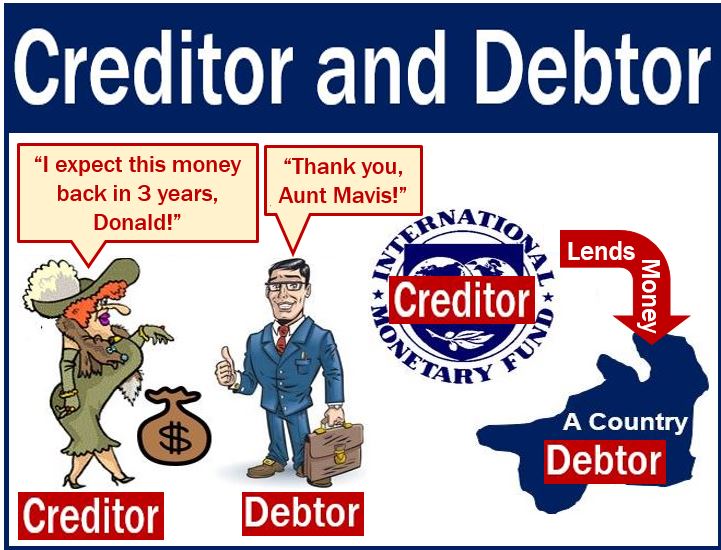

If you owe somebody money, that person is a creditor, and you are a debtor. The term may also refer to a company, organization, or government. The creditor has provided goods, services, or money to another party. The creditor is also under the assumption that the other party will pay the debt at a future date.

Creditors may be suppliers or people who have provided credit to an individual or company.

When somebody takes out a loan with a bank, the creditor is the bank, and the borrower is the debtor.

A company’s employees may be creditors when the firm owes them wages and bonuses, as are governments (owed taxes).

In the financial world, we often refer to creditors when talking about short-term loans, mortgage loans, and long-term bonds.

Put simply; creditors are people who are expecting debtors to pay them back. In other words, creditors are lenders while debtors are borrowers.

In accounting, money that a company owes are liabilities in a balance sheet. If the company had to sign a promissory note for the quantity it owes, it would record and report the amount as Notes Payable.

If there was no promissory note, however, it will report it as Accounts Payable.

From credit to creditor

The term comes from the word ‘credit,’ which in the financial and business world means the lending of money, a good or service.

We refer to a lender who has a lien or other legal claim to the debtor’s assets as a secured creditor. Unsecured creditors have no recourse to debtors’ assets.

Personal and real creditors

Personal creditors: these are people who lend money to family or friends.

Real creditors: these are businesses such as banks or finance companies. They have legal contracts with borrowers. In most cases, they are secured creditors.

When a company goes into liquidation, the liquidator tries to settle as many debts as possible. The people and companies waiting for their money are creditors.

Shareholders are the last people to get their money back. If there is not enough money for the shareholders, they get nothing.