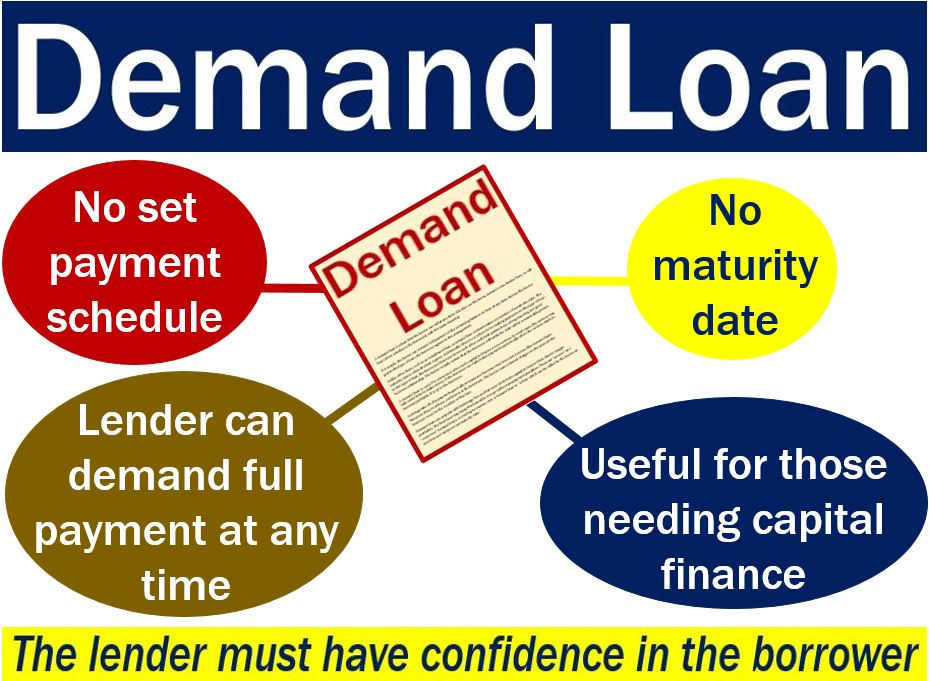

A Demand Loan is a loan that the lender can call at any time. We also use the terms Demand Note, Broker Loan, or Call Loan (when a broker is the borrower) with the same meaning. Put simply; the lender can demand full payment of the remaining balance on the loan at any time. Before the lender grants this type of loan, the borrower agrees to the arrangement.

Unlike other loans, such as an installment loan, a demand loan contract makes no mention of a maturity date. The maturity date is when the loan expires.

Additionally, there is no schedule for making payments on this type of loan.

In this type of loan, the lender and borrower know each other well. Both parties have a long-standing and good business relationship.

The lender is fairly certain that the borrower will settle the debt within a reasonable period.

The Cambridge Dictionary has the following definition of ‘demand loan’:

“A loan which has to be paid back when the lender asks for it, rather than by a particular fixed date.”

Demand loan useful for new ventures

A demand loan is useful for a borrower who needs capital to finance a new venture. In most cases, the venture may take some time to make money.

The borrower can make token payments periodically when the venture starts to become profitable. As things take off, the payments gradually increase and become more frequent.

Lenders like demand loans. However, they must have confidence in the borrower. Due to their callable nature, lenders issuing demand loans often conduct thorough risk assessments to ensure the borrower’s financial stability and the likelihood of prompt repayment when the loan is called The lender earns interest charges on the amount the borrower owes for the duration of the loan.

Interest rates on demand loans are often variable, meaning they can change over time based on market conditions, which adds a level of unpredictability for the borrower in terms of repayment costs.

Brokerage houses like demand loans

Demand loans are popular with brokerage houses that need short-term capital to finance their clients’ margin portfolios. The borrower may repay the loan all in one go without prepayment penalties.

There are ‘secured’ and ‘unsecured’ demand loans.

Video – What is a Demand Loan?

This video, from our YouTube partner channel – Marketing Business Network – explains what a ‘Demand Loan’ is using simple and easy-to-understand language and examples.