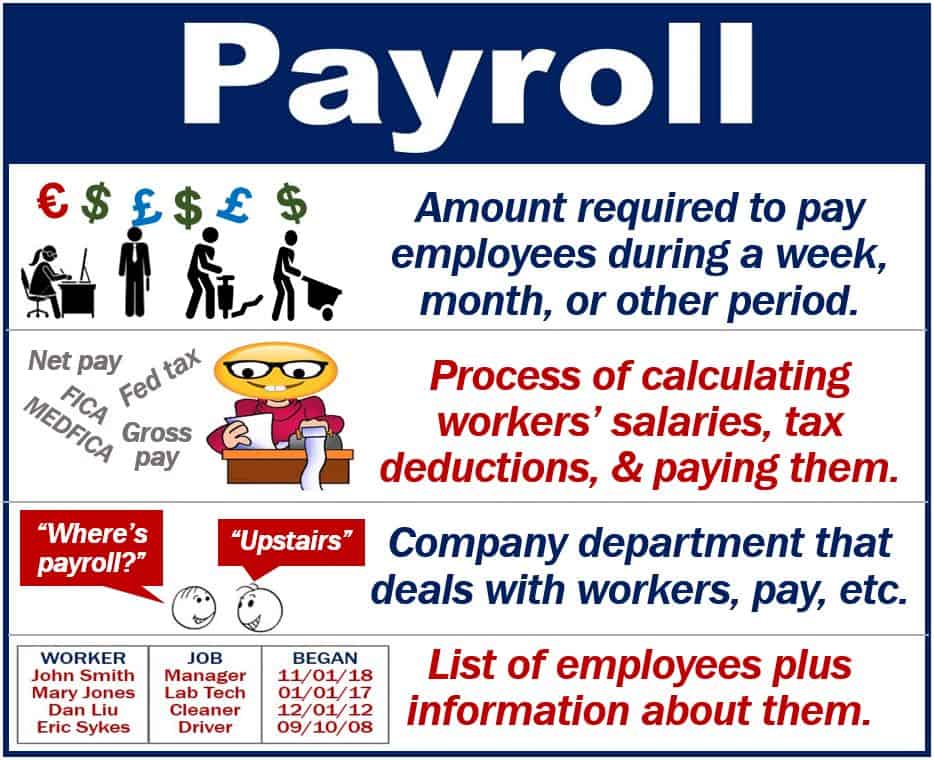

The term ‘payroll‘ may refer to the workers in a company, plus information about them. It might also refer to the amount of money the employer pays its workers. We often use the term when we are talking about the process of calculating workers’ pay and taxes. For example, an accountant may say the following to her husband: “I will be home late tonight. I am doing payroll.”

We also use the term for the department in a company that deals with workers’ pay and taxes.

Any business that employs people has a payroll. In fact, unless nobody works there, it is impossible to avoid it.

Payroll – accounting

From an accounting point of view, payrolls are very important. Workers’ wages and taxes that companies must pay, for example, significantly affect net income. It is also important because employees’ wages and taxes are subject to rules and regulations.

Net income means income after paying for the cost of goods, delivering them, expenses, taxes, and also depreciation. It means the same as ‘net profit.’

In some countries, such as the United States, for example, there are federal, state, and local regulations concerning companies’ payrolls.

Human resources

From an HR point of view, payroll is also crucial because workers are sensitive to mistakes and irregularities. The letters HR stand for Human Resources.

Especially those related to their paychecks, vacation entitlements, maternity leave, and deductions for tax and social security contributions.

Payroll taxes

Local and national governments across the world usually require employers to deduct taxes at source. This means, withholding income taxes from workers’ wages.

United Kingdom

Countries have various terms for this. Britons call it PAYE. PAYE stands for Pay As You Earn. An employee on a PAYE system never sees his or her gross pay, only the net pay.

United States

in the U.S. payroll taxes are distinct from income taxes, even though they’re both based on salaries.

Payroll taxes, which fund programs like Social Security and Medicare, are charged to employers based on salary levels.

The income and payroll taxes that are deducted from employees’ paychecks are treated as trust fund taxes because the employer holds this money in trust until it’s later sent to the government.

Specific software

Employers who want to run payroll themselves may need specific software to report to their tax authorities.

The software helps the employer with tasks such as:

- Recording information about their employees.

- Calculating workers’ pay and deductions.

- Reporting payroll data to tax authorities.

- Working out how much tax the employer needs to pay.

- Working out statutory pay, for example, sick pay or maternity pay.

HM Revenue and Customs (HMRC), the UK’s tax office, says employers can choose from free software and paid-for software. If you employ fewer than ten workers, you can use the free software.

Payroll taxes – USA

In the United States, payroll taxes are taxes paid on employees’ salaries and wages. The US government uses these taxes to finance social insurance programs. Medicare and Social Security, for example, are social insurance programs.

These social insurance taxes make up nearly one-quarter of combined federal, state, and local government revenue. Social insurance taxes are the second-biggest source of government revenue in the US.

According to the Tax Foundation, the biggest social insurance taxes in the U.S. are the federal payroll taxes, commonly shown as FICA and MEDFICA on pay stubs. These include a 12.4% tax for Social Security and a 2.9% tax for Medicare, which together total 15.3%. This tax is split evenly between employers and employees, with each responsible for 7.65% of the total.

Interesting related articles: