A Public Limited Company (abbreviated as PLC) is a public company under British and Irish law. It is also a public company in some Commonwealth nations. It is similar to publicly traded companies in the US.

Members of the public can buy and sell a PLC’s shares on the stock exchange. In order for a company to become a PLC, it has to have a share capital of at least £50,000. This is mandatory as part of the company registration process for a PLC.

A PLC can either be listed or unlisted on a stock exchange. A public company in the UK has to have the words “public limited company”, “PLC”, or “plc” at the end of its legal name.

The suffix “PLC/plc” and the term “public limited company” emerged in 1974. Before this, limited companies used the term “Limited” (“Ltd”) at the end of their name. In fact, some private limited companies still use that term.

Most globally-famous British companies are PLCs, but not all of them – Virgin Group Ltd. is not.

Most globally-famous British companies are PLCs, but not all of them – Virgin Group Ltd. is not.

A PLC needs to have a minimum of at least two directors. Members have to agree to obtain some of the shares once the company is registered.

Companies generally go public because they want access to more funds, and from a wider range of shareholders.

When a private limited company goes public, it becomes a public limited company.

How a Public Limited Company is incorporated

In the UK, all companies that are incorporated must register with Companies House (an agency of the Department for Business, Innovation, and Skills).

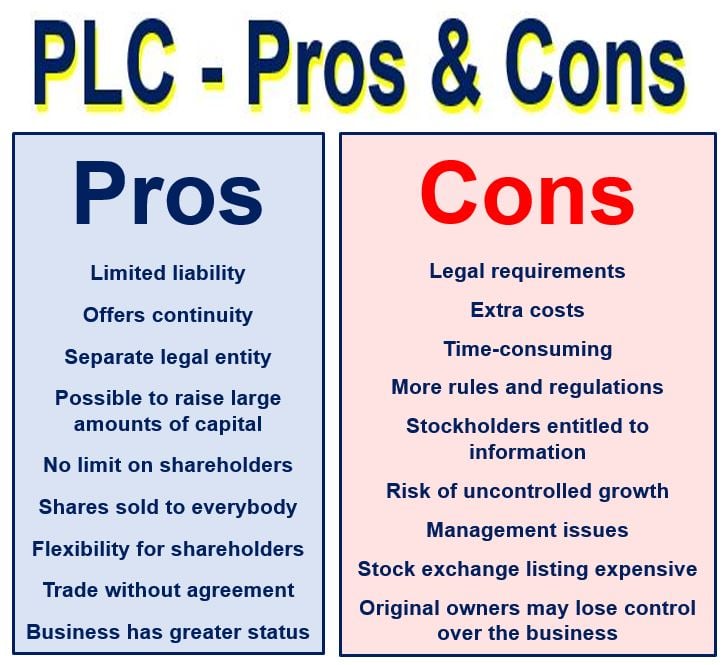

If you have a Private Limited Company and are wondering whether to turn it into a Public Limited Company, you should consider the advantages and disadvantages carefully. If remaining in control is your top priority, perhaps floating it may not be for you.

If you have a Private Limited Company and are wondering whether to turn it into a Public Limited Company, you should consider the advantages and disadvantages carefully. If remaining in control is your top priority, perhaps floating it may not be for you.

There is a registration fee associated with becoming a PLC, and the following documents have to be submitted to the Registrar of Companies:

Memorandum of Association – includes the company name, its registered office address, and the company objects. This is also known as the ‘charter of a company’ or ‘constitution of the company’. The memorandum has to be signed by each subscriber in front of a witness.

Articles of Association – establishes the rules of how a company will be operating its internal affairs. These articles state the inter-management, inter-member, and inter-employee relationship.

Form 1 – provides information on who the directors of the company are, its secretary, and the intended registered office.

Form 12 – a declaration that the company will adhere to all legal requirements.

Types of shares

Bearer shares – these are ordinary share warrants that denote legal ownership of a company.

Cumulative preference – if for some reason the company is unable to pay the dividend one year, the amount due will be carried forward to successive years.

Ordinary shares – these shares offer no special rights or restrictions.

Preference shares -preference stockholders are the first to be paid in good or bad years, and also if the company goes bankrupt.

Redeemable – these are shares that are issued under the condition that the company will buy them back after a certain period.

Initial Public Offering

An initial public offering, or IPO, occurs when a company is floated – when it goes public – when its shares can be bought and sold by members of the public.

Private limited companies use IPOs as a means of raising capital. Some businesses may decide to go public so that their owners, employees, and early investors can liquidate money by selling their shares.

After the IPO in the UK, the company becomes a PLC, and its shares are traded publicly in the financial marketplace. The company does not have to repay the capital to its public investors.