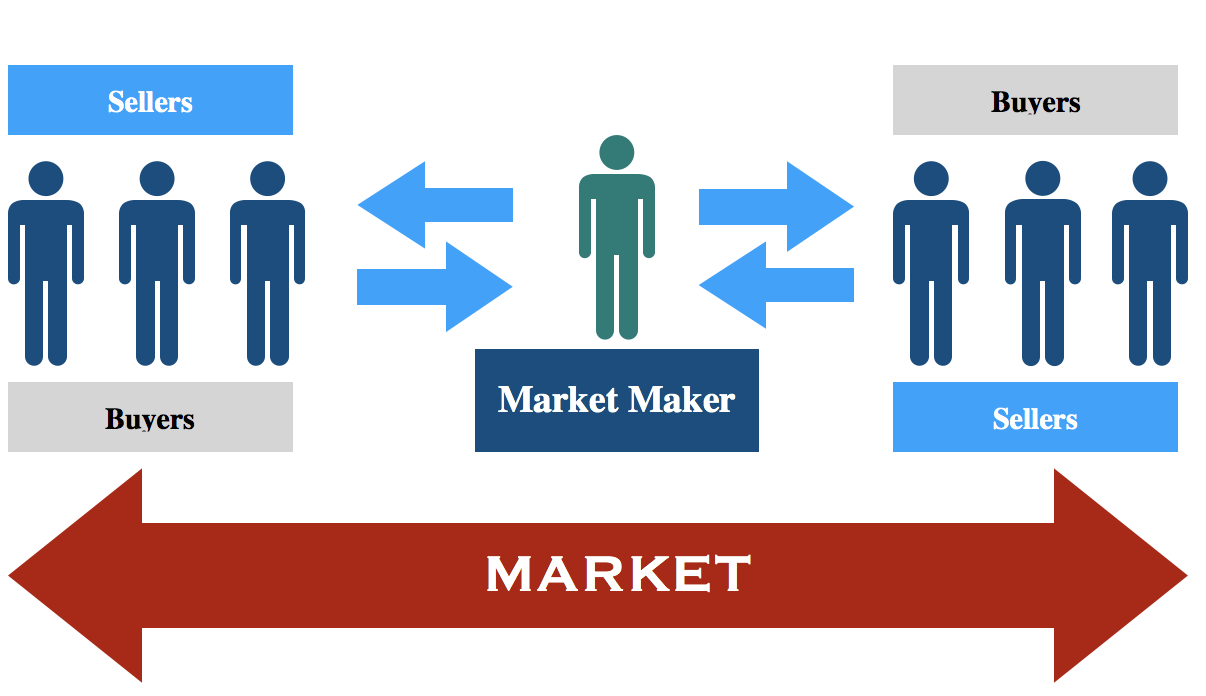

A market maker is a company or individual that regularly buys and sells securities at a publicly quoted price to provide liquidity to the markets. Their role is to satisfy market demand for a security during the trading day.

The US Securities and Exchange Commission defines a market maker as “a firm that stands ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price.”

According to FT Lexicon, a market maker “quotes bid and offer prices for securities that they hold in inventory, and is prepared and able to buy or sell those securities at any time on its own account.”

Market makers ensure that there is always a two-sided market with a reasonable spread for certain securities by posting bids and offers as often as necessary.

Market makers also facilitate smoother price movements and reduce volatility by mediating between surplus and shortage in the market.

In the US, the term is commonly heard in the context of “over the counter” (OTC) markets, such as Nasdaq.

We refer to those who stand ready to buy and sell stocks listed on an exchange, such as the New York Stock Exchange, or London Stock Exchange as “third market makers.”

How market makers make money

Market makers are compensated for the risks they take by setting a difference between the ask and bid price (this is known as the bid-offer spread).

For example, a market maker may buy shares from a seller for $50 each (the ask price) and then sell those shares to a buyer for $50.05 (the bid price). While the spread isn’t that much market makers can trade millions of securities on a daily basis.

This Marketing Business Network video explains what a market maker is in a way that’s simple and easy to understand:

NASDAQ

NASDAQ market makers are “independent dealers competing for investor orders by displaying buy and sell interest in NASDAQ-listed securities.” According to Nasdaq, “nearly 300 active registered firms commit capital in the securities in which they choose to make a market.” Market makers are not exclusive dealers and there can be more than one market maker for a stock.

NYSE

The NYSE differs from NASDAQ in that it has Designated Market Makers (DMMs), formerly known as “specialists”, who act as the official market maker for a given security. According to NYSE, “the obligations of DMMs are to maintain fair and orderly markets for their assigned securities.” If investors are selling, DMMs are typically buying, and vice versa.

Canadian Securities Exchange

The Canadian Securities Exchange says on its website that it awards market making assignments based on:

- the dealers prominence in a given sector.

- the dealer’s commitment to offer a competitive two-sided market.

- the dealer’s ability to meet with the commitments established in the application.

- a specific request from an issuer.

London Stock Exchange

According to the London Stock Exchange, “a member firm can elect to register as a market maker in one or more securities but must be able to meet the obligations that are associated with the role.” A basic requirement is for a market maker “to make prices and deal either on the order book, off the order book or both.”