of investment products.

Additionally, with asset allocations, investors try to get the best possible compound returns on their investments.

Investors spread their investments across commodities, property, bonds, stocks, private equity, and cash. Subsequently, if the value of one asset class declines significantly, the impact on the portfolio overall is minimal.

According to the US Securities and Exchange Commission, determining the right combination of these assets is highly individual, influenced by factors such as your investment timeline and how comfortable you are with risk.

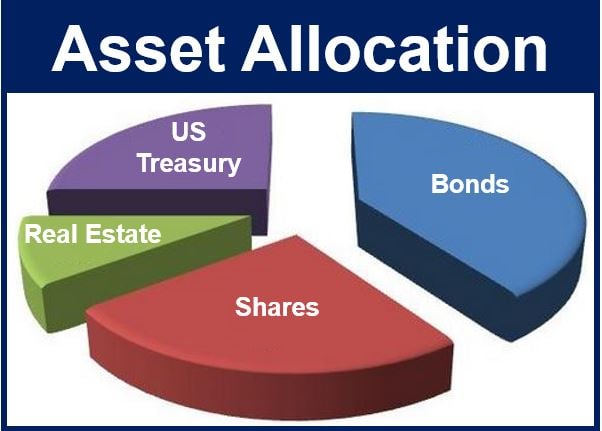

Asset allocation refers to the way a portfolio consists of a wide range of investments. For example, in this image, the investor has allocated investments across four asset classes.

Asset allocation – eggs in many baskets

Put simply; asset allocation is the investors’ equivalent of not placing all their eggs in one basket.

When determining returns on an investment portfolio, your investment spread matters. In fact, successful investors say that asset allocation is probably the most important factor.

Different asset classes do not all fluctuate in tandem. Just because one sector of the economy is doing well, that does not mean they are all thriving. So, logically, it makes sense to spread out your investments.

Three main asset classes

The three principal asset classes – fixed-income, cash & equivalents, and equities – have varying levels of risk. They also have varying levels of return. Consequently, each one behaves differently at any given moment.

Asset allocation is not only about spreading your investments, but also choosing the right ones.

There is no magic formula for the right asset allocation. What mix of investment classes you might choose depends on your risk tolerance and goals.

Furthermore, your investment horizon is also an important factor. Your investment horizon refers to how long you plan to invest before obtaining your goal.

Asset allocation – simple and complex

A simple portfolio may, for example, include just three investment classes. You might just purchase some stocks and bonds. Perhaps, you will also buy some cash alternatives. Examples of cash alternatives are savings accounts, money market deposit accounts, or money market funds.

A more complex strategy may include many more asset classes and sub-classes. For example, you could break down stocks into subcategories such as small cap stocks, large cap stocks, high-tech stocks, etc.

Asset allocation is about spreading your investments so that you do not over-expose your portfolio to one asset class.

If you set up your asset allocation successfully, you should get a good balance of investment performance. While the investments in one asset class are performing poorly, those in another category will be doing well.

The gains in the later will make up for the losses in the former. Subsequently, the overall performance of your investment portfolio will be steady.

Even so, remember that investing always involves risk. There are no guarantees.