A Challenger Bank, sometimes referred to as a Neobank, is a small bank that is threatening the rankings of large banks. The term includes any new or upcoming bank that has recently gained a license. Above all, it is a small bank that is biting at the heels of the ‘big four’ or ‘big five’ banks.

For example, America’s ‘big four’ banks are JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo.

In the United Kingdom, there used to be the ‘big four.’ They were HSBC, Lloyds, Barclays, and RBS. Since Banco Santander entered British retail banking, they are now the ‘Big Five.’

The big four or big five have either acquired or beaten their smaller competitors.

TSB (Trustee Savings Bank) was never quite one of the big banks in the UK. In fact, when it looked as if it might become a dangerous challenger bank, Lloyds acquired it. The European Commission forced Lloyds to sell off TSB. So it subsequently became a challenger bank again.

However, in 2010 Metro Bank got its first new British banking license and everything changed, literally forever.

Since Metro became a challenger bank, the floodgates have opened in the UK. Several budding financial institutions, such as Tandem and Atom Bank are fighting for banking licenses and new customers.

Moneyfacts.co.uk has the following definition for a challenger bank:

“It’s a bank that’s far smaller than a national brand that’s been specifically designed to compete with the Big Four (HSBC, Lloyds, Barclays, and RBS), be it through offering superior service, better deals, or more often than not, a combination of the two.”

Forbes.com states that a Challenger bank is also known as a Neobank.

Advent of the challenger bank

The UK has a history of small banks occasionally snapping at the heels of the big four. However, nothing significantly changed until the global financial crisis struck in 2007/8.

The taxpayer bailed out Britain’s major banks during the financial crisis. The big four were also facing technology meltdowns. The Bank of England (BoE) decided that the country would benefit from more competition.

The BoE eased the rules and regulations regarding setting up a bank. Subsequently, a flood of new applicants for new licenses emerged. Examples include Atom, Metro Bank, Tandem, and dozens of others.

The online challenger bank

Before the Internet, all that mattered was to have lots of branches. If you had many branches, you stayed on top.

The leaders had superior economies of scale compared to the smaller player. They also had large, diversified balance sheets that allowed interbank and money market borrowing at ultra-low interest rates.

However, consumers started doing their shopping, working, and movie viewing online. They also began communicating with one another and having fun online.

The online word widened the competitive playing field for banks considerably.

Add to this the credit crunch of 2007, and you suddenly had a very different environment. Suddenly, having lots of physical branches across the country was not an advantage. In fact, it became a burden.

Those branches and their employees consumed valuable resources. Those resources could be better spent improving technology.

Consumers became more interested in navigating rapidly than talking to a bank employee. In fact, fewer and fewer people wanted to see somebody for their banking activities.

Legacy systems in major banks

Even today, the large banks still have a *legacy system. Many of them still exist because the taxpayer bailed them out.

* A legacy system or legacy platform is a computer system in a company that is obsolete.

When the challenger bank came onto the scene, it did so with state-of-the-art computer systems. They also had super websites that consumers liked to use.

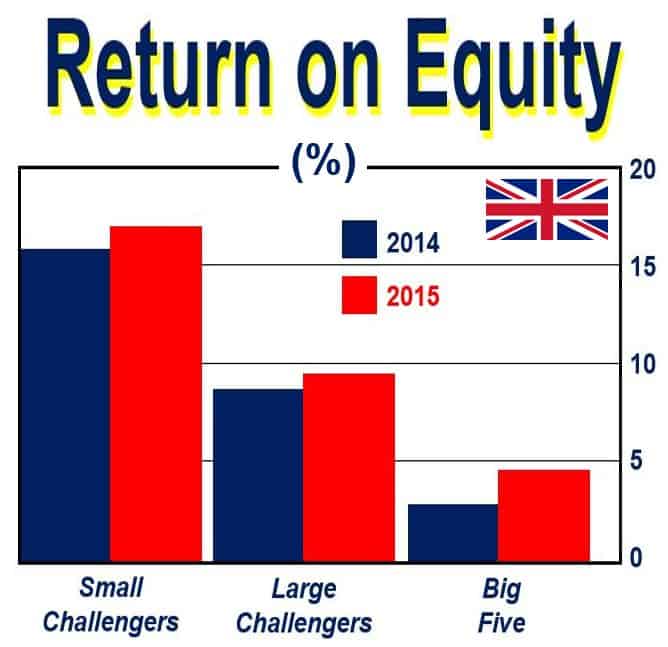

The British economy is now in the post-crisis recovery stage. This is a period when challenger banks can gain market share in a big way. In fact, it is now an opportunity to smash the dominance of the ‘big five.’

Today’s challenger bank has more suitable and up-to-date software than the major banks. It also has user-friendly websites and a tight management structure. In other words, senior management knows what is happening on the shop floor.

Challenger banks can provide a more personalized service to customers than the big five.

Big five won’t die

The ‘big five’ still form an essential part of our economic fabric. They will be around for decades to come. They offer services that most of us need such as current accounts and mainstream mortgages.

However, the new licensing laws and the preference for online banking by consumers have changed things. Small and specialized institutions have a fairer and more realistic environment today in which to thrive and grow.

Alan Margolis, Head of Bridging, United Trust Bank, said:

“The seismic changes in the financial market that followed the credit crunch have allowed the specialist banks to emerge and flourish as they find their niches and demonstrate one of the positive aspects of the free market.”

Challenger bank glory days

Trade journals warn that the challenger bank glory days will soon be gone. The small lender’s niche markets have become saturated.

It is now much harder to compete for customers compared to a few years ago. Conditions becoming progressively more congested.

The UK’s big five are returning to growth. Above all, they are starting to respond effectively to customer demands.

In an article in The Telegraph, Tim Wallace writes that politicians and regulators are changing. They are now less likely treat challenger banks more leniently than their giant cousins. This will make it harder for the upstarts.

Since 2010, a typical challenger bank has had a business model of targeting profitable lending niches. Competition within these niches has intensified. In fact, margins are already shrinking.

To respond effectively, challenger banks will need to create new product lines. In other words, they will become more complex and will take on more staff. So, they will become like the ‘big five.’

They gained against the big boys because they identified the major banks’ weaknesses. The challenger banks set themselves up differently and focused on other things.

What will happen when the challenger banks start acquiring those weaknesses?

On 23rd June 2016, the British electorate voted for Brexit – BRitain EXITing the European Union. The future of all Britain’s banks is now uncertain.

If the Government manages to negotiate a Soft Brexit, the country’s financial institutions will probably fare well. Above all, if we keep our passporting rights, British banking has a good future.

If the country ends up with a Hard Brexit, the future for all British financial institutions look bleak.

Video – What is a Neobank?

This video presentation, from our YouTube partner channel – Marketing Business Network, explains what a ‘Neobank (Challenger Bank)‘ is using simple and easy-to-understand language and examples.