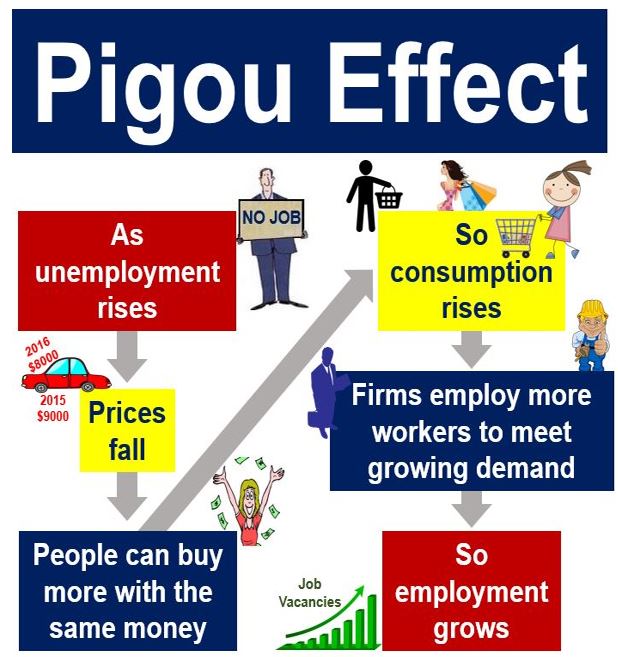

The Pigou Effect is an economics concept, put forward by British economist Arthur Pigou (1877-1959), that a major decline in prices stimulates an economy and triggers a wealth effect that generates full employment. In other words, as prices go down, consumers have more spare cash available for spending, their greater purchases fuel demand for more production, which means that suppliers take on more workers – so there are more jobs.

** The wealth effect is an economic theory that people spend more when they perceive themselves to be better off. If my house rises in value, I feel richer and go out and spend more money.

Pigou was wrong

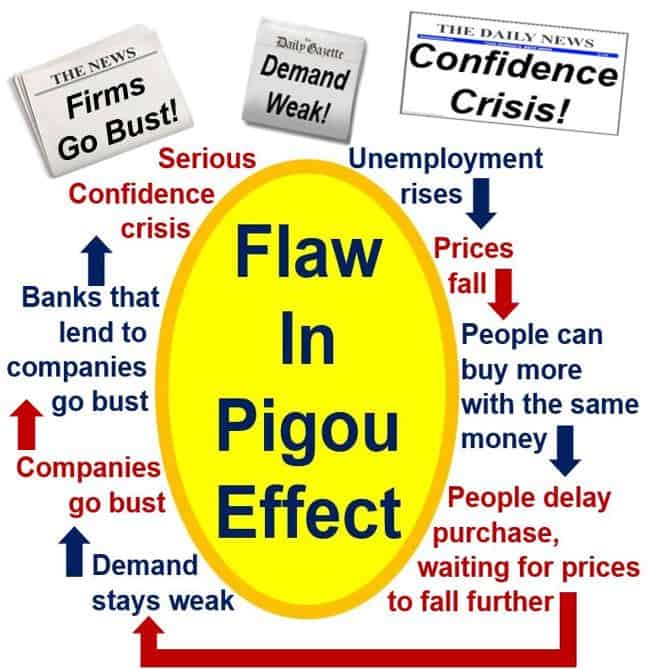

In practice, however, this mechanism does not work out, because if the price decline is steep enough, a large number of employers will go broke, bringing down with them several lenders (banks) that were unable to recover money owed to them.

Michał Kalecki (1899-1970), a Polish economist, who was economic adviser to the governments of India, Mexico, Israel, Cuba and Poland, and was also Deputy Director of the United National Economic Department in New York City, criticized the Pigou Effect because:

“The adjustment required would increase catastrophically the real value of debts, and would consequently lead to wholesale bankruptcy and a confidence crisis.”

This illustrates a counterintuitive dynamic where deflation, typically seen as increasing consumers’ purchasing power, can instead contract economic activity by escalating the burden of debt.

If the decline in prices is gradual, people do not know where or when it will stop, and both producers and consumers will hold onto their money, which leads to a liquidity trap.

The Economist’s glossary of terms says the following regarding the Pigou Effect:

“Named after Arthur Pigou (1877-1959), a sort of wealth effect resulting from deflation. A fall in the price level increases the real value of people’s savings, making them feel wealthier and thus causing them to spend more. This increase in demand can lead to higher employment.”

Pigou first popularized the Pigou Effect in 1943, when his article – The Classical Stationary State – was published in the Economic Journal.

How Pigou defined the Pigou Effect

Arthur Pigou defined the Pigou Effect as the sum of government bonds and the money supply divided by the price level. Keynes’ General Theory was not enough in not specifying a link from ‘real balances’ to current consumption levels, he argued.

Pigou suggested that the inclusion of such a ‘wealth effect’ would make a country’s economy more ‘auto-correcting’ to declines in aggregate demand than Keynes had predicted.

When an economy is stuck in a liquidity trap, monetary stimulus cannot be used as a tool to increase output because the connection between personal income and money demand is negligible.

-

Sir John Richard Hicks

Sir John Richard Hicks (1904-1989), one of the most influential economists of the twentieth century, believed that this might be another reason – together with **sticky prices – for persistently high unemployment levels.

** Sticky prices are prices that do not respond rapidly to changes in economic conditions, such as lower/higher levels of demand, or production, delivery or raw material costs.

The Pigou Effect, however, creates a mechanism with which the economy can escape the trap: As unemployment goes up the price level goes down, which increases real balances and thus consumption grows.

The economy eventually shifts to the new equilibrium – at full employment. Pigou believed than an equilibrium with employment at the classical natural rate – below the full employment rate – would only happen if wages and prices were sticky.

Japan’s lost decade and the Pigou Effect

The Lost Decade is the time after the asset price bubble’s collapse within Japan’s economy. The term initially was used to refer to the years 1991 to 200, but more recently has also included 2001 to 2010. Hence, the newer term – The Lost 20 Years – also exists.

-

Japan’s economy shrank

From 1995 to 2007, Japan’s GDP (gross domestic product) declined from $5.33 trillion to $4.36 trillion, real wages dropped by about 5%, while inflation remained stubbornly around 0%.

If the Pigou Effect always worked as Pigou had predicted, the Bank of Japan’s policy of close-to-zero interest rates should have ended the country’s deflation sooner.

Japan experienced a very long period of stagnating consumer expenditure while prices were going down – economists point to this as another apparent piece of evidence against the Pigou Effect.

Pigou had hypothesized that declining prices would make consumers feel wealthier, and would consequently increase their spending.

-

Consumers delayed their purchases

However, all surveys carried out in Japan during that period reported that consumers preferred to postpone their purchases, because they expected prices to fall further – they were waiting for better bargains.

This behavior reflects the notion of ‘deflationary expectations,’ where sustained price declines lead consumers to delay spending, which paradoxically exacerbates the economic downturn by reducing aggregate demand.

Such deflationary spirals can prompt central banks to implement unconventional monetary policies, aiming to incentivize spending and investment to reflate the economy.

Video – What is the Pigou Effect?

This video presentation, from our YouTube partner channel – Marketing Business Network, explains what ‘The Pigou Effect’ is using simple and easy-to-understand language and examples.