A beneficiary is somebody designated to receive benefits or assets from a will, trust, insurance policy, or any financial instrument. The beneficiary could be a non-person entity, such as a charity organization, a non-profit foundation, a business entity, or a trust fund.

The concept of beneficiaries plays a vital role in insurance policies, estate planning, retirement accounts, and more.

When an entity benefits

The term may also refer to an entity that benefits from a change or new event.

For example, if I say “Rich people are the main beneficiaries of the new tax legislation,” I mean that the new taxation law is great for rich people. This article focuses on the term’s meaning when used in financial and estate planning (wills).

The beneficiary and grantor

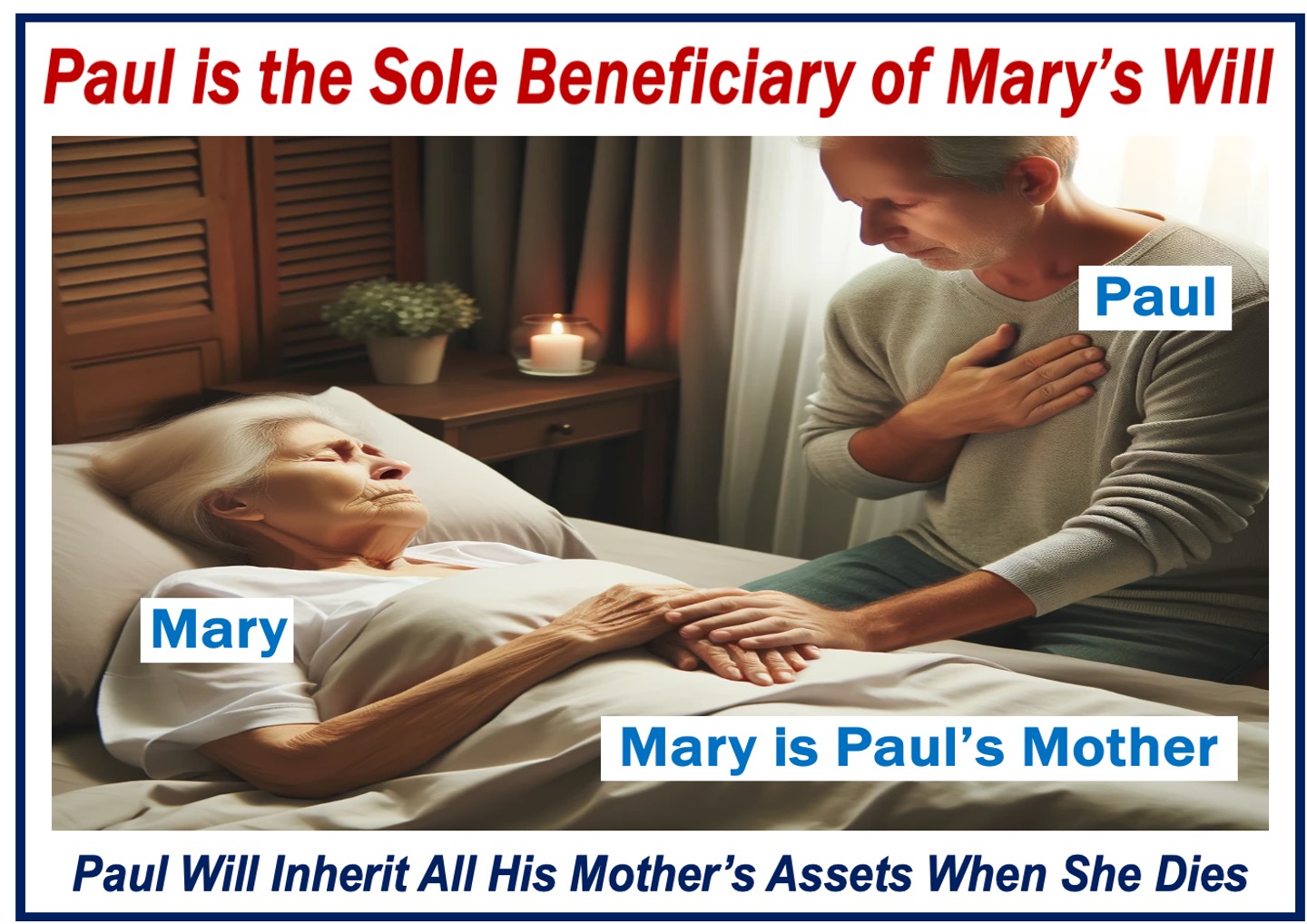

At its core, the role of a beneficiary is straightforward. When somebody creates a will or sets up a financial account, they can specify who will inherit the assets or benefits when they die.

The person bequeathing the assets is the grantor, while the receiver is the beneficiary. The assets could be money, property, or investments, to name a few. To bequeath means to leave personal property or assets to someone through a will.

Two main types

There are two main types of beneficiaries: primary and contingent:

Primary beneficiary: This is the first in line to receive the assets.

Contingent beneficiary: If the primary beneficiary cannot receive the assets, because, for example, they are dead, the contingent beneficiary becomes the inheritor – the one who receives the assets.

This distinction ensures that the grantor’s assets are distributed according to their wishes, even if something unexpected happens.

Choosing a beneficiary

Who should be your beneficiary is an important decision, one that should not be taken lightly. It requires careful consideration.

If you are not familiar with the law, you should consider seeking legal advice to ensure that your assets are distributed as intended, without any unforeseen complications.

Also, beneficiary designations may not always remain the same while you are alive. You may get married, divorced, or have more children. All these important life events could change who you want your beneficiaries to be.

Conclusion

A beneficiary is a fundamental component of financial and estate planning, enabling us to direct how our assets are distributed after we die.

Understanding who your beneficiaries are and keeping this information updated ensures that your legacy is honored.