What exactly is a debit card?

A debit card is a payment card that pulls money straight from your checking account each time you buy something or withdraw cash.

A debit card is a convenient financial tool for managing everyday expenses. Linked to your checking (also called debit) account, it gives you instant access to your own funds, making everyday spending simple. Each purchase or ATM withdrawal immediately reduces your balance, so you can only spend what you have.

You can use the card to pay at most physical stores, shop online, or take money out of ATMs (cash machines).

To get a better picture of your debit card benefits and potential drawbacks, it’s important to understand how debit cards work and and what features matter most.

What Does a Debit Card Look Like?

When you first look at a debit card you’ll notice that it’s got a lot of numbers and symbols on it. But what do they all mean? Below, we’ve compiled a list of the typical features found on a debit card and their purpose:

Debit Card Anatomy at a Glance

| Feature | Why it matters |

|---|---|

| Card Number | Unique 16-digit ID used to route every transaction. Some banks may choose not to print this number on the card for additional security. |

| Cardholder’s Name | Confirms who is authorized to use the card. Most cards show the cardholder’s full name. However, some banks allow cards without a name based on their policies. |

| Expiration Date | The card comes with a validity period indicated by an expiration date. Before this date is reached, the bank (typically) issues a new card automatically. |

| Financial Institution Logo | Identifies the bank or financial institution responsible for managing your account. |

| Payment Network Logo | This logo stands for the electronic payment network, like Visa or Mastercard. It helps process transactions globally between the bank, the cardholder, and the merchant. |

| EMV Chip | It encrypts data to protect against fraud at terminals. This provides a more secure method of payment when the card is inserted into a payment terminal. |

| Contactless Payment Symbol | Enables tap-to-pay with compatible payment terminals. If your card has this symbol, you can pay by tapping it on a terminal. |

| Magnetic Strip | The black magnetic strip on the back stores data about the cardholder’s account. This is used for transactions when the card is swiped at a terminal. |

| Signature Panel | Located on the back of the card, this panel provides an additional layer of security, as it can be compared to the signature on your ID during in-person transactions. |

| CVV / CVC Code | This three- or four-digit code is found near the signature panel. It is a key security feature for online and phone purchases and should never be shared with others. |

| Issuing Bank’s Contact Information | This includes the bank’s website and customer service phone number. You can use this to report issues or ask for help with your card. |

How to Use a Debit Card?

Points of Sale (POS)

At physical stores, using a debit card is straightforward. When at the checkout, the cashier may verify your identity by checking if the name on your ID matches the name on the card. In some cases, they may compare signatures if the card has a signature panel. The card is then either inserted into the payment terminal (if it has an EMV chip) or swiped using the magnetic strip.

Before entering your PIN, it’s essential to double-check the amount displayed on the terminal. Once the user confirms the correct amount and enters the PIN, the system will process the transaction. This happens only if there are enough funds in the account.

With contactless payments, the process is simpler. Many transactions, particularly smaller ones, do not need the same level of verification. If your card has a contactless symbol and you want to pay this way, just hold your card above the terminal’s NFC reader. In most cases, there’s no need to enter a PIN or provide an ID, making it a convenient option for quick purchases.

Online Purchases

When you shop online, you need to give important details. This includes your 16-digit card number, the card’s expiration date, and the CVV or CVC security code. Many online retailers also require the billing address associated with the card to further verify the transaction.

Some banks have started issuing cards without these details printed on them. When this is the case, you are usually given access to your card details digitally through the bank’s mobile app.

For those seeking an additional layer of safety, some banks offer both a physical card and a digital version (just for online payments) accessible via official app that the bank provided you.

Cash Withdrawals

Debit cards also let you take cash out of ATMs. You can withdraw money by inserting the card into an ATM, entering your PIN, and selecting the amount you want to withdraw. Most banks do not charge fees when you use their ATMs.

However, you may incur additional fees when you withdraw cash from ATMs that are not affiliated with your bank. To avoid these charges, it’s a good idea to know the locations of your bank’s or its partner’s ATMs.

By understanding these different ways to use your debit card, you can manage your transactions more effectively and securely.

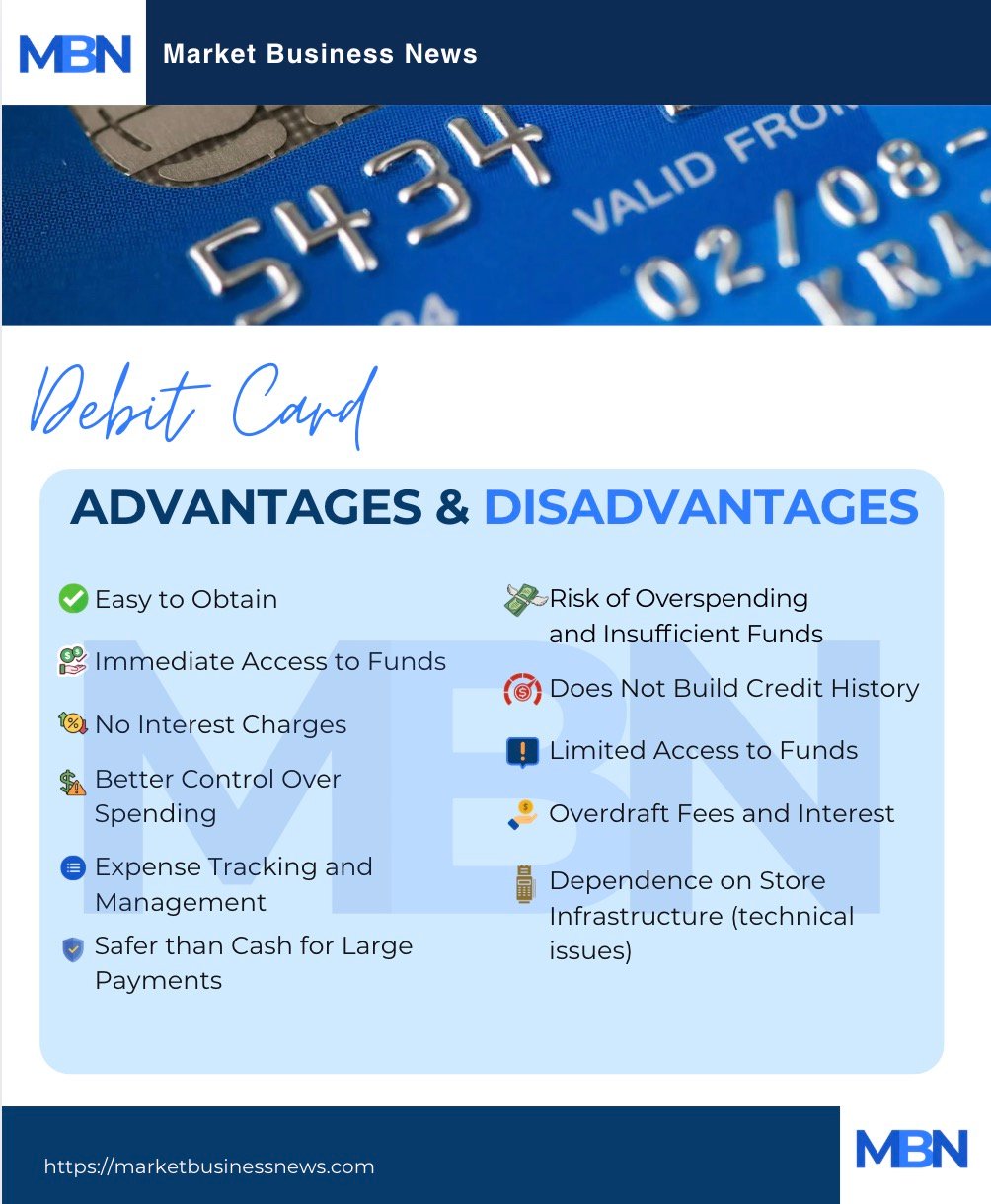

Advantages of a Debit Card

Now that we know more about debit cards, let’s explore the advantages of having one:

These advantages make debit cards a convenient and secure option for managing day-to-day transactions.

Disadvantages of a Debit Card

While a debit card is a useful financial tool, there are some disadvantages to consider when compared to other banking options:

What is an Overdraft?

Before continuing, it’s important to understand the term “overdraft.” This term refers to the extra amount that the bank may grant to your debit card when you do not have enough money in your account.

For example, suppose the bank granted you an overdraft limit of $100. This means that if you do not have enough money, you can spend up to $100 more than you have.

This means that if your balance is $500 and you spend $550, you would be using $50 that the bank is lending you to complete the transaction. However, it is important to remember that this generates interest. Therefore, only use it only when absolutely necessary.

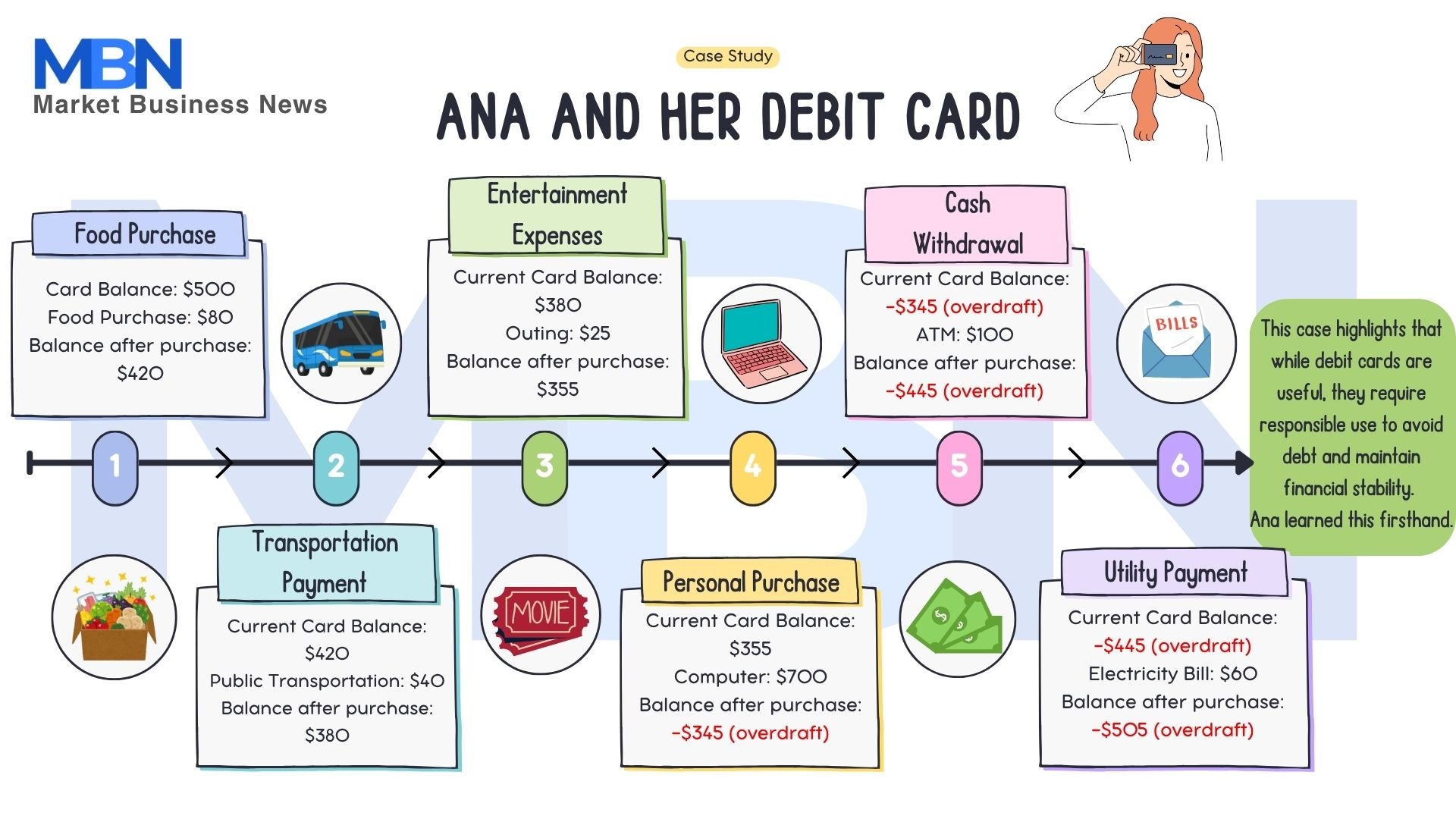

Case Study: Ana and Her Debit Card

Ana is a college student working part-time, and she has decided to open a bank account to better manage her money. When she opened the account, she also requested a debit card to facilitate her daily purchases and manage her finances. The account requires a minimum balance of $100 to avoid fees and has an overdraft limit of $500.

Example:

Ana deposits $500 into her debit account and uses her card for the following transactions throughout the month:

- Food Purchase: Ana goes to the grocery store and spends $80. After using her debit card, her account balance is reduced to $420.

- Transportation Payment: To get to college, Ana uses public transportation and spends $40 on her debit card. Her new balance is $380.

- Entertainment Expenses: One weekend, Ana decides to go out with friends to the movies and spends $25. Now, her balance is $355.

- Personal Purchase: Ana finds a laptop she needs for her studies and decides to buy it for $700. However, she doesn’t have enough funds. Her balance before the purchase is $355, so she makes the purchase using the overdraft option her bank offers, which allows her to cover the difference. After the purchase, her balance is -$345, meaning she has used $345 of her overdraft.

- Cash Withdrawal: Mid-month, Ana needs cash, so she goes to an ATM and withdraws $100. This increases her negative balance to -$445.

- Utility Payment: Ana also uses her debit card to pay a $60 electricity bill, bringing her balance to -$505. She now realizes she needs to cover her overdraft as soon as possible to avoid additional charges.

Using the Account Statement:

At the end of the month, Ana receives her monthly bank statement, which provides a detailed record of all her transactions. This document includes information about:

- Transactions: A breakdown of each purchase, withdrawal, and payment made with her debit card, showing the dates and amounts. This helps her visualize her expenses and better understand how to manage her money.

- Final Balance: The statement shows her current balance of -$505 and her overdraft usage of $345. Ana realizes she must be more mindful of her spending and adjust her budget for the next month.

- Overdraft Fees: The statement shows extra charges for going over her balance. It also includes the interest rates for the overdraft. This helps her understand the financial consequences of her decisions.

Situation Analysis:

- Spending Control: Despite using her overdraft, Ana realizes the importance of managing her budget each month. By using her debit card, she knows she must be careful with her spending. She needs to keep at least $100 in her account.

- Overdraft: Ana can use an overdraft of up to $500 to make big purchases without cash. However, she knows this can lead to debt if she does not pay it back on time. Her bank will charge interest on the overdraft amount.

- Benefit of the Large Purchase: Purchasing the laptop with her debit card (via overdraft) allowed her to obtain a necessary product without carrying large amounts of cash. However, Ana needs to be aware of the risks involved in using the overdraft.

- Cash Withdrawal: By withdrawing cash, Ana experiences the convenience of using her debit card. She must remember that each withdrawal lowers her account balance. This can affect her ability to keep the required minimum balance.

Conclusion of the Case Study:

Using her debit card has helped Ana manage her personal finances throughout the month. She was able to enjoy some benefits, such as making immediate purchases without carrying large amounts of cash. Accessing the available overdraft has highlighted the importance of managing her money correctly and being mindful of her spending.

This case study shows that debit cards can be useful tools. However, they also need responsible use to avoid debt and manage money well. Ana now knows it is important to control her spending. She should avoid using the overdraft for future purchases.