Nominal price is an estimated price that may not actually reflect the real market price of an asset (it does not adjust for inflation). It is also known as the current dollar price.

It could be a price set because of a negotiation, or as an initial price when a product is first introduced to the market.

Usually the value of something is measured in real terms instead of nominal terms. Real value makes adjustments (such as inflation) to give a more accurate measure.

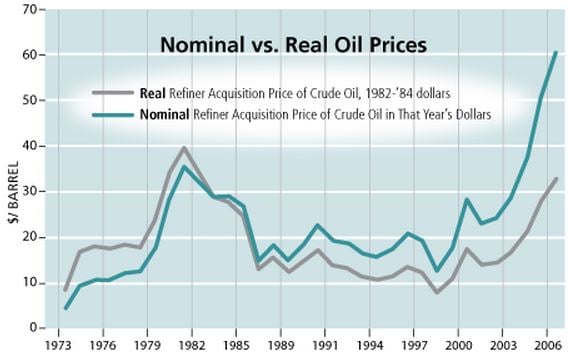

Nominal prices for oil were higher in 2006 than at any other time during the graph’s period. However, the gray line (real prices) show the highest year was 1981. (Source: stlouisfed.org)

Nominal prices for oil were higher in 2006 than at any other time during the graph’s period. However, the gray line (real prices) show the highest year was 1981. (Source: stlouisfed.org)

In economics, nominal values of factors, such as economic growth and personal income, are not adjusted for inflation. For example, a country reporting GDP growth of 3% and an inflation rate of 1%, would have a real GDP growth rate of 2%.

It is also the stated value of an issued security. The nominal value of a security is also known as its face value or par value.

The nominal value of a security is fixed. What does change is the security’s market value (which can be very different from its nominal value).

Calculating nominal and real rate of return

If you purchase a $1,000 bond and sell it a year later for $1,100, your nominal rate of return (which has not factored in inflation) is 10%.

If the inflation rate for that 12-month period was 4%, your real rate of return was 10% minus 4%, which equals 6%.