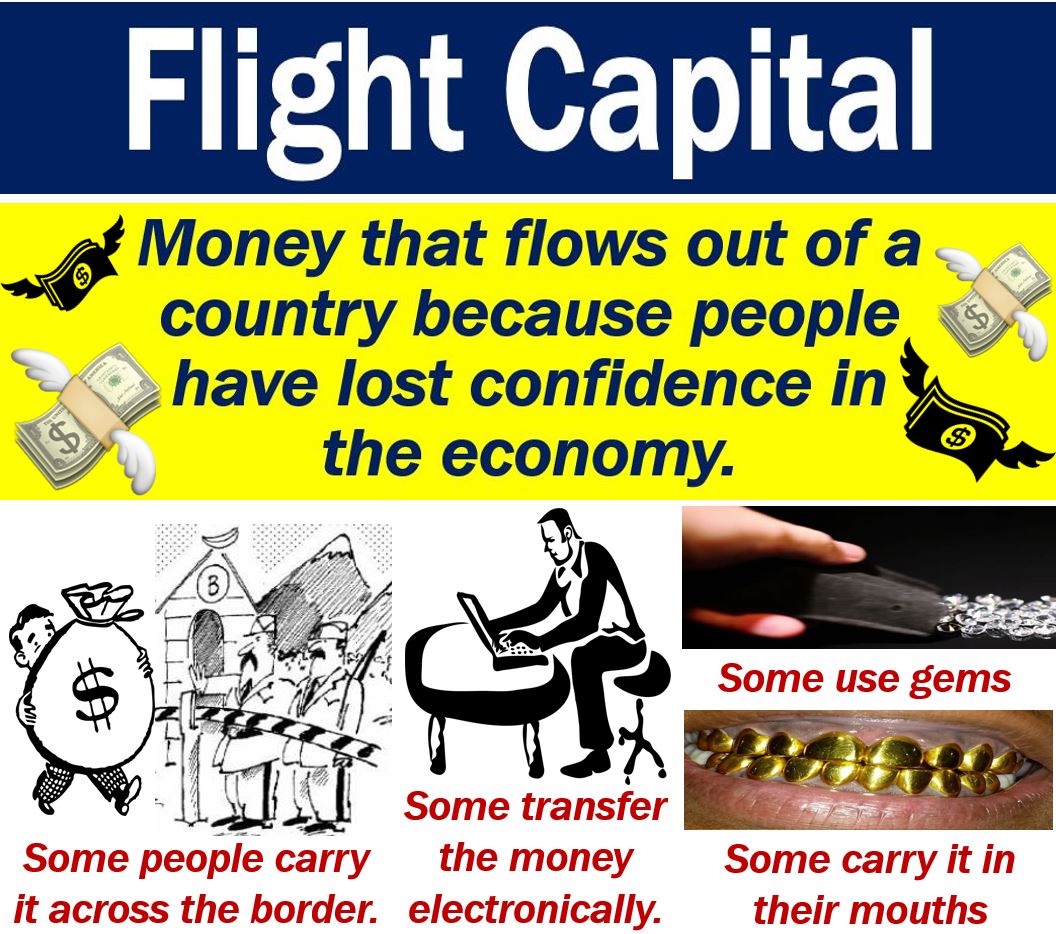

Flight capital is money that somebody or a company has transferred abroad during a capital flight. Specifically, they have transferred the money to avoid inflation, a devaluation, taxes, or something bad in the domestic economy.

Flight capital refers to the capital itself, i.e., the money. The action of sending flight capital is ‘capital flight.’

In other words, ‘capital flight’ is the event, while ‘flight capital’ is the money. Capital flight occurs when money leaves a country, usually because people have lost confidence in the economy.

Collins Dictionary has the following definition of the term:

“Funds transferred abroad in order to avoid high taxes or to provide for a person’s needs if flight from the country becomes necessary.”

Flight capital – hard currency

During a capital flight, people typically send their money to a country with a hard currency.

A hard currency is a currency that people trust. We expect a hard currency to maintain its value because it belongs to an extremely stable economy.

The US dollar, pound sterling, euro, Swiss franc, and Japanese yen, for example, are hard currencies. Hard currencies contrast with soft currencies.

Flight capital – reasons

There are many reasons why people transfer their money out of a country. Below is a list of some of them.

Taxes

A sudden increase in tax rates may lead to capital flight. When the socialist government of Francoise Mitterrand in the 1980s raised taxes, billions of dollars’ worth of flight capital left France.

Capital controls

Capital controls are measures governments take to control how much money leaves or enters a country.

Unfortunately, rather than solving a capital flight problem, the measure often exacerbates it.

Interest rates

Let’s imagine two fictitious countries, Country A and Country B. They are neighbors.

One day, Country B suddenly announces that it is tripling interest rates. Billions of dollars’ worth of flight capital from Country A ends up in Country B.

In other words, people with resources in Country A have transferred their money to Country B.

They have done this because interest rates are considerably higher in Country B than Country A. This means that they will earn more from their savings in Country B.

Also, Country B’s currency will probably rise in value.

Interest rates are like money magnets, i.e., they attract money. The higher the interest rate, the more powerful the magnet is.

Political and social instability

A political crisis can trigger capital flight. When citizens start losing confidence in their government, they also lose confidence in their economy.

When Britons voted in a referendum in 2016 to leave the EU, the pound sterling plummeted.

Capital also leaves a country when there is serious social instability. A country with daily demonstrations that start becoming violent can lose billions as flight capital moves to save havens.