A Bank Draft, Banker’s Draft, Bank Check (UK: cheque), or Teller’s Check is a check that a bank provides for a customer drawn by the bank itself. The bank guarantees the check because it has already paid for it.

The draft usually contains the payee’s name. The payee is the person who receives the money from the bank draft.

When we present a personal check, it draws money from the owner’s bank account. So, if the owner’s account does not have sufficient funds to cover the payment, the check will bounce. With a bank draft, on the other hand, the bank has already withdrawn that money. In other words, there is no chance that the check will bounce.

When customers request a bank draft, they must transfer the amount of the draft from their account immediately. They must also pay a fee and any additional administration charges.

Unless the bank draft is stolen or a forgery, the bank has already transferred the funds. In fact, the only way a valid bank draft could fail would be if the bank had gone bust.

We use bank drafts when we are dealing with large amounts of money. Also, when the receiver does not accept a personal check, a bank draft is a good option.

Alternatively, you should consider transferring money from your account to the payee’s account. A bank transfer is faster and safer than using a bank draft.

Under English law, a bank draft is not a bill of exchange. This is because the bank draft money does not come from a third party but from the bank itself. However, it might be a negotiable instrument.

According to the National Bank of Canada, a bank draft is a payment instrument backed by the issuing financial institution, giving the recipient a guarantee that funds are available. While it resembles a regular cheque in appearance, the key difference is that a regular cheque can bounce due to insufficient funds, whereas a bank draft carries the promise of payment.

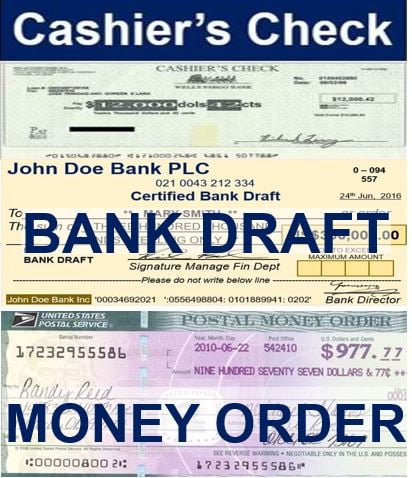

Bank draft – Cashier’s or Certified Check

Cashier’s checks, certified checks, and bank drafts are all types of bank checks that are safer than personal checks. However, the three are not the same:

Certified Check

A certified check is a personal check that the customer signs and the bank certifies. The bank certifies that the customer has enough funds to clear the check and that the signature is genuine.

The bank will usually set aside the funds to make sure that the check clears. However, on some occasions, this might not happen.

Money orders are easier to get than the other two. However, they are generally limited to no more than $1,000. So, if you plan to make a very large payment, a bank draft or cashier’s check is more suitable.

Cashier’s Check

The bank signs and guarantees a cashier’s check. The funds come from the bank rather than the customer’s account.

Of the three options mentioned here, cashiers’ checks are usually the most secure.

Bank Draft

Bank drafts are very similar to certified checks. However, with bank drafts, the bank sets aside the funds until somebody presents it. Bank drafts are more common than the other two options for large sums of money.

Many articles on the internet use the terms ‘bank draft’ and ‘cashier’s check’ with the same meaning. There are two possible reasons for this:

– The writer is mistaken.

– In some banks, the two terms have the same meaning.

Bank Draft vs. Money Order

Bank drafts and money orders are quite similar. We pay for both of them in advance and print the amount. Additionally, we see them both as very secure forms of payment to a third party.

The payer can use a money order or draft rather than carrying large quantities of money. However, you literally ‘buy’ a money order like you would a product in a store. You give the issuer cash who then creates the money order.

A bank draft, on the other hand, is a type of check that a bank guarantees with its own funds. This guarantee occurs after you have paid the bank the amount specified on the check.

Only banks issue bank drafts, but many types of businesses issue money orders. Not only can you get money orders at the post office but also at certified stores.

There is a limit to the size of a money order. Bank drafts, however, have no limit. In the US, most money orders have a $1,000 limit. In the UK, a post office ‘postal order’ (a type of money order) has a limit of £250.

If you are buying a house or a new car you will not use a money order, but rather a bank draft. You might also use a personal check or bank transfer.

The digital age

Interestingly, in the digital age, some financial institutions are exploring electronic bank drafts, which offer the same security and guarantees as traditional drafts but with the convenience of digital transactions.

Furthermore, the rising trend of mobile banking and fintech innovations is also influencing how bank drafts are processed, offering more streamlined and user-friendly methods for securing large transactions.