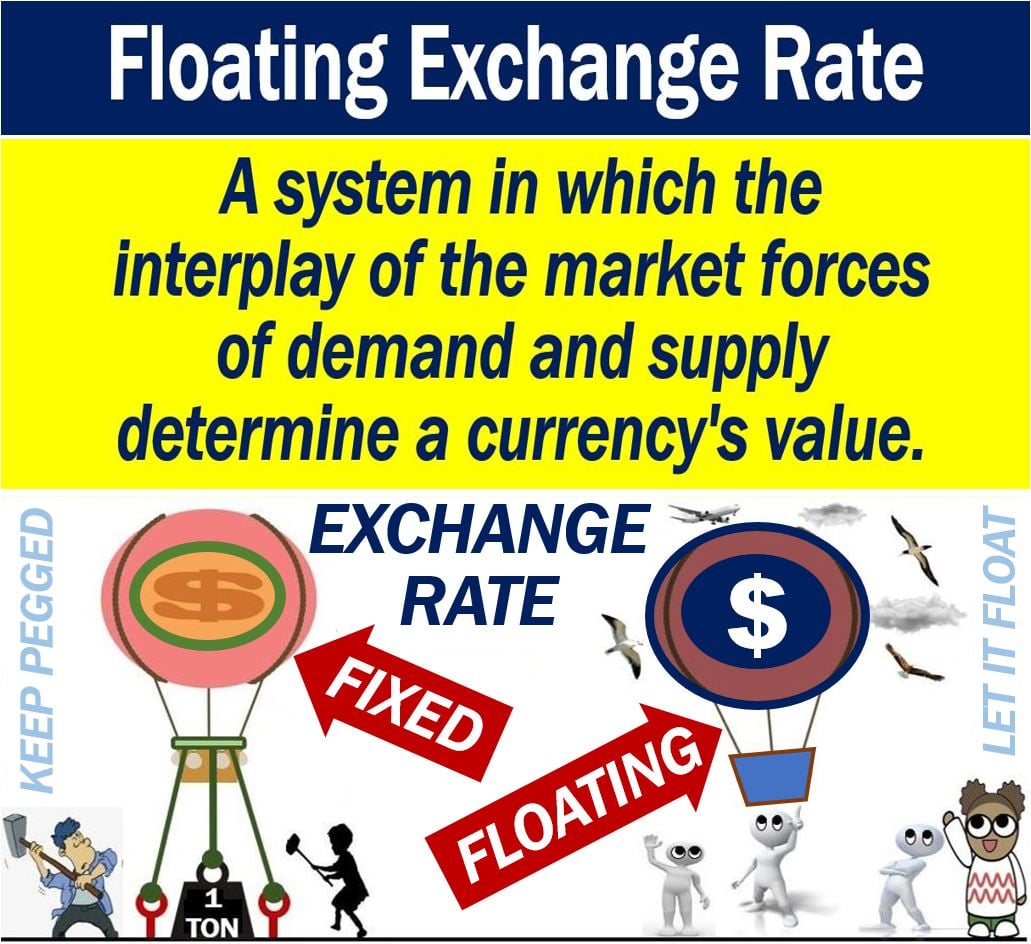

What is a floating exchange rate? Definition and examples

A floating exchange rate is one in which the value of a currency fluctuates in response to supply and demand. The interplay of the market forces of demand and supply determine the currency’s value. Rather than government intervention, the currency’s value reflects public confidence in that country’s economy.

Put simply, the value of a currency in a floating exchange rate depends on market forces. In this context, the term ‘market forces’ means the forces of supply and demand.

We also call it a fluctuating exchange rate or flexible exchange rate.

A fixed or floating exchange rate

A floating exchange rate contrasts with a fixed exchange rate.

A fixed exchange rate is a system in which the government attempts to maintain the value of its currency.

It either tries to peg it to a hard currency like the dollar or a basket of currencies. In a fixed exchange rate, the government may also try to shadow the price of gold or silver.

Does a floating exchange rate exist?

Even though some governments say they have a free-market system, their central banks might intervene.

In other words, they might intervene if the currency goes down or up too much.

Put simply; there is not one true floating exchange rate in the world.

Exchange rates – advanced economies

The exchange rates in the US, UK, Euro Area, and Japan are more similar to a floating than a fixed exchange rate.

The governments and central banks of the advanced economies will try to let their currencies float freely. They will only intervene if there is a crisis or the currency has fluctuated too wildly.

Canada’s exchange rate resembles a pure floating exchange rate most closely. The Bank of Canada has not intervened to defend the Canadian dollar since 1998.

Floating exchange rate – pros and cons

Pros

- It is auto-correcting, i.e., self-correcting. Market forces determine the value of the currency. The system automatically adjusts to any changes in supply and demand.

- Better protection from external events. The country’s currency will withstand economic movements in other counties more successfully. When there is free movement of demand and supply, the domestic economy has protection from changes in the global economy.

- The government has more freedom. Specifically, it has more freedom to determine what its domestic policies are. A floating exchange rate self-corrects any balance of payment imbalance that a domestic policy may cause.

Cons

- Greater fluctuations, i.e., there is more volatility. Sometimes, the fluctuations can be severe.

- A floating exchange rate uses scarce resources to predict future currency values.

According to GREEN GARAGE: “When the exchange rates are highly volatile, the risk faced by financial market participants face is greatly increased.”

“This is why substantial resources are used to predict exchange rate changes so that the exposure to risk can be managed.”

- It can sometimes exacerbate existing problems. For example, if inflation is already a problem, and the currency declines in value, inflation will get worse.