The Federal Open Market Committee (FOMC) is part of the US Federal Reserve System, the United States’ central bank, that makes key decisions regarding interest rates and the growth of the country’s money supply. It oversees America’s open market operations, i.e. the Federal Reserve’s buying and selling of Treasury securities.

The FOMC is the principal organ of America’s national monetary policy.

The Federal Reserve controls the three tools of monetary policy:

- Open market operations.

- The discount rate.

- Reserve requirements.

A meeting of the Federal Open Market Committee at the Eccles Building, Washington, D.C. (Image: Wikipedia)

A meeting of the Federal Open Market Committee at the Eccles Building, Washington, D.C. (Image: Wikipedia)

The discount rate and reserve requirements are the responsibility of the Board of Governors of the Federal Reserve system, while the FOMC is in charge of open market operations.

Utilizing the three tools, the Fed influences the demand for and supply of balances that banks hold at Federal Reserve Banks and in this way changes the federal funds rate.

The federal funds rate is the rate at which banks lend balances at the Federal Reserve to other financial institutions overnight.

According to the Federal Reserve:

“Changes in the federal funds rate trigger a chain of events that affect other short-term interest rates, foreign exchange rates, long-term interest rates, the amount of money and credit, and, ultimately, a range of economic variables, including employment, output, and prices of goods and services.”

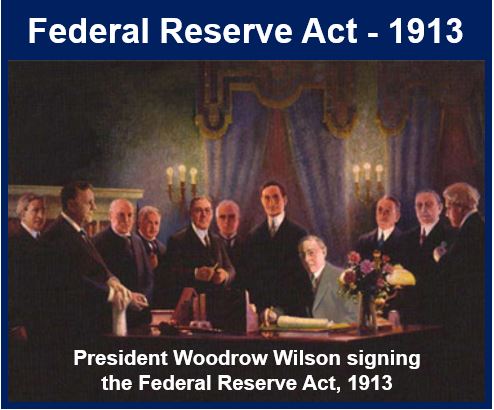

The Federal Reserve Act of 1913 gave the Federal Reserve responsibility for setting monetary policy. (Image: Federal Reserve Bank of Philadelphia)

The Federal Reserve Act of 1913 gave the Federal Reserve responsibility for setting monetary policy. (Image: Federal Reserve Bank of Philadelphia)

FOMC structure

The FOMC comprises 12 members:

- the 7 members of the Board of Governors of the Federal Reserve System,

- the president of the Federal Reserve Bank of New York,

- four of the other eleven Reserve Bank presidents. They serve one-year terms on rotation.

The FOMC meets eight times per year (scheduled meetings). The Committee reviews financial and economic conditions, determines the appropriate monetary policy to take, and assesses the risks to its long-term objectives of sustainable economic growth and price stability.

The Committee may also hold unscheduled meetings as necessary to assess and decide on economic and financial developments.

Following each regular meeting, the FOMC issues a policy statement that summarizes its economic outlook and policy decision at that meeting. The Chairman holds a press briefing four times a year to present the FOMC’s current economic forecasts and to provide additional context for its policy decisions.

A full set of minutes is published three weeks after the conclusion of each regular meeting. Five years after each meeting, complete transcripts are published.

According to the Board of Governors of the Federal Reserve System:

“Usually, the FOMC conducts policy by adjusting the level of short-term interest rates in response to changes in the economic outlook. Since 2008, the FOMC has also used large-scale purchases of Treasury securities and securities that were issued or guaranteed by federal agencies as a policy tool in an effort to lower longer-term interest rates and thereby improve financial conditions and so support the economic recovery.”