A Cash Cow is a profitable product or business that brings in a steady flow of income. It may also refer to a business venture that generates more profit than it cost to acquire or create.

The expression refers to the idea that something produces ‘milk,’ i.e., profit, long after we have recovered the cost of investment.

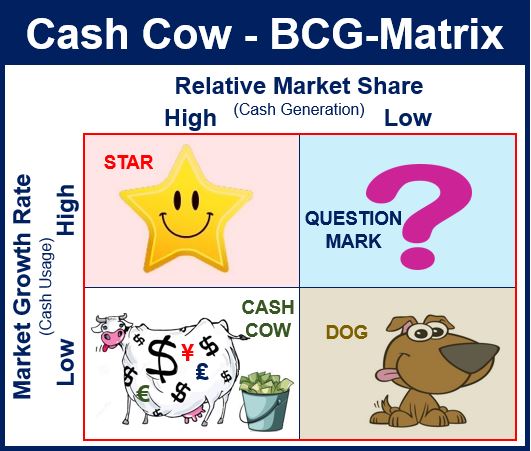

Bruce D. Henderson created the growth-share BCG-Matrix for the Boston Consulting Group in 1970. In the Matrix, a cash cow is a company with high market share in a slow-growing industry.

The cash cow generates more money than the amount needed to maintain the business. In other words, it gives back more than you put into it.

Companies love cash cows, because of their income-generating qualities. They can ‘milk’ the cash cows with the minimum of investment because investment would be a waste of money. It would be a waste of money because it is a slow-growth industry.

Example of cash cow

Imagine company ZYX International has four divisions. One of them makes roof tiles. The roof tile division manufactures and sells 70% of its products in the European Union and the USA. The division has a return on assets (ROA) of 30%.

The tile business is mature. In other words, it has existed for a long time. The tile business grows at a rate of about 3% annually. XYZ has a leading market share in the sector.

The tile division is a cash cow. The market is growing slowly, so it needs little investment. Additionally, the high ROI means that profits in the division should be strong. ROI stands for Return On Investment.

The company does not need to reinvest in the roof tile division. In fact, it should not reinvest in that division.

A cash cow has a large market share in a mature industry. Therefore, there is no point in spending money in trying to grab more market share. Market share refers to the percentage of the total market your company’s sales represent.

However, complacency is a serious risk. It is a risk because small competitors may try to capture greater market share and eat into yours.

Coke is the perfect example of a cash cow because it generates abnormal profit in a mature market. Furthermore, it does not need to grow any further.

Cash cow companies

These are slow-growing, mature companies. They have plenty of cash left over after meeting their necessary annual expenses. Cash cow companies also dominate their industries.

Small investors love cash cow companies because they can finance their own growth and value. They can reinvest free cash flow to expand. Subsequently, they boost stockholder returns.

Above all, these companies can do this without undermining profitability. They do not even have to ask shareholders for additional capital.

Cash cow businesses can also return their free cash flow to stockholders. They do this through bigger dividends or share buybacks.

These companies’ strong market share bring in strong revenues every year. They also thrive in sectors with competitive barriers to entry.

They are also appealing targets for takeovers.

Cash cow may also refer to a company that is milked until it is dry. Many of them are state-run companies.

For example, the Mexican government drew the income from its state oil & gas company PEMEX. The Government put relatively little money back into it.

Venezuela’s state run oil industry has also suffered the same fate.

When a product reaches the end of its business cycle, marketing executives adopt a harvest strategy. The harvest strategy is part of the cash cow phase.

Video explanation

This video presentation explains what a ‘Cash Cow’ is using simple and easy-to-understand language and examples.