What is a focused fund? Definition and examples

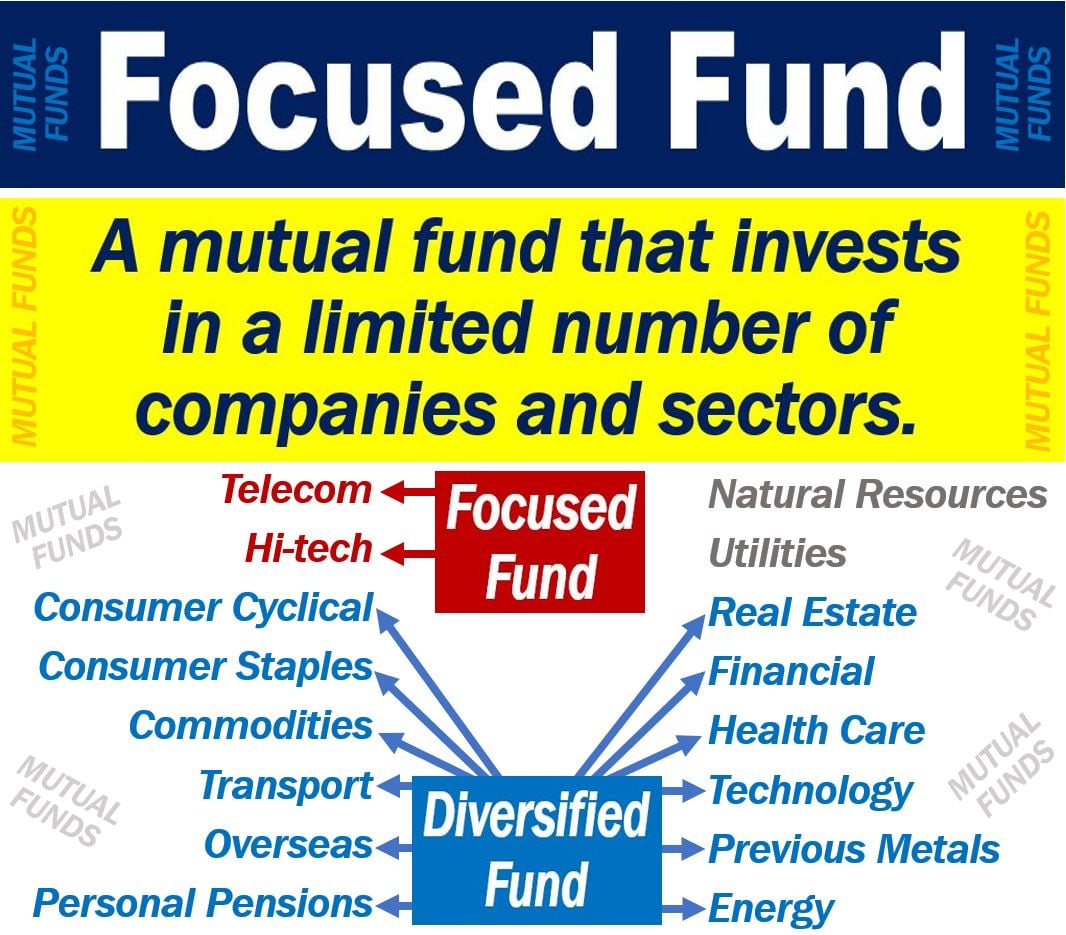

A focused fund is a mutual fund that has shares in a limited number of companies. It also holds shares in a limited number of sectors. A focused fund, typically, holds stocks in fewer than thirty companies and fewer than three sectors.

A mutual fund (UK: unit trust) is a company that pools the money of several investors and invests it in securities. It invests the money in, for example, stocks and bonds, and also in short-term debt. Some mutual funds pool the money of many hundreds of thousands of investors.

The Motley Fool has the following definition of the term:

“Focused funds keep their holdings to a minimum and typically limit their investments to a specific sector or a set number of sectors.”

“The securities that focused funds buy are usually thoroughly researched.”

Diversified vs. focused fund

A focused fund contrasts with a diversified fund. Diversified funds invest across many different sectors and many different asset classes. Diversification helps protect the investment portfolio from idiosyncratic events, i.e., events that affect just one sector.

Some diversified funds hold investments in hundreds of different companies and across every sector.

Focused fund benefits

The managers in charge of investing the mutual fund’s money study the focused fund companies carefully.

Because there are fewer companies to examine, fund managers can spend longer checking out each one.

These in-depth assessments can benefit the investors.

Good focused fund managers are often able to get a better return than the returns of the broader stock market.

Focused fund disadvantages

Experts always say that a diversified portfolio is better than one that focuses too much on one company or sector. That is the idea behind the saying “Don’t put all your eggs in one basket.”

A portfolio is a spread of investment products. A diversified portfolio is one with a wide spread of investments.

If the fund is very focused, it is vulnerable to downturns in specific companies or sectors. Put simply; a focused fund is riskier than a diversified fund.

If a fund focuses, for example, exclusively in banks, it will suffer significantly if banks suddenly start crashing.

What do experts recommend?

In an Economic Times article, Sanket Dhanorkar quoted a study which compared focused and diversified funds.

Dhanorkar wrote:

“Funds with a focused portfolio lose out. Over longer time periods, diversified funds, across categories, have fared better than focused funds.”

In an article on Money Today’s website, Renu Yadav says that focused funds have the potential to generate greater returns.

However, the author also points out that focused funds are riskier than diversified funds.