Brent crude – definition and meaning

Brent Crude is a trading classification of sweet light crude oil. It is one of the main benchmark prices for oil in the world. We also call it the London Brent, Brent Petroleum, and Brent Blend.

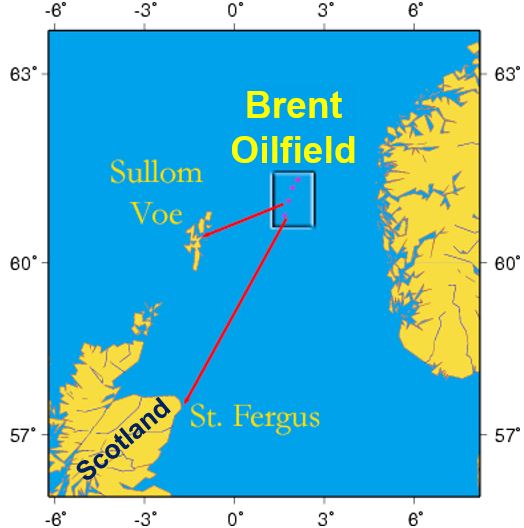

The Brent oil platform is in the North Sea. We extract oil from the region to produce petroleum and middle distillates.

Brent Crude contains around 0.37% of sulfur (British English: sulphur). It is, therefore, a ‘sweet crude.’ However, it is not as sweet as WTI (West Texas Intermediate).

We used to trade Brent Crude on the open outcry International Petroleum Exchange in London. However, in 2005, it began trading on the electronic IntercontinentalExchange (ICE) instead.

Currently, one contract of Brent Crude is equal to 1,000 barrels. The contracts are in U.S. dollars.

The name ‘Brent’ in the oil industry came from the naming policy of Shell UK Exploration and Production. The company was operating on behalf of Royal Dutch Shell and ExxonMobil.

In fact, Shell UK Exploration and Production originally named all its fields after birds. In this case, the bird was Brent Goose.

Brent is also an acronym of Broom(oseBerg), Rannoch, Etive, Ness and Tarber – the formation layers of the oil field.

Pricing of Brent Crude

Brent Crude and other major oil indexes have physical differences in crude oil specifications. Hence their varying prices. Changes in supply and demand also influence prices.

However, over the past few years, traders have been pricing Brent much higher than West Texas Intermediate (WTI). WTI, which is also known as Texas light sweet, is a different grade of crude oil. We also use TWI as a benchmark in oil pricing.

The EIA says this major price spread between the two oil indexes has occurred because of an oversupply of crude oil in North America. EIA stands for Energy Information Administration. Traders set the WTI price at Cushing, Oklahoma.

The oversupply is the result of greater oil production from Canadian oil sands and tight oil formations. Examples of tight oil formations include the Eagle Ford Formation, the Bakken Formation, and the Niobrara Formation.

The Brent Index

The ICE Futures Brent Index is the weighted average price of all confirmed 25-day Brent Blend, Forties, Oseberg, and Ekofisk (BFOE) deals. Furthermore, traders qualify intra-day assessments for the previous trading day for the appropriate delivery months.

TheIce.com reports the ICE Futures Brent Index on a daily basis. The Exchange and ICE Clear Europe use it on expiry of the front month futures contract as the final cash settlement price.

Video – Bret crude glut

In this Financial Times video, Energy Markets Editor David Sheppard explains why the price of Brent Crude rose in the summer of 2017.