What is factoring? Definition and examples

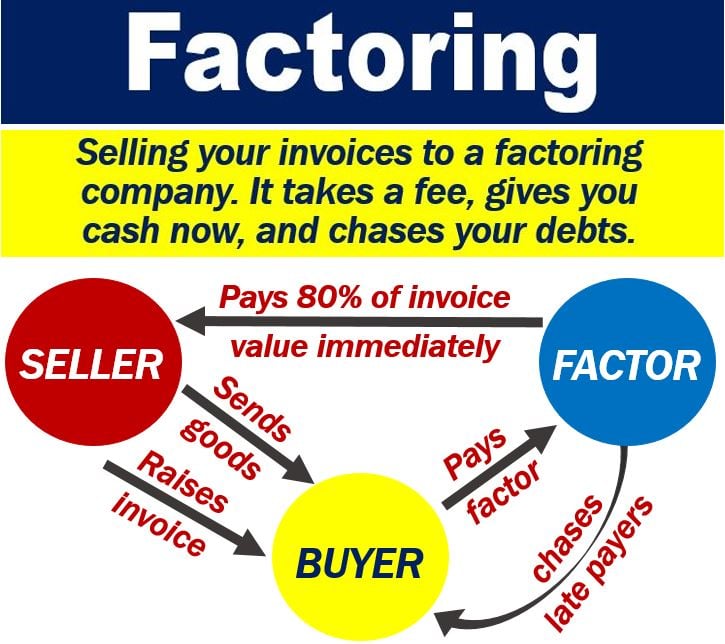

Factoring is a type of financing in which one company buys another company’s accounts receivable, i.e., its invoices (money it is owed). When a seller sends its customer an invoice, the factoring company pays the seller between 70% and 85% of the invoice’s value immediately. The seller gets the balance when the customer has paid the invoice. The customer pays the invoice factoring company.

This form of financing helps businesses with cash flow problems due to slow-paying customers. By financing its invoices, the company with cash flow problems has working capital

Cash flow is the flow of money in and out of a company, organization, or an account.

In algebra, ‘factoring’ (UK: factorising) is the process of finding a number’s factors. For example, in the equation 2 x 3 = 6, the numbers two and three are factors.

This article focuses on the meaning of the term in the world of business and finance.

Team Technology has the following definition of the term:

“[Factoring] is selling your invoices to a factoring company. You get cash quickly, and don’t have to collect the debt.”

“However, you lose some of the value of the invoice. The factoring company gets the debt and has to collect it.”

The company that buys your invoices makes money by charging you a percentage of the invoice’s value. We refer to the company that buys your invoices as the ‘factor.’

Factoring vs. invoice discounting

Do not confuse the term with invoice discounting. With invoice discounting, a company asks for a loan and uses its accounts receivable as collateral. With factoring, however, the company sells its accounts receivable.

In the United Kingdom, the difference between the two terms is not so clear.

In some UK markets, people consider invoice discounting as a form of factoring. Specifically, when it involves the ‘assignment of receivables’ in factoring statistics.

Regarding the meaning of invoice discounting in the UK, Wikipedia writes:

“It is therefore also not considered to be borrowing in the UK. In the UK the arrangement is usually confidential in that the debtor is not notified of the assignment of the receivable and the seller of the receivable collects the debt on behalf of the factor.”

“In the UK, the main difference between factoring and invoice discounting is confidentiality.”

Factoring pros and cons

Pros

– You get your money quickly.

– Less hassle. The factor assumes all the hassle of credit control, i.e., chasing bad debts. You can subsequently free up your and other people’s time on running the business.

A bad debt is a payment that is overdue and will either never be paid or will require drastic action. The creditor may have to take the debtor to court. The debtor is the peson or party that owes money.

– You can better control the flow of cash in the company. It also makes it easier to plan ahead.

– Customers tend to respect factors. Therefore, they are more likely to pay on time.

– If you choose non-recourse factoring, you will not have to worry about bad debts.

– Your factor will credit check your customers. This can help ensure that you do business with good quality customers.

Cons

– The factor gets a percentage of your invoice value. Therefore, your profit margin suffers.

– You will lose some flexibility. You must do business with companies that the factor approves.

– According to BIBusinessInfo.co.uk: “Queries and disputes may have a negative impact on your available funding. For this reason, factoring works best when a business is efficient and there are few disputes and queries.”

– Some of your customers may not like the factor’s credit controllers, i.e., debt chasers.

– Addition risk. ‘Getting your money quickly’ is like a drug, according to Byte Start. Getting off it might not be easy. You may, for example, require an injection of capital to get free.

FinanceExpert has some interesting information on factoring. Its website explains what it is, how it works, and how businesses can take advantage of it. It also tells us what the costs are.