A Fixed Exchange Rate is a system in which the government tries to maintain the value of its currency. In other words, the government or central bank tries to maintain its currency’s value in relation to another currency. The government may also try to maintain its currency’s value in relation to a basket of currencies. If the currency’s value changes too much, the government or central bank intervenes.

Fixed exchange rates can also simplify international transactions by providing a consistent pricing mechanism across borders.

The term ‘fixed exchange rate’ may also refer to a currency whose value closely follows that of gold or silver.

Floating vs. fixed exchange rate

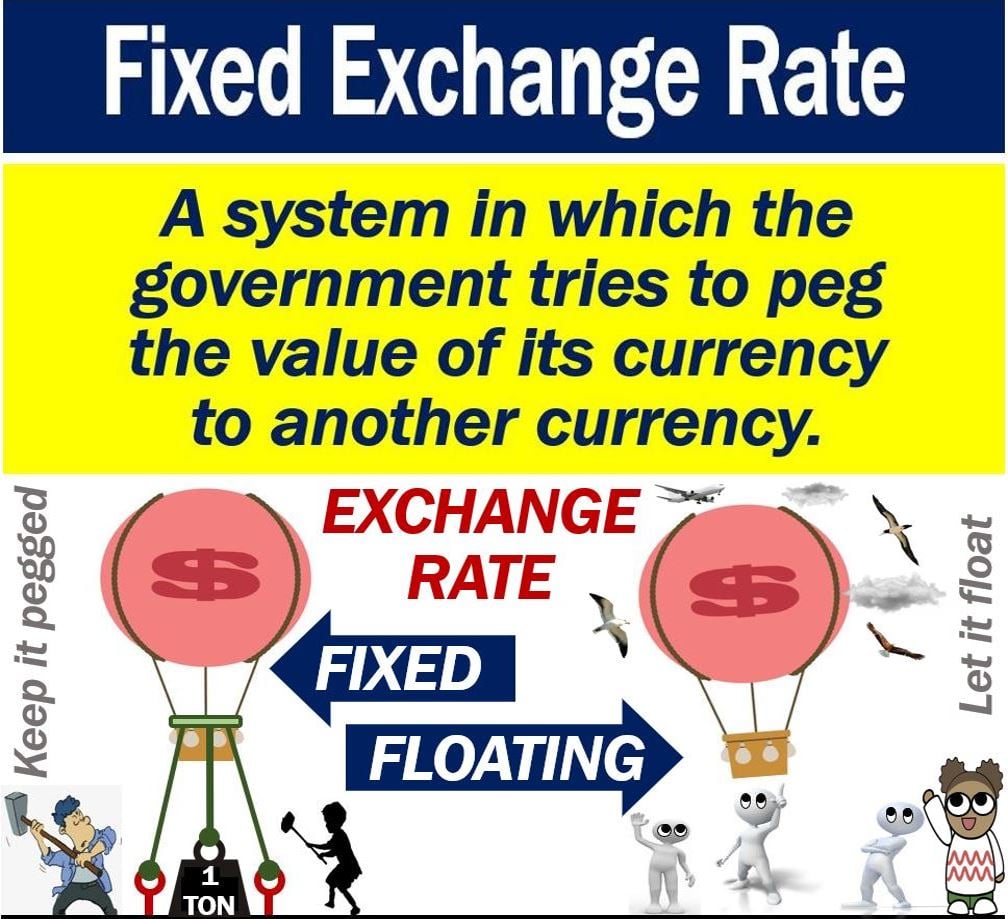

A pegged exchange rate is the same as a fixed exchange rate. It contrasts with a floating exchange rate.

In a country with a floating exchange rate regime, the government does not intervene. Market forces determine the currency’s value. Market forces are the forces of supply and demand, which in a totally free market, determine prices.

The Czech National Bank says the following regarding a floating and fixed exchange rate:

“A fixed exchange rate denotes a nominal exchange rate that is set firmly by the monetary authority with respect to a foreign currency or a basket of foreign currencies.”

“By contrast, a floating exchange rate is determined in foreign exchange markets depending on demand and supply, and it generally fluctuates constantly.”

The Czech National Bank is the Central Bank of the Czech Republic.

In a fixed exchange rate system, the central bank or government intervenes if the currency’s value moves too much. This is not the case in a floating exchange rate system.

Fixed exchange rate – pros and cons

There are advantages and disadvantages to using a fixed exchange rate system.

-

Advantages

A government typically fixes its exchange rate because its currency’s value had been fluctuating too wildly. By pegging the currency to a more stable one, the government hopes to bring stability.

After stabilizing a fluctuating currency, trade and foreign investments usually increase.

Small economies, especially those for which international trade forms a major part of GDP, need stability. GDP stands for Gross Domestic Product.

Sometimes, the best way to achieve this is to introduce a fixed exchange rate system.

The system is also helpful for countries which borrow mainly in foreign currency.

International financial institutions, such as the International Monetary Fund, often play a pivotal role in supporting countries that adopt fixed exchange rates during periods of economic adjustment.

Regarding the advantages of pegging a currency to another one, thebalance.com writes:

“A fixed exchange rate provides currency stability. Investors always know what the currency is worth. That makes the country’s businesses attractive to foreign direct investors.”

“They don’t have to protect themselves from wild swings in the currency’s value.”

-

Disadvantages

When markets are turbulent, maintaining the value of a currency can be expensive. The central bank needs to make sure it has enough foreign exchanges to intervene.

Speculators may ‘short’ the currency, i.e., artificially pushing down its value.

To prop up its currency, the central bank has to use up its precious foreign exchange reserves. If the reserves are not enough, it will subsequently have to push up interest rates.

Rising interest rates can slow down the economy. Sometimes, they can slow down the economy so much that a recession ensues.

Regarding the disadvantages of having a fixed exchange rate, an article in scribd.com says:

“The needs of the exchange rate can dominate policy, and this may not be best for the economy at that point.”

Sometimes, defending its currency becomes so absorbing that the government has little time to focus on anything else.

Video – What are Fixed Exchange Rates?

This educational video, from our sister channel on YouTube – Marketing Business Network, explains what ‘Fixed Exchange Rates’ are using simple and easy-to-understand language and examples.